- Hong Kong

- /

- Consumer Services

- /

- SEHK:1935

If You Had Bought JH Educational Technology (HKG:1935) Stock A Year Ago, You Could Pocket A 144% Gain Today

It's been a soft week for JH Educational Technology INC. (HKG:1935) shares, which are down 12%. But that doesn't change the fact that the returns over the last year have been very strong. Indeed, the share price is up an impressive 144% in that time. So we think most shareholders won't be too upset about the recent fall. More important, going forward, is how the business itself is going.

See our latest analysis for JH Educational Technology

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year, JH Educational Technology actually saw its earnings per share drop 21%.

This means it's unlikely the market is judging the company based on earnings growth. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

We think that the revenue growth of 10% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

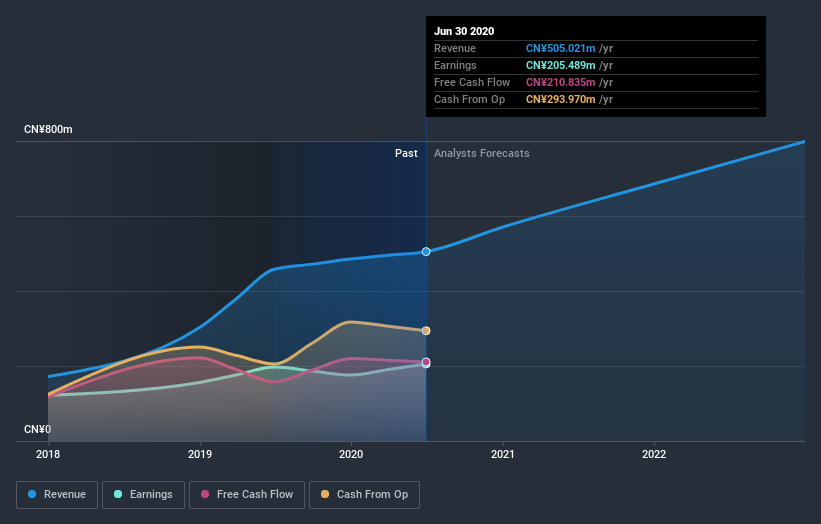

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at JH Educational Technology's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between JH Educational Technology's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for JH Educational Technology shareholders, and that cash payout contributed to why its TSR of 155%, over the last year, is better than the share price return.

A Different Perspective

JH Educational Technology boasts a total shareholder return of 155% for the last year. The more recent returns haven't been as impressive as the longer term returns, coming in at just 4.2%. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). Before deciding if you like the current share price, check how JH Educational Technology scores on these 3 valuation metrics.

We will like JH Educational Technology better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade JH Educational Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1935

JH Educational Technology

An investment holding company, provides higher and secondary education, and related management services in the People’s Republic of China.

Excellent balance sheet and good value.

Market Insights

Community Narratives