- Hong Kong

- /

- Consumer Services

- /

- SEHK:1565

Shareholders Will Probably Hold Off On Increasing Virscend Education Company Limited's (HKG:1565) CEO Compensation For The Time Being

In the past three years, the share price of Virscend Education Company Limited (HKG:1565) has struggled to grow and now shareholders are sitting on a loss. Per share earnings growth is also poor, despite revenues growing. In light of this performance, shareholders will have a chance to question the board in the upcoming AGM on 24 February 2023, where they can impact on future company performance by voting on resolutions, including executive compensation. We think shareholders may be cautious of approving a pay rise for the CEO at the moment, based on our analysis below.

See our latest analysis for Virscend Education

How Does Total Compensation For Yude Yan Compare With Other Companies In The Industry?

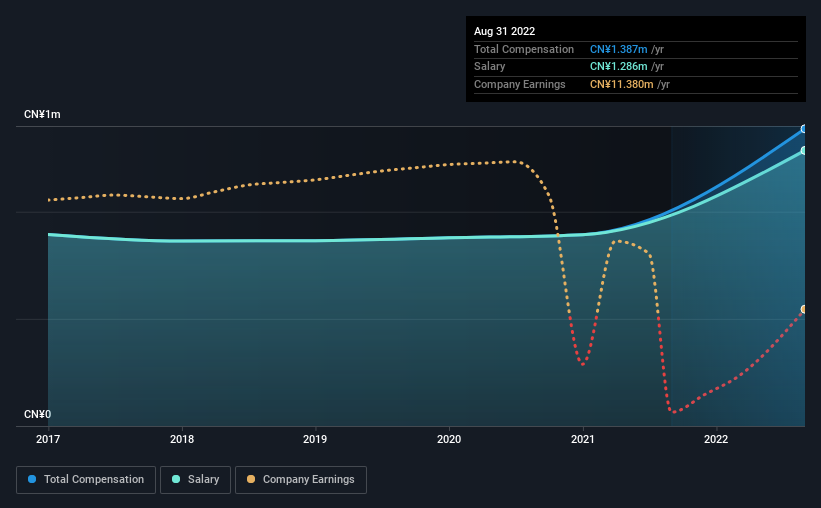

According to our data, Virscend Education Company Limited has a market capitalization of HK$491m, and paid its CEO total annual compensation worth CN¥1.4m over the year to August 2022. We note that's an increase of 55% above last year. We note that the salary portion, which stands at CN¥1.29m constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the Hong Kong Consumer Services industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was CN¥1.9m. This suggests that Virscend Education remunerates its CEO largely in line with the industry average. What's more, Yude Yan holds HK$239m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2022 | 2020 | Proportion (2022) |

| Salary | CN¥1.3m | CN¥893k | 93% |

| Other | CN¥101k | - | 7% |

| Total Compensation | CN¥1.4m | CN¥893k | 100% |

On an industry level, around 81% of total compensation represents salary and 19% is other remuneration. According to our research, Virscend Education has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Virscend Education Company Limited's Growth

Virscend Education Company Limited has reduced its earnings per share by 69% a year over the last three years. Its revenue is up 45% over the last year.

The decrease in EPS could be a concern for some investors. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Virscend Education Company Limited Been A Good Investment?

The return of -90% over three years would not have pleased Virscend Education Company Limited shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

The returns to shareholders is disappointing along with lack of earnings growth, which goes some way in explaining the poor returns. Shareholders will get the chance at the upcoming AGM to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 5 warning signs for Virscend Education (of which 3 are a bit unpleasant!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Virscend Education, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you're looking to trade Virscend Education, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1565

Virscend Education

An investment holding company, provides private education services in the People’s Republic of China.

Proven track record second-rate dividend payer.

Market Insights

Community Narratives