- Hong Kong

- /

- Hospitality

- /

- SEHK:308

China Travel International Investment Hong Kong Limited's (HKG:308) Shareholders Might Be Looking For Exit

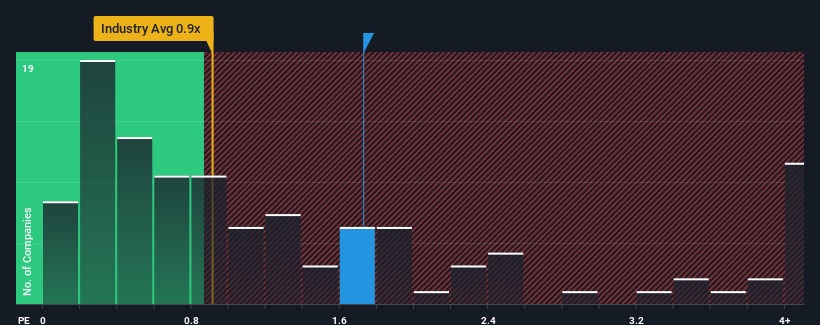

When you see that almost half of the companies in the Hospitality industry in Hong Kong have price-to-sales ratios (or "P/S") below 0.9x, China Travel International Investment Hong Kong Limited (HKG:308) looks to be giving off some sell signals with its 1.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for China Travel International Investment Hong Kong

What Does China Travel International Investment Hong Kong's P/S Mean For Shareholders?

Recent times haven't been great for China Travel International Investment Hong Kong as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on China Travel International Investment Hong Kong will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For China Travel International Investment Hong Kong?

In order to justify its P/S ratio, China Travel International Investment Hong Kong would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 20%. Pleasingly, revenue has also lifted 49% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 4.7% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 26%, which is noticeably more attractive.

With this information, we find it concerning that China Travel International Investment Hong Kong is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From China Travel International Investment Hong Kong's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for China Travel International Investment Hong Kong, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for China Travel International Investment Hong Kong with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:308

China Travel International Investment Hong Kong

Provides travel and tourism services.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives