- Hong Kong

- /

- Hospitality

- /

- SEHK:1992

Does Fosun Tourism Group's (HKG:1992) Share Price Gain of 18% Match Its Business Performance?

We believe investing is smart because history shows that stock markets go higher in the long term. But if when you choose to buy stocks, some of them will be below average performers. Unfortunately for shareholders, while the Fosun Tourism Group (HKG:1992) share price is up 18% in the last year, that falls short of the market return. We'll need to follow Fosun Tourism Group for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

View our latest analysis for Fosun Tourism Group

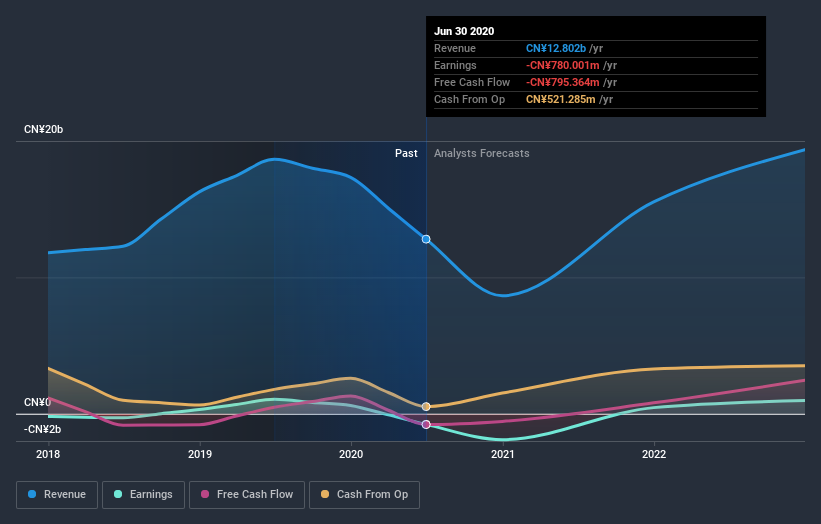

Fosun Tourism Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Fosun Tourism Group saw its revenue shrink by 31%. The lacklustre gain of 18% over twelve months, is not a bad result given the falling revenue. We'd want to see progress to profitability before getting too interested in this stock.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Fosun Tourism Group stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're happy to report that Fosun Tourism Group are up 18% over the year. While it's always nice to make a profit on the stock market, we do note that the TSR was no better than the broader market return of about 28%. However, that falls short of the 43% gain it has made, for shareholders, in the last three months. It's worth taking note when returns accelerate, as it can indicate positive change in the underlying business, and winners often keep winning. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Fosun Tourism Group (at least 1 which is potentially serious) , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Fosun Tourism Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1992

Fosun Tourism Group

An investment holding company, provides tourism and leisure solutions in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Moderate growth potential with acceptable track record.

Market Insights

Community Narratives