- Hong Kong

- /

- Consumer Services

- /

- SEHK:2779

China Xinhua Education Group (HKG:2779) Has A Rock Solid Balance Sheet

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that China Xinhua Education Group Limited (HKG:2779) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for China Xinhua Education Group

How Much Debt Does China Xinhua Education Group Carry?

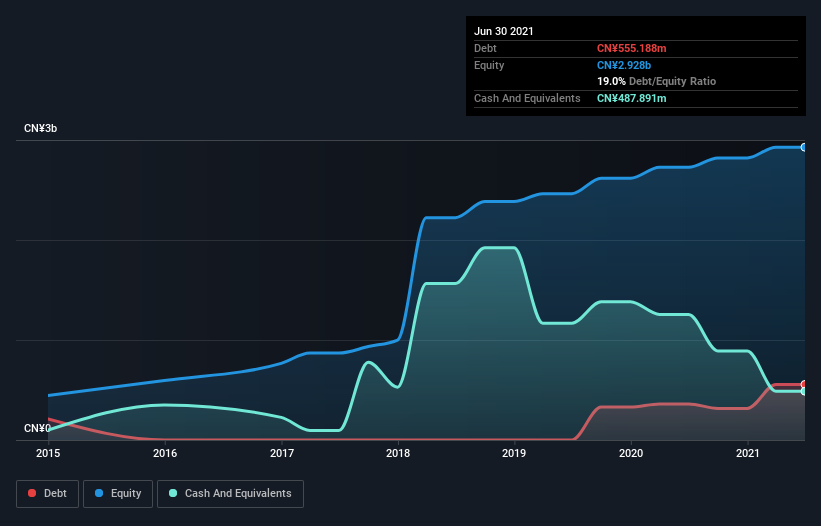

The image below, which you can click on for greater detail, shows that at June 2021 China Xinhua Education Group had debt of CN¥555.2m, up from CN¥361.0m in one year. However, it also had CN¥487.9m in cash, and so its net debt is CN¥67.3m.

How Strong Is China Xinhua Education Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that China Xinhua Education Group had liabilities of CN¥383.6m due within 12 months and liabilities of CN¥458.2m due beyond that. Offsetting this, it had CN¥487.9m in cash and CN¥1.77b in receivables that were due within 12 months. So it actually has CN¥1.42b more liquid assets than total liabilities.

This surplus strongly suggests that China Xinhua Education Group has a rock-solid balance sheet (and the debt is of no concern whatsoever). Having regard to this fact, we think its balance sheet is as strong as an ox.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

China Xinhua Education Group has net debt of just 0.16 times EBITDA, suggesting it could ramp leverage without breaking a sweat. But the really cool thing is that it actually managed to receive more interest than it paid, over the last year. So it's fair to say it can handle debt like a hotshot teppanyaki chef handles cooking. In addition to that, we're happy to report that China Xinhua Education Group has boosted its EBIT by 49%, thus reducing the spectre of future debt repayments. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since China Xinhua Education Group will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, China Xinhua Education Group produced sturdy free cash flow equating to 75% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Happily, China Xinhua Education Group's impressive interest cover implies it has the upper hand on its debt. And the good news does not stop there, as its EBIT growth rate also supports that impression! Based on the data we have reviewed, it's as clear as day that China Xinhua Education Group's balance sheet is as healthy as a vaccinated Olympian. We're no more concerned about its debt than sailing off the edge of the earth. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that China Xinhua Education Group is showing 1 warning sign in our investment analysis , you should know about...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2779

China Xinhua Education Group

Provides higher and secondary vocational education services in the People's Republic of China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives