- Hong Kong

- /

- Real Estate

- /

- SEHK:1908

3 Asian Dividend Stocks With Up To 9.8% Yield

Reviewed by Simply Wall St

As global markets navigate a landscape marked by inflation concerns and policy uncertainties, Asian equities have also faced pressures from geopolitical tensions and trade dynamics. In this environment, dividend stocks can offer a measure of stability and income potential, making them an appealing choice for investors seeking resilience amidst volatility.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.49% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.92% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.23% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.24% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.51% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.12% | ★★★★★★ |

Click here to see the full list of 1153 stocks from our Top Asian Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

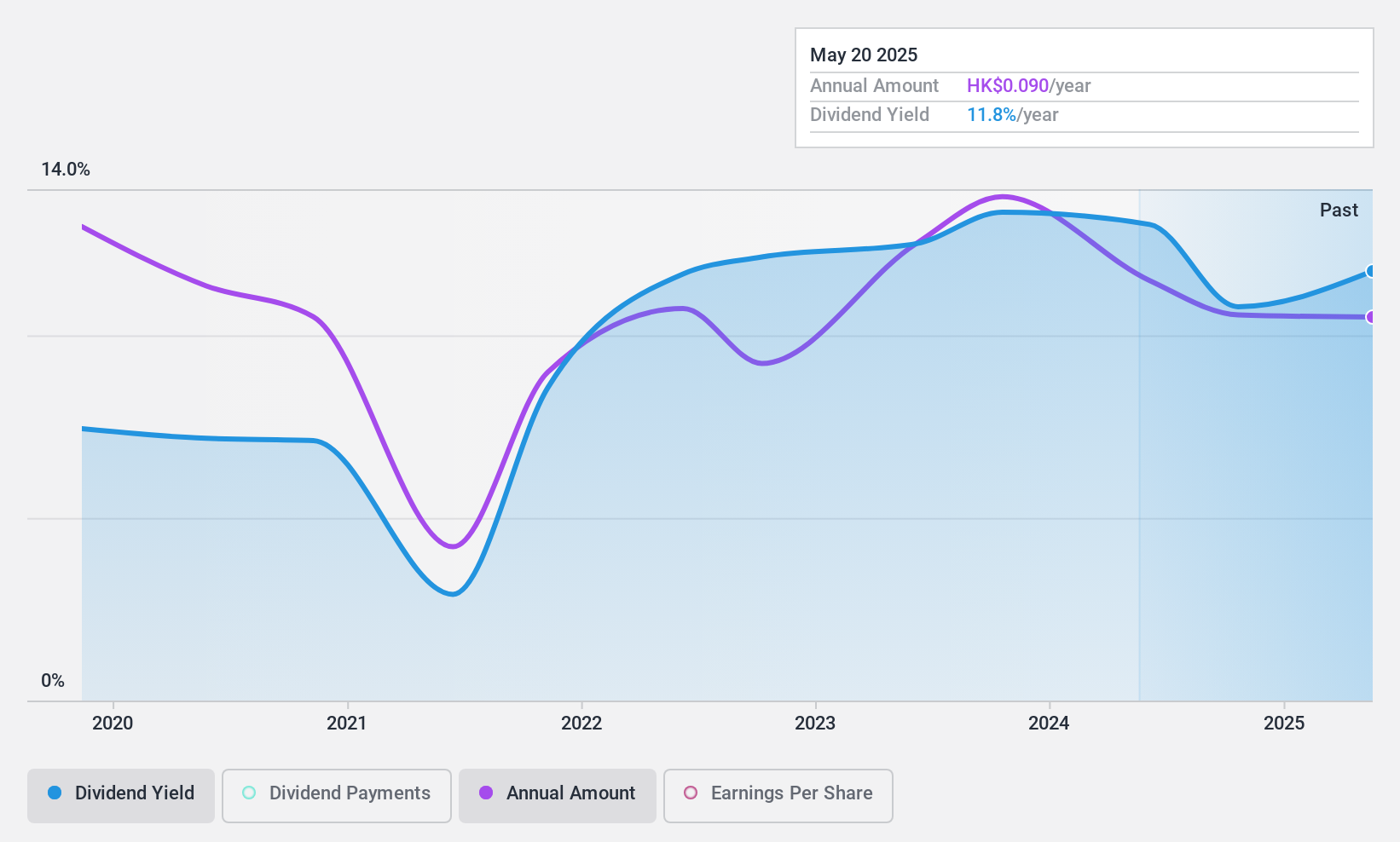

Haitong Unitrust International Financial Leasing (SEHK:1905)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Haitong Unitrust International Financial Leasing Co., Ltd. operates as a financial leasing company in the People’s Republic of China with a market cap of HK$7.58 billion.

Operations: Haitong Unitrust International Financial Leasing Co., Ltd. generates revenue primarily from its financial services segment, specifically commercial leasing, amounting to CN¥3.68 billion.

Dividend Yield: 9.9%

Haitong Unitrust International Financial Leasing offers a dividend covered by earnings (47.6% payout ratio) and cash flows (4.2% cash payout ratio), with a yield in the top 25% of Hong Kong's market. However, its dividends have been unstable over five years, with payments declining. The company recently changed auditors to Deloitte Touche Tohmatsu and entered a RMB 100 million finance lease arrangement with Suqian CNG, reflecting active financial management despite high debt levels.

- Unlock comprehensive insights into our analysis of Haitong Unitrust International Financial Leasing stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Haitong Unitrust International Financial Leasing is priced lower than what may be justified by its financials.

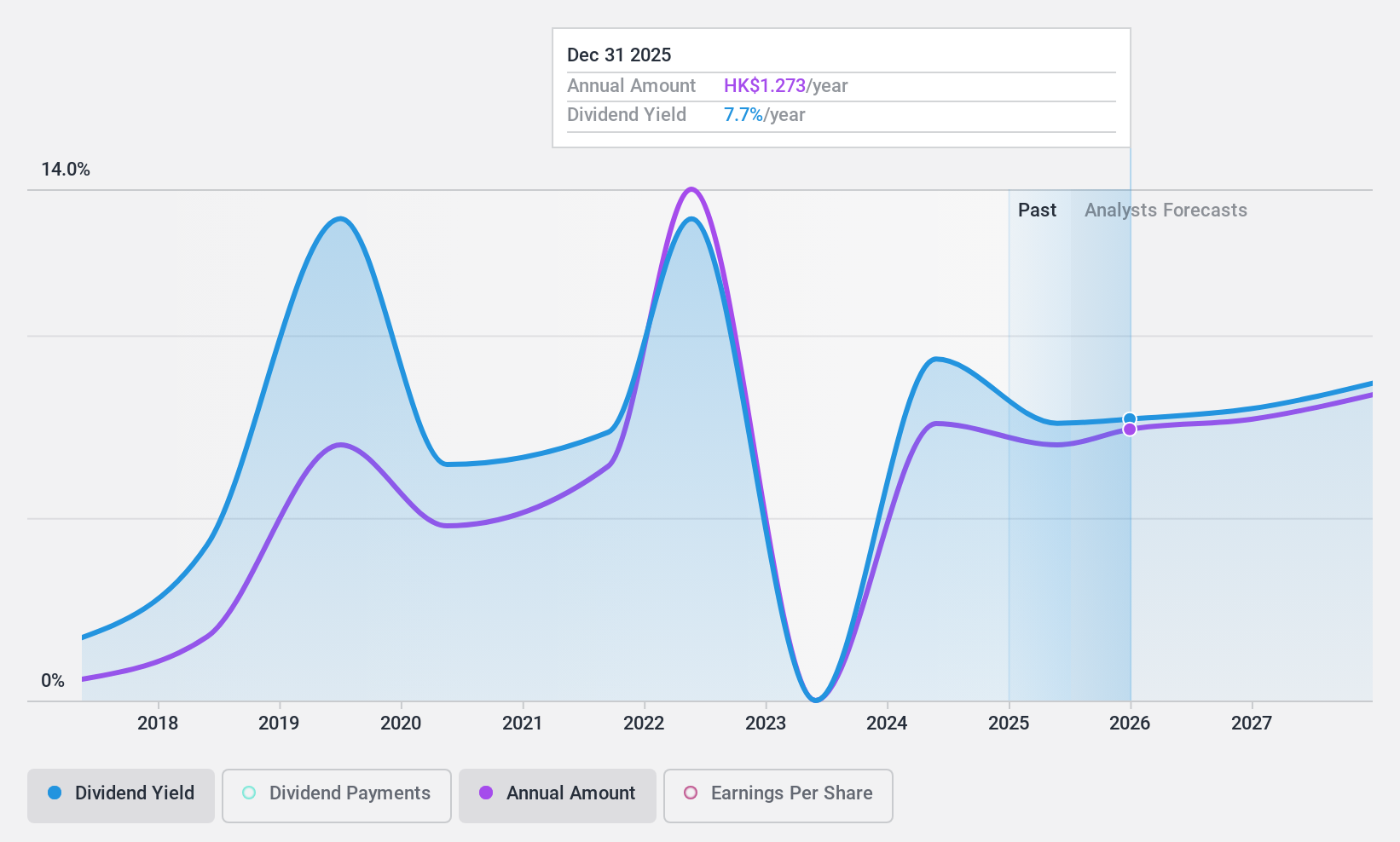

C&D International Investment Group (SEHK:1908)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: C&D International Investment Group Limited is an investment holding company involved in property development, real estate industry chain investment services, and industry investment activities across Mainland China, Hong Kong, Macau, Taiwan, and internationally with a market cap of HK$31.15 billion.

Operations: C&D International Investment Group Limited generates its revenue primarily from Property Development and Property Management and Other Related Services, amounting to CN¥142.82 billion.

Dividend Yield: 8.1%

C&D International Investment Group's dividend yield is among the top 25% in Hong Kong, but its sustainability is questionable due to a lack of free cash flow coverage. Despite a reasonable payout ratio (52.6%), dividends have been volatile over the past decade. Recent strategic alliances involve significant capital commitments, potentially impacting financial flexibility. The company reported RMB103.36 billion in sales for 2024, down significantly from the previous year, highlighting potential revenue challenges amidst ambitious development projects.

- Dive into the specifics of C&D International Investment Group here with our thorough dividend report.

- Upon reviewing our latest valuation report, C&D International Investment Group's share price might be too pessimistic.

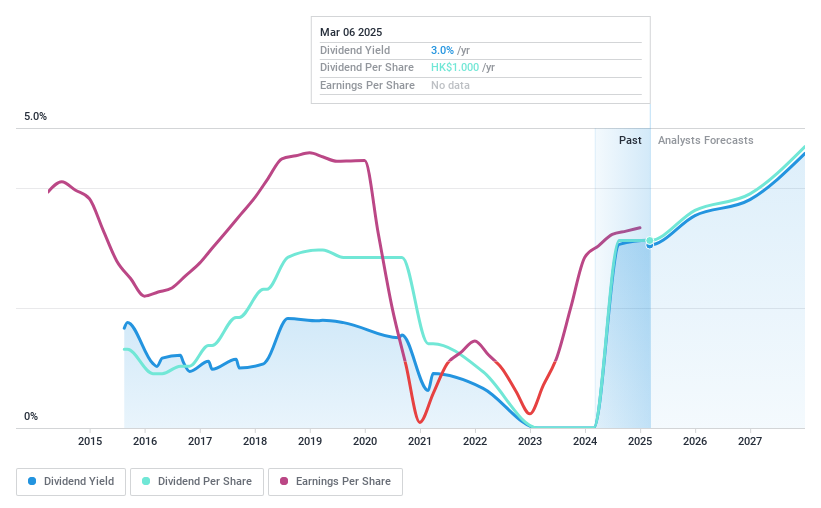

Galaxy Entertainment Group (SEHK:27)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Galaxy Entertainment Group Limited is an investment holding company that operates in the gaming and entertainment sectors across Macau, Hong Kong, and Mainland China with a market capitalization of approximately HK$139.46 billion.

Operations: Galaxy Entertainment Group Limited generates revenue primarily from its gaming operations in Macau, Hong Kong, and Mainland China.

Dividend Yield: 3.1%

Galaxy Entertainment Group's dividend sustainability is supported by a low payout ratio of 25.6%, although its cash payout ratio stands at 70.2%. Recent earnings growth of 28.3% bolsters financial stability, yet the dividend yield remains modest at 3.13%, below top-tier levels in Hong Kong. Despite an increase in dividends over the past decade, their volatility raises concerns about reliability. The stock trades significantly below fair value estimates, suggesting potential for appreciation amidst robust earnings performance.

- Navigate through the intricacies of Galaxy Entertainment Group with our comprehensive dividend report here.

- Our expertly prepared valuation report Galaxy Entertainment Group implies its share price may be lower than expected.

Seize The Opportunity

- Access the full spectrum of 1153 Top Asian Dividend Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1908

C&D International Investment Group

An investment holding company, engages in the property development, real estate industry chain investment services, and industry investment activities in the People’s Republic of China.

Excellent balance sheet and fair value.

Market Insights

Community Narratives