- Hong Kong

- /

- Hospitality

- /

- SEHK:265

Orient Victory Smart urban Services Holding Limited's (HKG:265) Popularity With Investors Under Threat As Stock Sinks 30%

Orient Victory Smart urban Services Holding Limited (HKG:265) shareholders that were waiting for something to happen have been dealt a blow with a 30% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 31% share price drop.

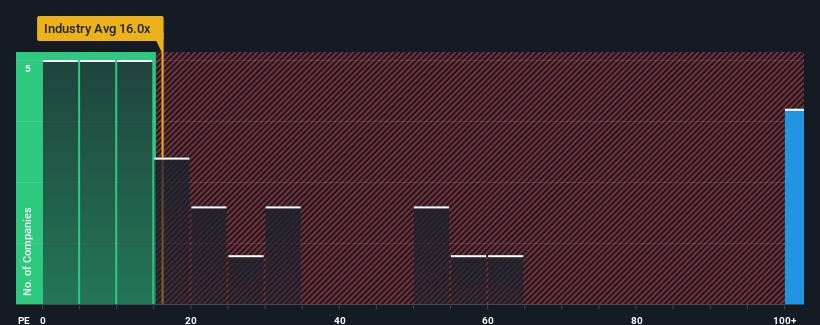

Although its price has dipped substantially, Orient Victory Smart urban Services Holding's price-to-earnings (or "P/E") ratio of 133.3x might still make it look like a strong sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 9x and even P/E's below 5x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

We'd have to say that with no tangible growth over the last year, Orient Victory Smart urban Services Holding's earnings have been unimpressive. It might be that many are expecting an improvement to the uninspiring earnings performance over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Orient Victory Smart urban Services Holding

What Are Growth Metrics Telling Us About The High P/E?

Orient Victory Smart urban Services Holding's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. That's essentially a continuation of what we've seen over the last three years, as its EPS growth has been virtually non-existent for that entire period. Therefore, it's fair to say that earnings growth has definitely eluded the company recently.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's noticeably less attractive on an annualised basis.

With this information, we find it concerning that Orient Victory Smart urban Services Holding is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

A significant share price dive has done very little to deflate Orient Victory Smart urban Services Holding's very lofty P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Orient Victory Smart urban Services Holding currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 2 warning signs for Orient Victory Smart urban Services Holding that we have uncovered.

Of course, you might also be able to find a better stock than Orient Victory Smart urban Services Holding. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Gangyu Smart Urban Services Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:265

Gangyu Smart Urban Services Holding

An investment holding company, provides property management and leasing services for residential and commercial properties in Mainland China.

Flawless balance sheet low.