As global markets grapple with tariff fears, inflation concerns, and growth uncertainties, the Asian stock market remains a focal point for investors seeking opportunities. Penny stocks, often representing smaller or newer companies in Asia, continue to capture attention due to their potential for growth at lower price points. Despite being an outdated term, penny stocks can still offer promising prospects when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Financial Health Rating |

| Lever Style (SEHK:1346) | HK$1.26 | HK$799.83M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.15 | HK$47.57B | ★★★★★★ |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.30 | SGD9.09B | ★★★★★☆ |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.04 | CN¥3.52B | ★★★★★★ |

| Beng Kuang Marine (SGX:BEZ) | SGD0.205 | SGD40.84M | ★★★★★★ |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.48 | SGD457.62M | ★★★★★★ |

| Interlink Telecom (SET:ITEL) | THB1.44 | THB2B | ★★★★☆☆ |

| China Zheshang Bank (SEHK:2016) | HK$2.38 | HK$80.47B | ★★★★★★ |

| Playmates Toys (SEHK:869) | HK$0.61 | HK$719.8M | ★★★★★★ |

| Jiumaojiu International Holdings (SEHK:9922) | HK$3.16 | HK$4.42B | ★★★★★★ |

Click here to see the full list of 1,167 stocks from our Asian Penny Stocks screener.

Let's review some notable picks from our screened stocks.

China Travel International Investment Hong Kong (SEHK:308)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Travel International Investment Hong Kong Limited offers travel and tourism services, with a market cap of HK$5.92 billion.

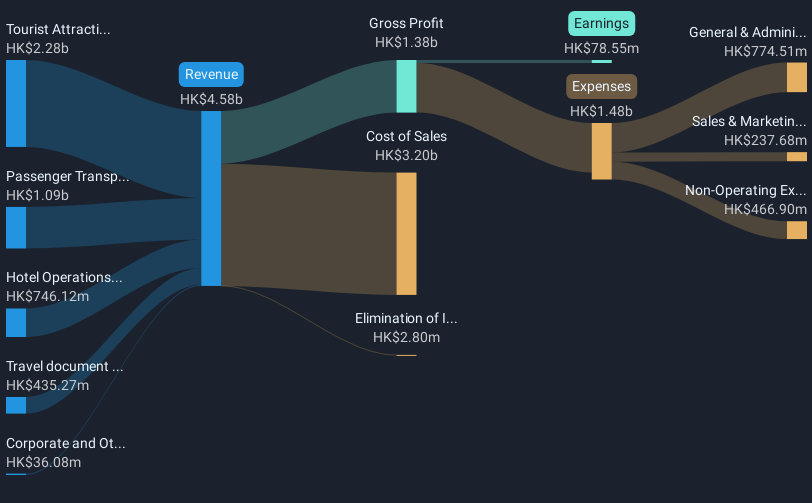

Operations: The company's revenue is derived from several segments, including Tourist Attraction and Related Operations (HK$2.28 billion), Passenger Transportation Operations (HK$1.09 billion), Hotel Operations (HK$746.12 million), and Travel Document and Related Operations (HK$435.27 million).

Market Cap: HK$5.92B

China Travel International Investment Hong Kong Limited, with a market cap of HK$5.92 billion, derives revenue from multiple segments such as Tourist Attraction Operations (HK$2.28 billion) and Passenger Transportation (HK$1.09 billion). The company has experienced management and board teams with average tenures of 2.3 and 5.6 years respectively, providing stability in leadership. Short-term assets exceed both short- and long-term liabilities, indicating sound financial health despite a low return on equity at 1%. Recent financials were impacted by a large one-off loss of HK$143.7 million, contributing to negative earnings growth over the past year but forecasts suggest potential recovery ahead with projected earnings growth of 41.33% annually.

- Get an in-depth perspective on China Travel International Investment Hong Kong's performance by reading our balance sheet health report here.

- Gain insights into China Travel International Investment Hong Kong's outlook and expected performance with our report on the company's earnings estimates.

China Boton Group (SEHK:3318)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Boton Group Company Limited, with a market cap of HK$1.75 billion, manufactures and sells flavors, fragrances, and e-cigarette products in China and internationally.

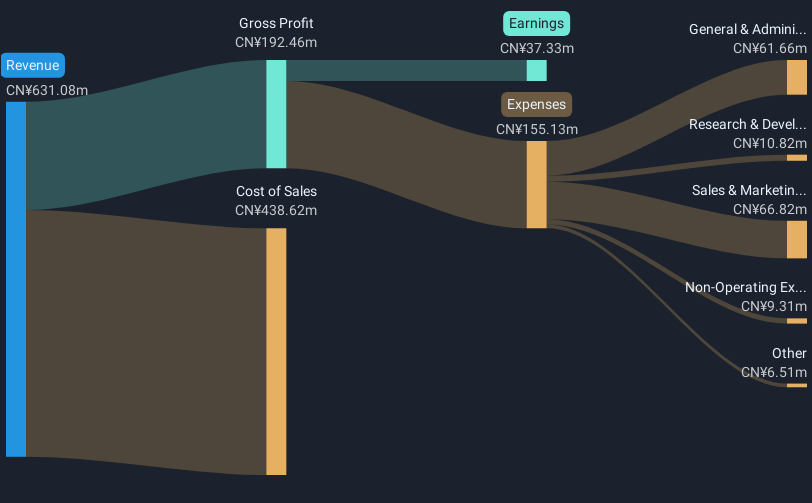

Operations: The company's revenue is primarily derived from its Flavor Enhancers segment at CN¥776.68 million, E-Cigarette Products at CN¥831.16 million, Food Flavors at CN¥184.96 million, Fine Fragrances at CN¥173.32 million, and Investment Properties contributing CN¥49.30 million.

Market Cap: HK$1.75B

China Boton Group, with a market cap of HK$1.75 billion, has seen its earnings grow significantly by 396.5% over the past year, despite a historical decline of 4.3% annually over five years. Revenue is primarily driven by e-cigarette products and flavor enhancers, totaling CN¥1.61 billion combined. The company faces challenges with interest coverage and debt not well supported by cash flow but benefits from reduced debt levels and seasoned management with an average tenure of 19.5 years. Recent guidance indicates a potential profit decrease due to global conditions and goodwill impairment in tobacco businesses acquired in 2016.

- Click here to discover the nuances of China Boton Group with our detailed analytical financial health report.

- Review our growth performance report to gain insights into China Boton Group's future.

Youngy Health (SZSE:300247)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Youngy Health Co., Ltd. is involved in the manufacture, export, and sale of sauna products in China with a market capitalization of CN¥3.20 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥3.2B

Youngy Health, with a market cap of CN¥3.20 billion, has demonstrated impressive earnings growth of 169.9% over the past year, significantly outpacing the Leisure industry's decline. The company is debt-free and boasts strong short-term asset coverage over both its short-term (CN¥122.7M) and long-term liabilities (CN¥17.1M). Despite achieving profitability in recent years with a 5-year average earnings growth of 78.4%, its Return on Equity remains low at 4.8%. A large one-off gain recently impacted financial results, while the board's relatively inexperienced tenure may present governance challenges moving forward.

- Dive into the specifics of Youngy Health here with our thorough balance sheet health report.

- Evaluate Youngy Health's historical performance by accessing our past performance report.

Where To Now?

- Reveal the 1,167 hidden gems among our Asian Penny Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300247

Youngy Health

Engages in the manufacture, export, and sale of sauna products in China.

Flawless balance sheet with proven track record.