- Hong Kong

- /

- Hospitality

- /

- SEHK:1832

It's Probably Less Likely That S.A.I. Leisure Group Company Limited's (HKG:1832) CEO Will See A Huge Pay Rise This Year

Key Insights

- S.A.I. Leisure Group's Annual General Meeting to take place on 30th of May

- Total pay for CEO Henry Tan includes US$280.0k salary

- The total compensation is similar to the average for the industry

- S.A.I. Leisure Group's EPS declined by 40% over the past three years while total shareholder loss over the past three years was 34%

In the past three years, the share price of S.A.I. Leisure Group Company Limited (HKG:1832) has struggled to grow and now shareholders are sitting on a loss. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. The AGM coming up on 30th of May will be an opportunity for shareholders to have their concerns addressed by the board and for them to exercise their influence on management through voting on resolutions such as executive remuneration. We think shareholders may be cautious of approving a pay rise for the CEO at the moment, based on our analysis below.

Check out our latest analysis for S.A.I. Leisure Group

How Does Total Compensation For Henry Tan Compare With Other Companies In The Industry?

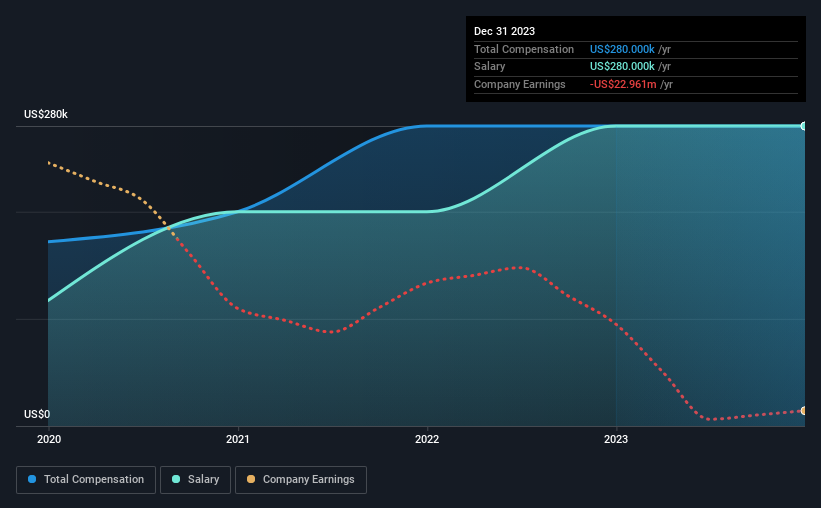

According to our data, S.A.I. Leisure Group Company Limited has a market capitalization of HK$212m, and paid its CEO total annual compensation worth US$280k over the year to December 2023. This was the same amount the CEO received in the prior year. It is worth noting that the CEO compensation consists entirely of the salary, worth US$280k.

On comparing similar-sized companies in the Hong Kong Hospitality industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was US$263k. So it looks like S.A.I. Leisure Group compensates Henry Tan in line with the median for the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$280k | US$280k | 100% |

| Other | - | - | - |

| Total Compensation | US$280k | US$280k | 100% |

On an industry level, roughly 84% of total compensation represents salary and 16% is other remuneration. Speaking on a company level, S.A.I. Leisure Group prefers to tread along a traditional path, disbursing all compensation through a salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at S.A.I. Leisure Group Company Limited's Growth Numbers

Over the last three years, S.A.I. Leisure Group Company Limited has shrunk its earnings per share by 40% per year. It achieved revenue growth of 134% over the last year.

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has S.A.I. Leisure Group Company Limited Been A Good Investment?

The return of -34% over three years would not have pleased S.A.I. Leisure Group Company Limited shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

S.A.I. Leisure Group rewards its CEO solely through a salary, ignoring non-salary benefits completely. The returns to shareholders is disappointing along with lack of earnings growth, which goes some way in explaining the poor returns. Shareholders will get the chance at the upcoming AGM to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 3 warning signs for S.A.I. Leisure Group (of which 2 don't sit too well with us!) that you should know about in order to have a holistic understanding of the stock.

Important note: S.A.I. Leisure Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1832

S.A.I. Leisure Group

An investment holding company, provides leisure tourism services in Saipan, Guam, and Hawaii.

Low and slightly overvalued.