- Hong Kong

- /

- Hospitality

- /

- SEHK:1978

LH Group's (HKG:1978) Shareholders Will Receive A Smaller Dividend Than Last Year

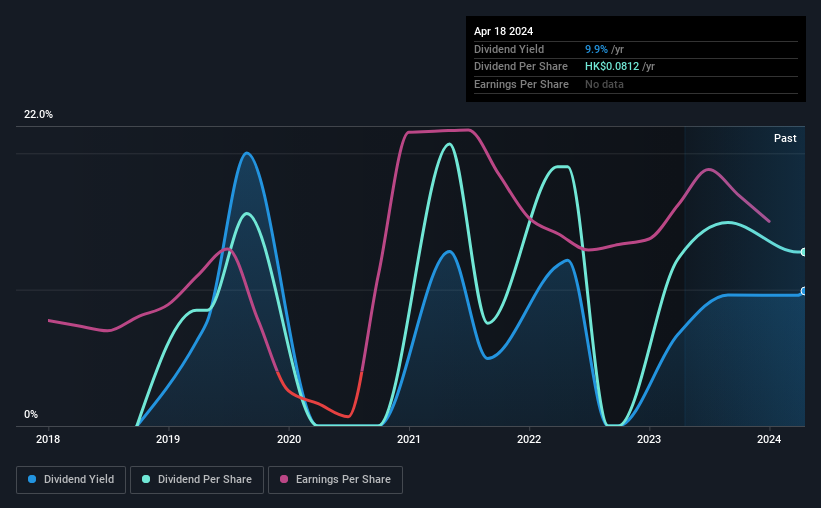

LH Group Limited's (HKG:1978) dividend is being reduced from last year's payment covering the same period to HK$0.0406 on the 27th of June. The yield is still above the industry average at 9.9%.

Check out our latest analysis for LH Group

LH Group Doesn't Earn Enough To Cover Its Payments

A big dividend yield for a few years doesn't mean much if it can't be sustained. The last payment made up 80% of earnings, but cash flows were much higher. This leaves plenty of cash for reinvestment into the business.

Over the next year, EPS could expand by 17.6% if the company continues along the path it has been on recently. If the dividend continues on its recent course, the payout ratio in 12 months could be 188%, which is a bit high and could start applying pressure to the balance sheet.

LH Group's Dividend Has Lacked Consistency

Looking back, LH Group's dividend hasn't been particularly consistent. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. Since 2019, the annual payment back then was HK$0.054, compared to the most recent full-year payment of HK$0.0812. This means that it has been growing its distributions at 8.5% per annum over that time. It's good to see the dividend growing at a decent rate, but the dividend has been cut at least once in the past. LH Group might have put its house in order since then, but we remain cautious.

LH Group Might Find It Hard To Grow Its Dividend

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. We are encouraged to see that LH Group has grown earnings per share at 18% per year over the past five years. The payout ratio is very much on the higher end, which could mean that the growth rate will slow down in the future, and that could flow through to the dividend as well.

In Summary

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 2 warning signs for LH Group that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1978

LH Group

An investment holding company, operates as a full-service restaurant company in Hong Kong.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.