- Hong Kong

- /

- Consumer Services

- /

- SEHK:2371

Chuanglian Holdings Limited (HKG:2371) Doing What It Can To Lift Shares

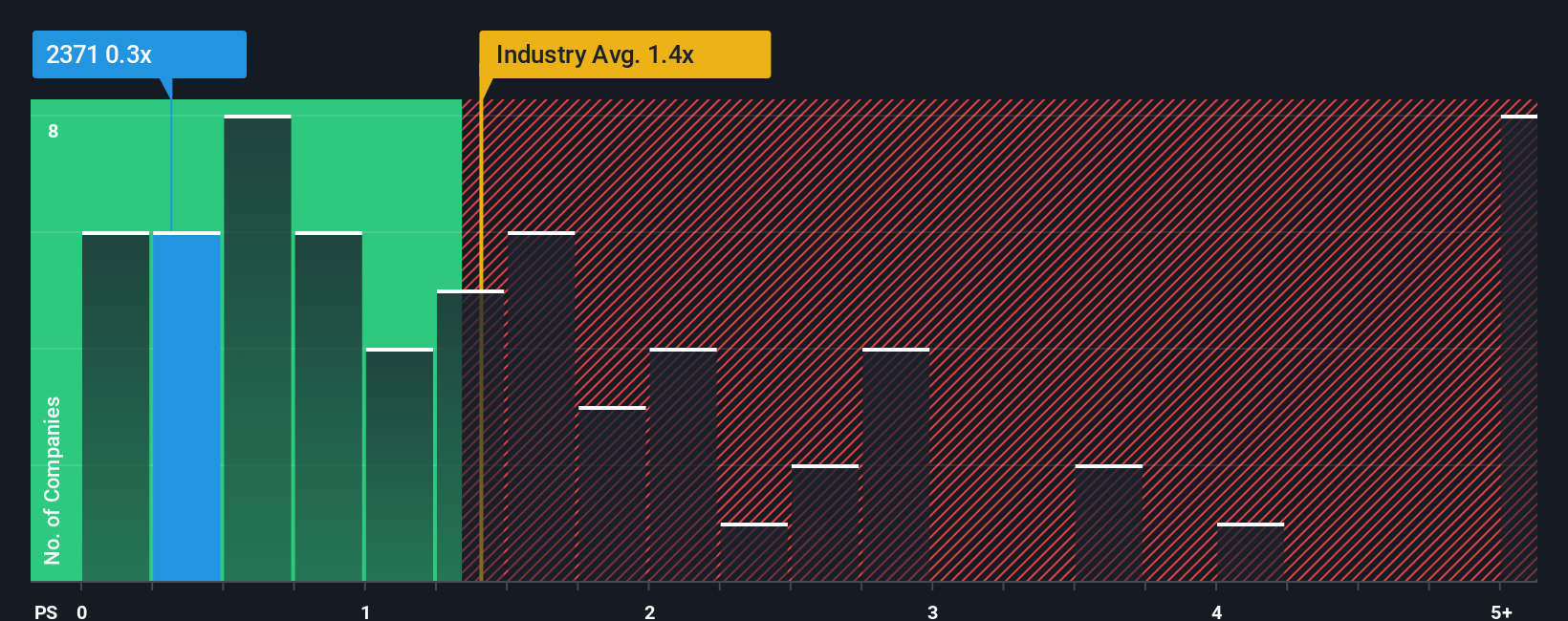

When close to half the companies operating in the Consumer Services industry in Hong Kong have price-to-sales ratios (or "P/S") above 1.4x, you may consider Chuanglian Holdings Limited (HKG:2371) as an attractive investment with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Chuanglian Holdings

What Does Chuanglian Holdings' Recent Performance Look Like?

The revenue growth achieved at Chuanglian Holdings over the last year would be more than acceptable for most companies. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Chuanglian Holdings' earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Chuanglian Holdings?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Chuanglian Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 18% last year. Pleasingly, revenue has also lifted 89% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is only predicted to deliver 13% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that Chuanglian Holdings' P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Chuanglian Holdings currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Chuanglian Holdings (at least 1 which is potentially serious), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Chuanglian Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2371

Chuanglian Holdings

An investment holding company, provides online training and education services in the People’s Republic of China and Hong Kong.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives