- Hong Kong

- /

- Consumer Services

- /

- SEHK:1890

China Kepei Education Group (HKG:1890) Shareholders Booked A 37% Gain In The Last Year

It hasn't been the best quarter for China Kepei Education Group Limited (HKG:1890) shareholders, since the share price has fallen 16% in that time. But looking back over the last year, the returns have actually been rather pleasing! To wit, it had solidly beat the market, up 37%.

View our latest analysis for China Kepei Education Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

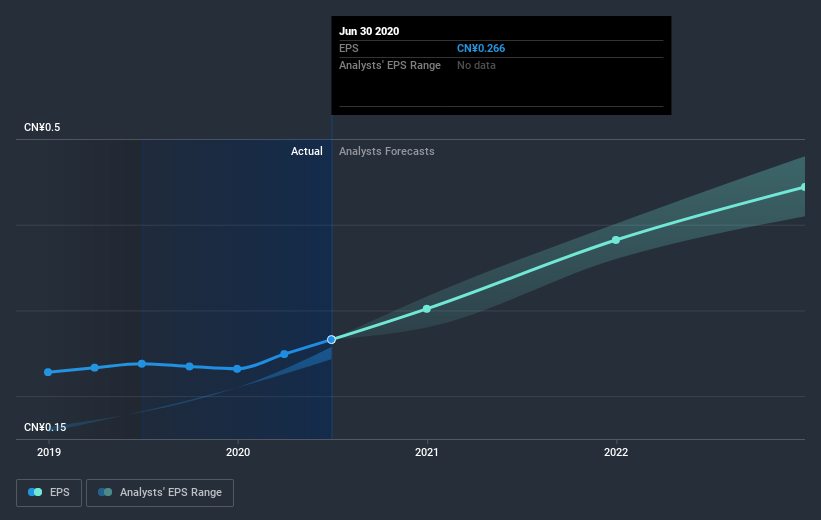

China Kepei Education Group was able to grow EPS by 12% in the last twelve months. This EPS growth is significantly lower than the 37% increase in the share price. This indicates that the market is now more optimistic about the stock.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on China Kepei Education Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for China Kepei Education Group the TSR over the last year was 39%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

China Kepei Education Group boasts a total shareholder return of 39% for the last year (that includes the dividends) . Unfortunately the share price is down 16% over the last quarter. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. Before deciding if you like the current share price, check how China Kepei Education Group scores on these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade China Kepei Education Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1890

China Kepei Education Group

An investment holding company, provides private vocational education services focusing on profession-oriented and vocational education in the People’s Republic of China.

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives