- Hong Kong

- /

- Consumer Services

- /

- SEHK:1765

Here's Why Hope Education Group (HKG:1765) Has A Meaningful Debt Burden

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Hope Education Group Co., Ltd. (HKG:1765) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Hope Education Group

How Much Debt Does Hope Education Group Carry?

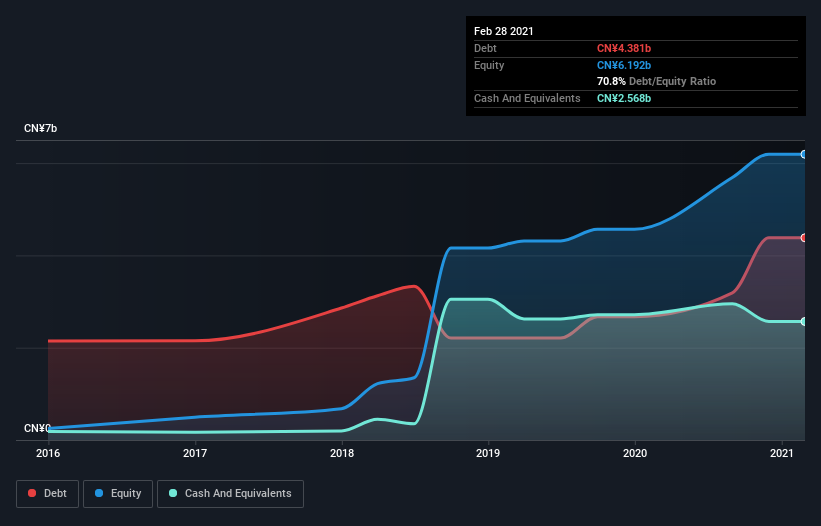

You can click the graphic below for the historical numbers, but it shows that as of February 2021 Hope Education Group had CN¥4.38b of debt, an increase on CN¥2.67b, over one year. However, it does have CN¥2.57b in cash offsetting this, leading to net debt of about CN¥1.81b.

A Look At Hope Education Group's Liabilities

The latest balance sheet data shows that Hope Education Group had liabilities of CN¥4.29b due within a year, and liabilities of CN¥4.66b falling due after that. On the other hand, it had cash of CN¥2.57b and CN¥867.0m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥5.52b.

Hope Education Group has a market capitalization of CN¥13.2b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Hope Education Group has a debt to EBITDA ratio of 2.8 and its EBIT covered its interest expense 3.6 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Notably, Hope Education Group's EBIT was pretty flat over the last year, which isn't ideal given the debt load. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Hope Education Group can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, Hope Education Group created free cash flow amounting to 9.3% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

Both Hope Education Group's conversion of EBIT to free cash flow and its interest cover were discouraging. But its not so bad at growing its EBIT. When we consider all the factors discussed, it seems to us that Hope Education Group is taking some risks with its use of debt. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example Hope Education Group has 4 warning signs (and 1 which can't be ignored) we think you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1765

XJ International Holdings

An investment holding company, engages in the provision of higher education and secondary vocational education services in China and Malaysia.

Good value with proven track record.

Market Insights

Community Narratives