- Hong Kong

- /

- Consumer Services

- /

- SEHK:1769

Promising Penny Stocks To Consider In November 2024

Reviewed by Simply Wall St

Global markets have been buoyed by a recent surge in U.S. stocks, driven by expectations of accelerated growth and favorable tax policies following the Republican election victory. For investors willing to explore beyond the major indices, penny stocks—often representing smaller or newer companies—can present intriguing opportunities. While the term may seem outdated, these investments continue to offer potential for growth at lower price points, especially when supported by strong financials and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.22 | MYR343.4M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR135.97M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$545.92M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.475 | MYR2.36B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.865 | MYR287.13M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.25 | £847.72M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.6075 | A$71.21M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB2.04 | THB1.67B | ★★★★★★ |

Click here to see the full list of 5,756 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

VEF (OM:VEFAB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: VEF AB (publ) is a venture capital firm focused on early venture, emerging growth, and growth capital investments, with a market cap of SEK2.22 billion.

Operations: The firm generates revenue primarily through its investments in equity securities, amounting to $67.74 million.

Market Cap: SEK2.22B

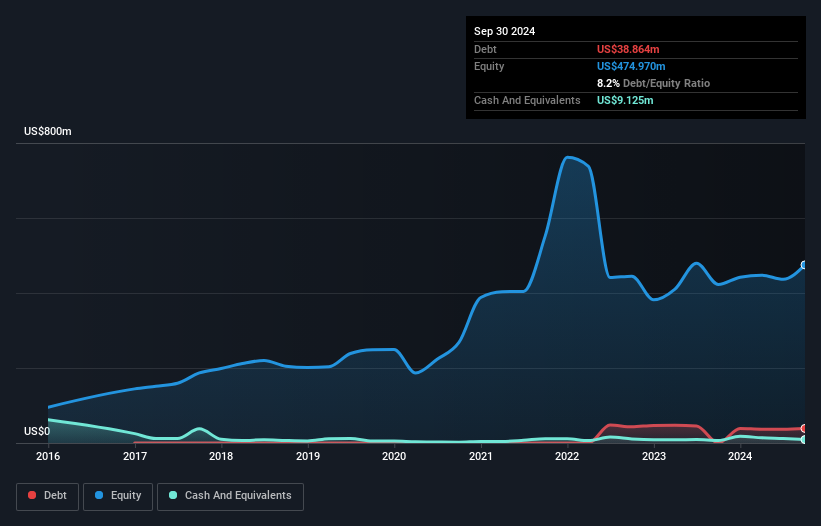

VEF AB has recently transitioned to profitability, reporting a net income of US$38.23 million for Q3 2024, a significant turnaround from the previous year's loss. Despite trading at nearly 69% below its estimated fair value, the company's earnings have declined by an average of 21.6% annually over five years. While short-term assets comfortably cover liabilities, long-term liabilities remain uncovered by these assets. The management and board are experienced, and debt levels are satisfactorily managed with operating cash flow covering debt obligations well. Analysts expect potential stock price growth of around 54%, reflecting positive market sentiment.

- Navigate through the intricacies of VEF with our comprehensive balance sheet health report here.

- Gain insights into VEF's historical outcomes by reviewing our past performance report.

Left Field Printing Group (SEHK:1540)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Left Field Printing Group Limited is an investment holding company that offers printing solutions and services in Australia, with a market cap of HK$249.34 million.

Operations: The company generates revenue of HK$546.63 million from its printing solutions and services segment in Australia.

Market Cap: HK$249.34M

Left Field Printing Group Limited, with a market cap of HK$249.34 million, offers a stable financial position as it operates debt-free and maintains short-term assets of HK$262.2 million, which comfortably cover its liabilities. Despite a decline in earnings over the past five years, recent performance shows significant improvement with earnings growing 264.1% over the past year and net profit margins increasing from 1.8% to 6.6%. The board is experienced with an average tenure of 6.5 years, although the company's return on equity remains low at 13.3%. Recent half-year results indicate steady sales and improved net income compared to last year.

- Click here to discover the nuances of Left Field Printing Group with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Left Field Printing Group's track record.

Scholar Education Group (SEHK:1769)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Scholar Education Group is an investment holding company that offers K-12 after-school education services in the People's Republic of China, with a market cap of HK$2.81 billion.

Operations: The company generates revenue primarily from its private education services, amounting to CN¥718.40 million.

Market Cap: HK$2.81B

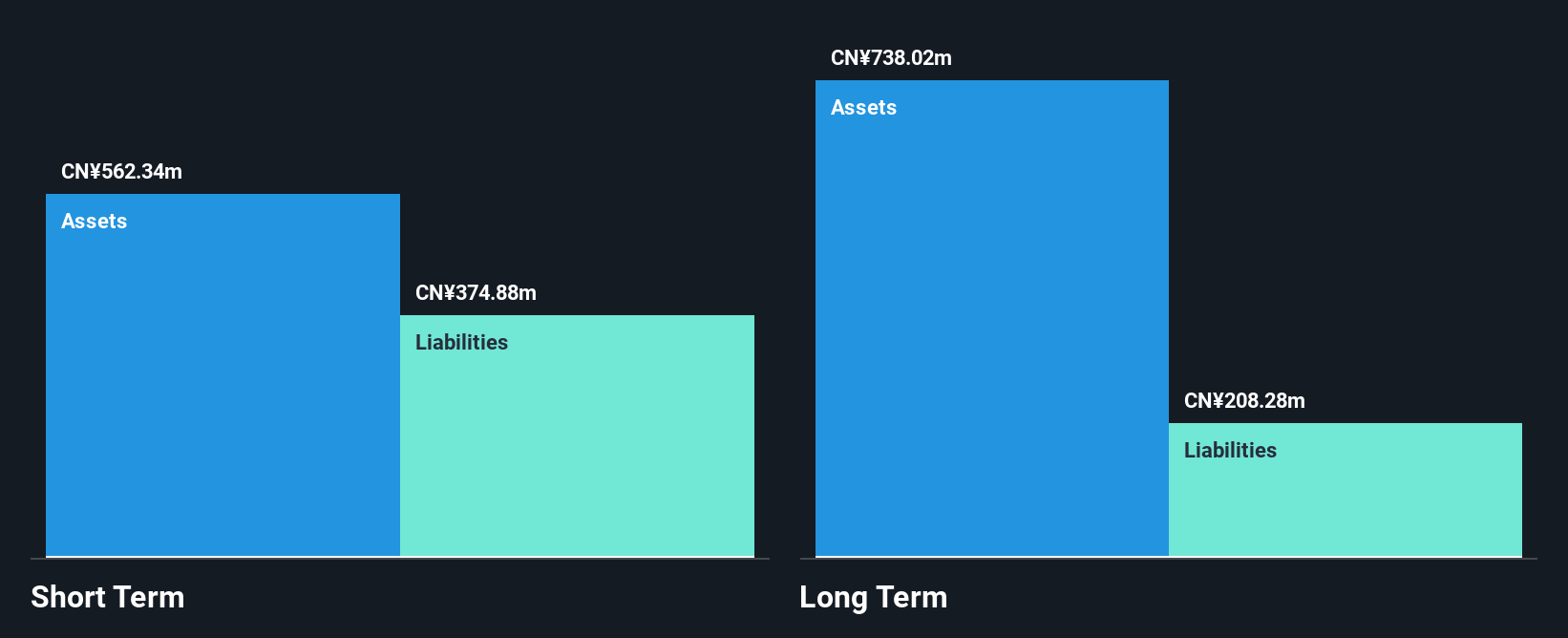

Scholar Education Group, with a market cap of HK$2.81 billion, demonstrates a solid financial foundation in the education sector. The company has shown robust revenue growth, reporting CN¥399.11 million for the half year ended June 2024, up from CN¥251.32 million the previous year. Net income also increased to CN¥82.65 million from CN¥42.94 million, reflecting high-quality earnings and strong operational cash flow that covers its debt well (848.3%). Despite negative earnings growth over the past year compared to industry averages, Scholar Education's seasoned management and board provide stability as it trades significantly below estimated fair value while maintaining stable weekly volatility (9%).

- Dive into the specifics of Scholar Education Group here with our thorough balance sheet health report.

- Evaluate Scholar Education Group's prospects by accessing our earnings growth report.

Taking Advantage

- Dive into all 5,756 of the Penny Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1769

Scholar Education Group

An investment holding company, provides K-12 after-school education services in the People’s Republic of China.

Flawless balance sheet with moderate growth potential.