- Hong Kong

- /

- Consumer Services

- /

- SEHK:2262

Are Steve Leung Design Group Limited's (HKG:2262) Mixed Financials The Reason For Its Gloomy Performance on The Stock Market?

Steve Leung Design Group (HKG:2262) has had a rough three months with its share price down 29%. It seems that the market might have completely ignored the positive aspects of the company's fundamentals and decided to weigh-in more on the negative aspects. Fundamentals usually dictate market outcomes so it makes sense to study the company's financials. Particularly, we will be paying attention to Steve Leung Design Group's ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Put another way, it reveals the company's success at turning shareholder investments into profits.

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Steve Leung Design Group is:

3.0% = HK$9.6m ÷ HK$319m (Based on the trailing twelve months to June 2025).

The 'return' is the yearly profit. That means that for every HK$1 worth of shareholders' equity, the company generated HK$0.03 in profit.

See our latest analysis for Steve Leung Design Group

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Steve Leung Design Group's Earnings Growth And 3.0% ROE

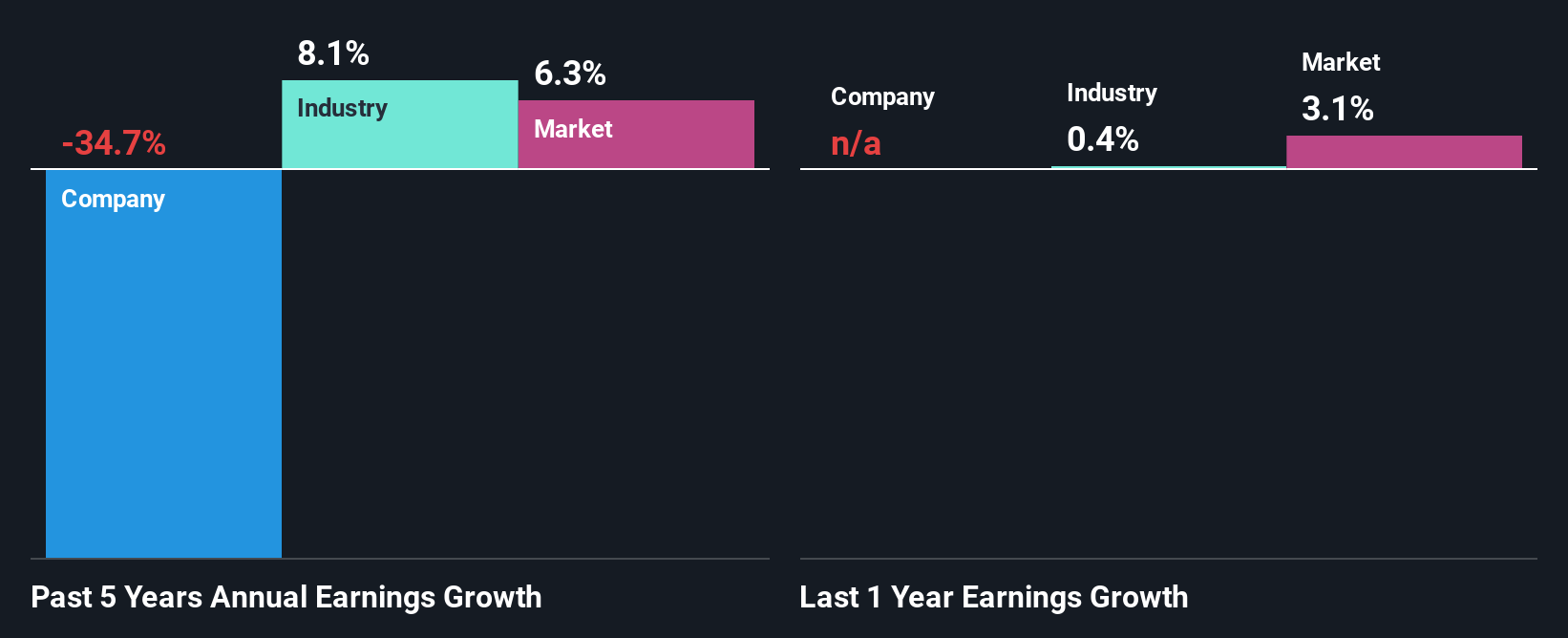

It is hard to argue that Steve Leung Design Group's ROE is much good in and of itself. Even when compared to the industry average of 10%, the ROE figure is pretty disappointing. Given the circumstances, the significant decline in net income by 35% seen by Steve Leung Design Group over the last five years is not surprising. We reckon that there could also be other factors at play here. For example, the business has allocated capital poorly, or that the company has a very high payout ratio.

However, when we compared Steve Leung Design Group's growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 8.1% in the same period. This is quite worrisome.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. Is Steve Leung Design Group fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Steve Leung Design Group Making Efficient Use Of Its Profits?

Steve Leung Design Group doesn't pay any regular dividends, meaning that potentially all of its profits are being reinvested in the business, which doesn't explain why the company's earnings have shrunk if it is retaining all of its profits. So there might be other factors at play here which could potentially be hampering growth. For example, the business has faced some headwinds.

Summary

Overall, we have mixed feelings about Steve Leung Design Group. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. Wrapping up, we would proceed with caution with this company and one way of doing that would be to look at the risk profile of the business. Our risks dashboard will have the 1 risk we have identified for Steve Leung Design Group.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2262

Steve Leung Design Group

Engages in the provision of interior design services in the People’s Republic of China, Hong Kong, and Macau.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion