- Hong Kong

- /

- Consumer Services

- /

- SEHK:2469

3 High-Growth Companies With Insider Ownership Up To 30%

Reviewed by Simply Wall St

As global markets continue to respond positively to political developments and economic indicators, with U.S. stocks reaching record highs amid AI enthusiasm and potential trade deals, investors are increasingly focused on growth opportunities. In this context, companies with high insider ownership can be particularly attractive as they often signal strong internal confidence in the business's future prospects, aligning management interests closely with those of shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.9% |

| Pharma Mar (BME:PHM) | 11.9% | 55.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| HANA Micron (KOSDAQ:A067310) | 18.2% | 119.4% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Let's uncover some gems from our specialized screener.

MilDef Group (OM:MILDEF)

Simply Wall St Growth Rating: ★★★★★★

Overview: MilDef Group AB (publ) develops, manufactures, and sells rugged IT solutions and special electronics mainly for the security and defense sectors, with a market cap of SEK5.92 billion.

Operations: The company's revenue primarily comes from its Computer Hardware segment, totaling SEK1.14 billion.

Insider Ownership: 14.8%

MilDef Group is experiencing significant growth, with earnings projected to increase substantially at 84.9% annually, outpacing the Swedish market's 14%. Revenue is also expected to grow robustly at 44% per year. Recent contracts, such as those with the Swedish Defense Materiel Administration and BAE Systems Hagglunds, bolster its growth trajectory. Despite substantial insider selling recently, MilDef's strategic partnerships and innovative solutions like OneCIS enhance its potential for increased NATO interoperability and connectivity advancements.

- Delve into the full analysis future growth report here for a deeper understanding of MilDef Group.

- Our expertly prepared valuation report MilDef Group implies its share price may be too high.

Fenbi (SEHK:2469)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fenbi Ltd. is an investment holding company that offers non-formal vocational education and training services in the People’s Republic of China, with a market cap of HK$5.42 billion.

Operations: The company's revenue segments include CN¥648.46 million from sales of books and CN¥2.47 billion from tutoring services.

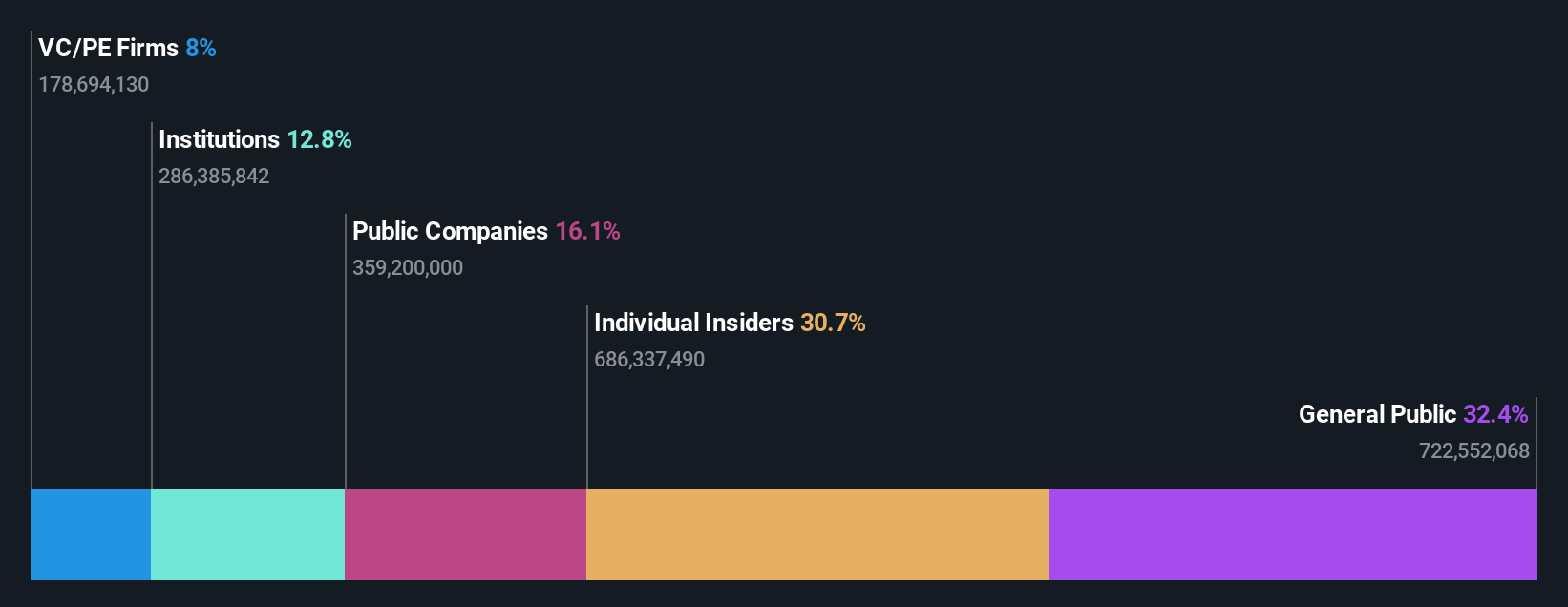

Insider Ownership: 30.6%

Fenbi's earnings are forecast to grow at 19.5% annually, surpassing the Hong Kong market's average of 11.3%. The company recently became profitable and is trading significantly below its estimated fair value. Revenue growth is projected at 8.9% per year, slightly above the market rate but not exceptionally high. Insider activity shows more shares bought than sold in recent months, despite no substantial insider buying reported. Recent board changes include Mr. LI Yong's resignation as a non-executive director.

- Take a closer look at Fenbi's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Fenbi is priced lower than what may be justified by its financials.

Angelalign Technology (SEHK:6699)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Angelalign Technology Inc. is an investment holding company that specializes in the research, development, design, manufacture, and marketing of clear aligner treatment solutions in the People’s Republic of China, with a market cap of HK$9 billion.

Operations: The company's revenue segment primarily consists of Dental Equipment & Supplies, generating CN¥1.72 billion.

Insider Ownership: 18.4%

Angelalign Technology's earnings are projected to grow significantly at 69.6% per year, outpacing the Hong Kong market's average of 11.3%. Despite trading at 31.7% below its estimated fair value, profit margins have decreased from last year's 13.1% to 2.5%. Revenue is expected to rise by 14.6% annually, faster than the market but not exceptionally high. Recent changes include a new principal business address in Hong Kong effective January 10, 2025.

- Unlock comprehensive insights into our analysis of Angelalign Technology stock in this growth report.

- The analysis detailed in our Angelalign Technology valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Access the full spectrum of 1465 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2469

Fenbi

An investment holding company, provides non-formal vocational education and training services in the People’s Republic of China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives