Global markets have recently experienced volatility, with U.S. stocks ending the week lower due to tariff uncertainties and mixed economic indicators such as job growth falling short of expectations. Amid these fluctuations, investors often look for opportunities that offer potential growth at lower entry points. Penny stocks, despite being considered a somewhat outdated term, still represent a viable investment area by highlighting smaller or newer companies that combine affordability with the possibility of significant returns when backed by strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.85 | HK$44.2B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £476.68M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £321.93M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.33 | MYR918.11M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £148.85M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.13 | HK$717.31M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

Click here to see the full list of 5,702 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Tukas Gida Sanayi ve Ticaret (IBSE:TUKAS)

Simply Wall St Financial Health Rating: ★★★★☆☆

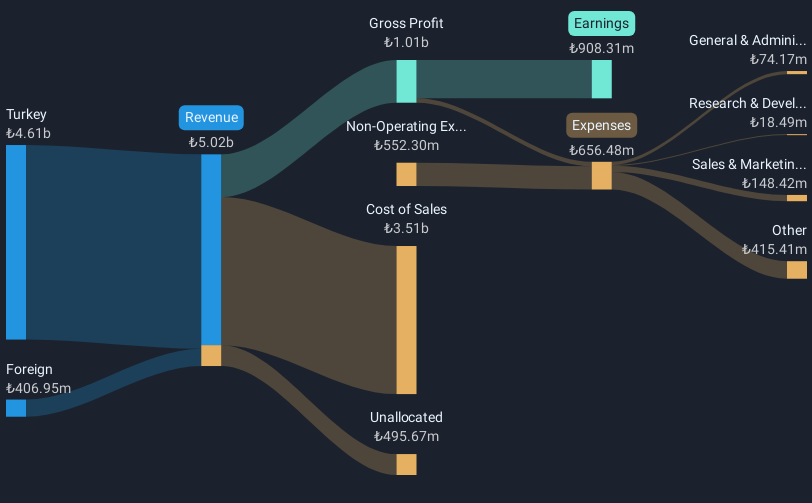

Overview: Tukas Gida Sanayi ve Ticaret A.S., along with its subsidiaries, manufactures and sells food products both in Turkey and internationally, with a market cap of TRY9 billion.

Operations: The company generates revenue of TRY4.52 billion from its food processing segment.

Market Cap: TRY9B

Tukas Gida Sanayi ve Ticaret A.S. presents a mixed picture for investors interested in penny stocks. The company's market cap stands at TRY9 billion, with revenues from its food processing segment reaching TRY4.52 billion. Despite having a satisfactory net debt to equity ratio of 20.4% and seasoned board members with an average tenure of 10.3 years, Tukas faces challenges such as negative operating cash flow and insufficient EBIT coverage for interest payments (0.9x). While its price-to-earnings ratio of 9.9x suggests good value compared to the TR market, recent earnings growth has been negative at -39.6%.

- Get an in-depth perspective on Tukas Gida Sanayi ve Ticaret's performance by reading our balance sheet health report here.

- Gain insights into Tukas Gida Sanayi ve Ticaret's past trends and performance with our report on the company's historical track record.

China Travel International Investment Hong Kong (SEHK:308)

Simply Wall St Financial Health Rating: ★★★★★☆

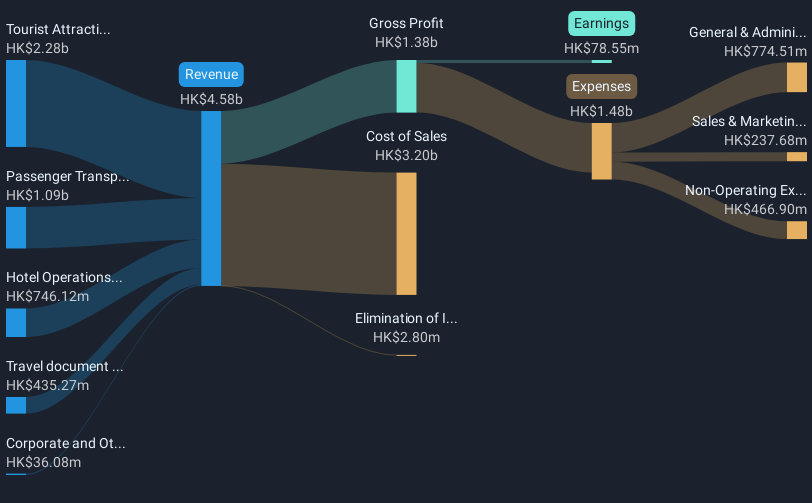

Overview: China Travel International Investment Hong Kong Limited offers travel and tourism services with a market cap of HK$5.59 billion.

Operations: The company's revenue is primarily derived from Tourist Attraction and Related Operations (HK$2.28 billion), Passenger Transportation Operations (HK$1.09 billion), Hotel Operations (HK$746.12 million), and Travel Document and Related Operations (HK$435.27 million).

Market Cap: HK$5.59B

China Travel International Investment Hong Kong Limited offers a complex scenario for penny stock investors. With a market cap of HK$5.59 billion, its revenue streams are diverse, yet the company faces challenges like declining earnings over the past five years and reduced profit margins (1.7% from 3.7% last year). Despite these hurdles, it maintains strong liquidity with short-term assets exceeding both short and long-term liabilities and more cash than total debt. The board's average tenure of 5.5 years indicates experienced leadership, though recent negative earnings growth (-48.8%) underscores volatility in financial performance amidst large one-off losses impacting results.

- Dive into the specifics of China Travel International Investment Hong Kong here with our thorough balance sheet health report.

- Examine China Travel International Investment Hong Kong's earnings growth report to understand how analysts expect it to perform.

China Boton Group (SEHK:3318)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Boton Group Company Limited manufactures and sells flavors, fragrances, and e-cigarette products across China, Europe, the United States, the rest of Asia, and internationally with a market cap of approximately HK$1.60 billion.

Operations: The company's revenue is derived from several segments, including Food Flavors (CN¥184.96 million), Fine Fragrances (CN¥173.32 million), Flavor Enhancers (CN¥776.68 million), E-Cigarette Products (CN¥831.16 million), and Investment Properties (CN¥49.30 million).

Market Cap: HK$1.6B

China Boton Group presents a mixed picture for penny stock investors. With a market cap of HK$1.60 billion, the company operates across diverse segments like e-cigarette products and flavor enhancers, generating significant revenue. Despite this, its earnings have declined by 4.3% annually over five years, though recent growth was substantial at 396.5%. The company's debt-to-equity ratio has improved to 45.7%, yet interest coverage remains weak at 2.8x EBIT. While trading below estimated fair value and backed by an experienced management team with an average tenure of 19.4 years, one-off gains have impacted recent financial results significantly.

- Click here to discover the nuances of China Boton Group with our detailed analytical financial health report.

- Gain insights into China Boton Group's outlook and expected performance with our report on the company's earnings estimates.

Make It Happen

- Click here to access our complete index of 5,702 Penny Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tukas Gida Sanayi ve Ticaret might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:TUKAS

Tukas Gida Sanayi ve Ticaret

Engages in the manufacture and sale of food products in Turkey and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives