- Hong Kong

- /

- Hospitality

- /

- SEHK:1901

Feiyang International Holdings Group Limited (HKG:1901) Might Not Be As Mispriced As It Looks After Plunging 26%

Feiyang International Holdings Group Limited (HKG:1901) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 79% share price decline.

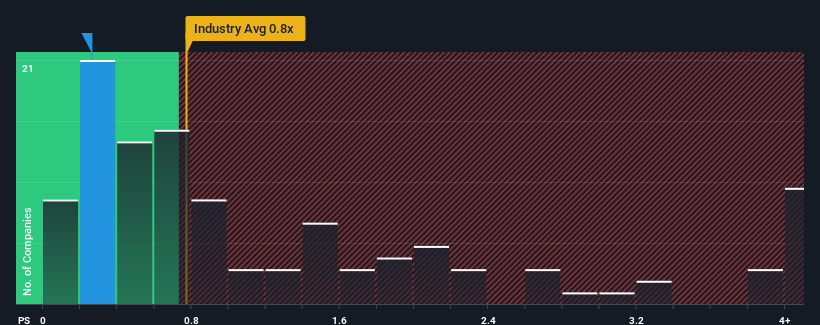

Since its price has dipped substantially, considering around half the companies operating in Hong Kong's Hospitality industry have price-to-sales ratios (or "P/S") above 0.8x, you may consider Feiyang International Holdings Group as an solid investment opportunity with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Feiyang International Holdings Group

What Does Feiyang International Holdings Group's P/S Mean For Shareholders?

Feiyang International Holdings Group certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Although there are no analyst estimates available for Feiyang International Holdings Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Feiyang International Holdings Group's Revenue Growth Trending?

In order to justify its P/S ratio, Feiyang International Holdings Group would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The amazing performance means it was also able to grow revenue by 272% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 20%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it odd that Feiyang International Holdings Group is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Feiyang International Holdings Group's P/S

Feiyang International Holdings Group's recently weak share price has pulled its P/S back below other Hospitality companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We're very surprised to see Feiyang International Holdings Group currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Feiyang International Holdings Group (1 is concerning!) that you should be aware of before investing here.

If you're unsure about the strength of Feiyang International Holdings Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1901

Feiyang International Holdings Group

An investment holding company, engages in the design, development, and sale of travel related products and services in the People’s Republic of China.

Good value with worrying balance sheet.

Market Insights

Community Narratives