As global markets navigate a landscape marked by easing trade tensions and mixed economic signals, investors are increasingly turning their attention to Asia, where opportunities in dividend stocks remain compelling. In this dynamic environment, selecting dividend stocks that offer stable yields can provide a measure of resilience and income stability, making them an attractive option for those looking to balance growth with income potential.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.88% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.26% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.53% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.14% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.07% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.98% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.11% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.44% | ★★★★★★ |

Click here to see the full list of 1231 stocks from our Top Asian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

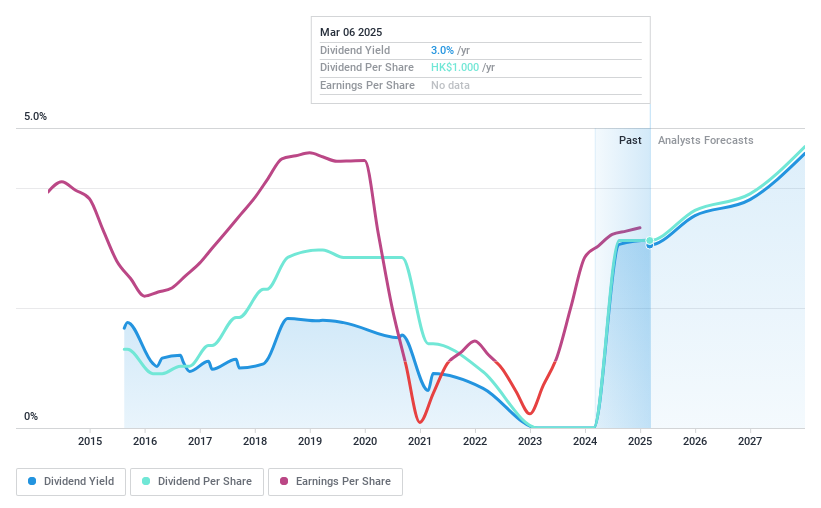

Galaxy Entertainment Group (SEHK:27)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Galaxy Entertainment Group Limited operates in the gaming and entertainment sectors across Macau, Hong Kong, and Mainland China, with a market capitalization of approximately HK$132.08 billion.

Operations: Galaxy Entertainment Group's revenue is primarily derived from its Gaming and Entertainment segment, which accounts for HK$40.25 billion, alongside a contribution of HK$3.18 billion from its Construction Materials segment.

Dividend Yield: 3.3%

Galaxy Entertainment Group's dividend payments are covered by earnings and cash flows, with payout ratios of 49.9% and 65.5%, respectively. However, the dividends have been unreliable over the past decade due to volatility, despite recent increases. The proposed final dividend is HK$0.5 per share for 2024, with payment scheduled for June 12, 2025. Earnings grew significantly last year to HK$8.76 billion from HK$6.83 billion in 2023, but significant insider selling raises concerns about stability.

- Dive into the specifics of Galaxy Entertainment Group here with our thorough dividend report.

- Our valuation report unveils the possibility Galaxy Entertainment Group's shares may be trading at a discount.

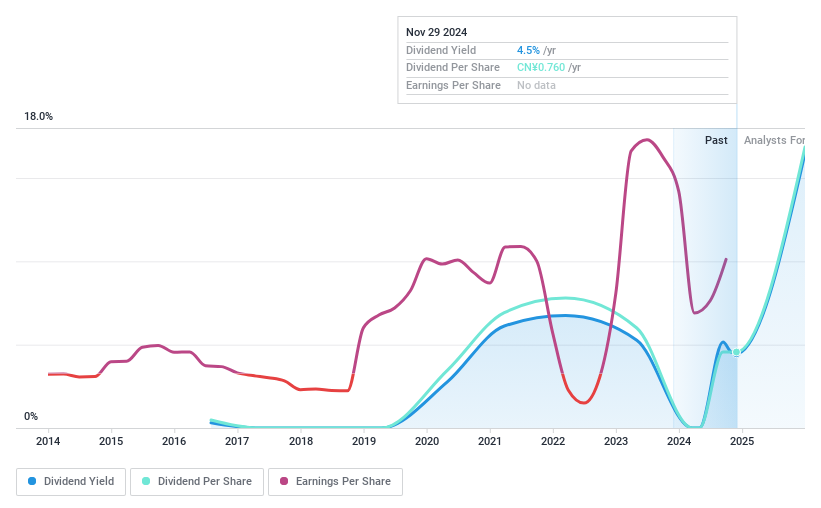

Shenzhen Kingkey Smart Agriculture TimesLtd (SZSE:000048)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shenzhen Kingkey Smart Agriculture Times Co., Ltd operates in the real estate and breeding sectors in China, with a market cap of CN¥8.34 billion.

Operations: Shenzhen Kingkey Smart Agriculture Times Co., Ltd generates revenue from its operations in the real estate and breeding industries within China.

Dividend Yield: 4.4%

Shenzhen Kingkey Smart Agriculture Times Ltd's dividends are covered by earnings and cash flows, with payout ratios of 49.1% and 37.5%, respectively, indicating sustainability. However, the dividend track record is unstable with volatility over its nine-year history. Despite trading at a significant discount to estimated fair value and recent earnings growth to CNY 112.03 million in Q1 2025, the dividend reliability remains questionable due to inconsistent past payments.

- Click to explore a detailed breakdown of our findings in Shenzhen Kingkey Smart Agriculture TimesLtd's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Shenzhen Kingkey Smart Agriculture TimesLtd shares in the market.

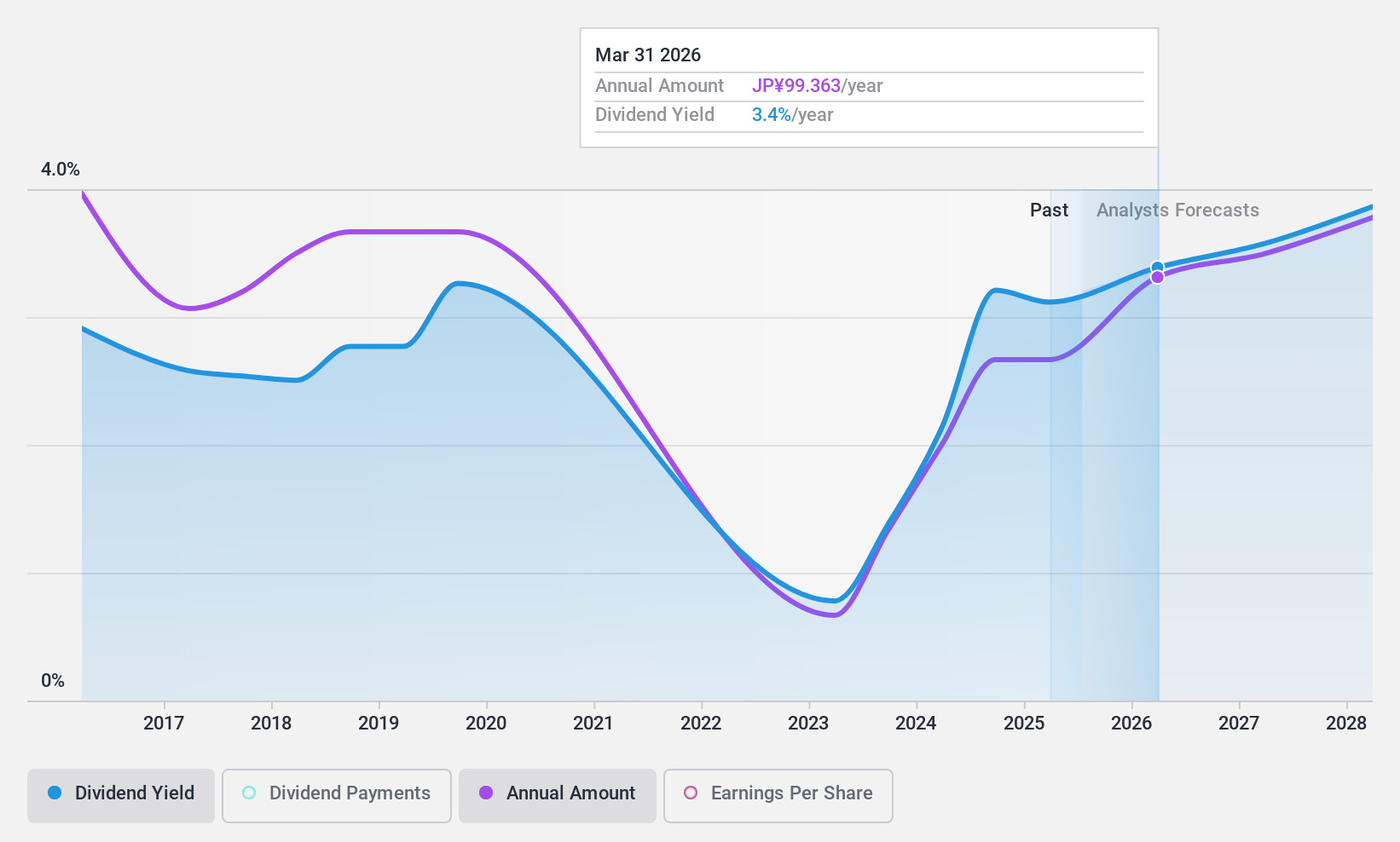

Japan Airlines (TSE:9201)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Japan Airlines Co., Ltd. operates scheduled and non-scheduled air transport services across Japan, Asia, Oceania, North America, the United Kingdom, and Europe with a market cap of ¥1.21 trillion.

Operations: Japan Airlines Co., Ltd.'s revenue segments include its Full Service Carrier Business at ¥1.45 trillion, Mileage/Finance and Commerce at ¥200.36 billion, and LCC operations at ¥104.13 billion.

Dividend Yield: 3.3%

Japan Airlines' dividend payments are supported by earnings and cash flows, with payout ratios of 35.1% and 43.9%, respectively, suggesting sustainability. Despite a recent increase to ¥46 per share, the dividend history has been volatile over the past decade. The company announced an interline agreement expanding connectivity between Japan and Hawaii, potentially boosting revenue streams. However, its dividend yield of 3.32% remains below top-tier payers in Japan's market at 3.94%.

- Delve into the full analysis dividend report here for a deeper understanding of Japan Airlines.

- Our comprehensive valuation report raises the possibility that Japan Airlines is priced higher than what may be justified by its financials.

Key Takeaways

- Get an in-depth perspective on all 1231 Top Asian Dividend Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9201

Japan Airlines

Provides scheduled and non-scheduled air transport services in Japan, Asia, Oceania, North America, the Unietd Kingdom, and Europe.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives