- Hong Kong

- /

- Hospitality

- /

- SEHK:200

Investors three-year losses grow to 70% as the stock sheds HK$2.2b this past week

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But the last three years have been particularly tough on longer term Melco International Development Limited (HKG:200) shareholders. Sadly for them, the share price is down 70% in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 67% lower in that time. More recently, the share price has dropped a further 39% in a month. However, we note the price may have been impacted by the broader market, which is down 23% in the same time period.

Since Melco International Development has shed HK$2.2b from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Melco International Development

Melco International Development isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years Melco International Development saw its revenue shrink by 33% per year. That's definitely a weaker result than most pre-profit companies report. The swift share price decline at an annual compound rate of 19%, reflects this weak fundamental performance. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

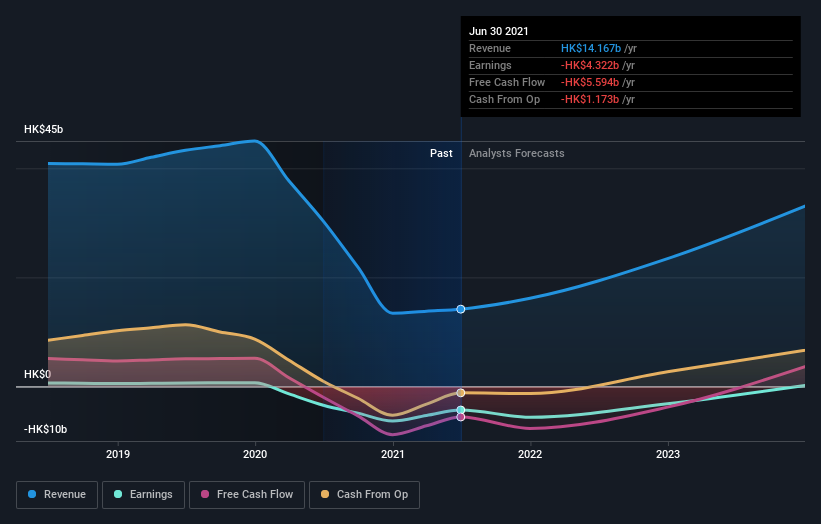

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. If you are thinking of buying or selling Melco International Development stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

We regret to report that Melco International Development shareholders are down 67% for the year. Unfortunately, that's worse than the broader market decline of 31%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Melco International Development better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Melco International Development (at least 1 which is concerning) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:200

Melco International Development

An investment holding company, engages in the leisure and entertainment business in Macau, the Philippines, and Cyprus.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives