- Hong Kong

- /

- Consumer Services

- /

- SEHK:1448

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by record-high U.S. indexes and positive economic indicators such as falling jobless claims and rising home sales, investors are keenly observing the Federal Reserve's upcoming decisions on interest rates. Amidst this backdrop of broad-based gains and geopolitical uncertainties, dividend stocks remain an attractive option for those seeking steady income streams in a dynamic market environment. In selecting dividend stocks, it is crucial to focus on companies with strong financial health and consistent payout histories, which can provide stability even when market conditions fluctuate.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.28% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.89% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.60% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.46% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.45% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.92% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.70% | ★★★★★☆ |

Click here to see the full list of 1964 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

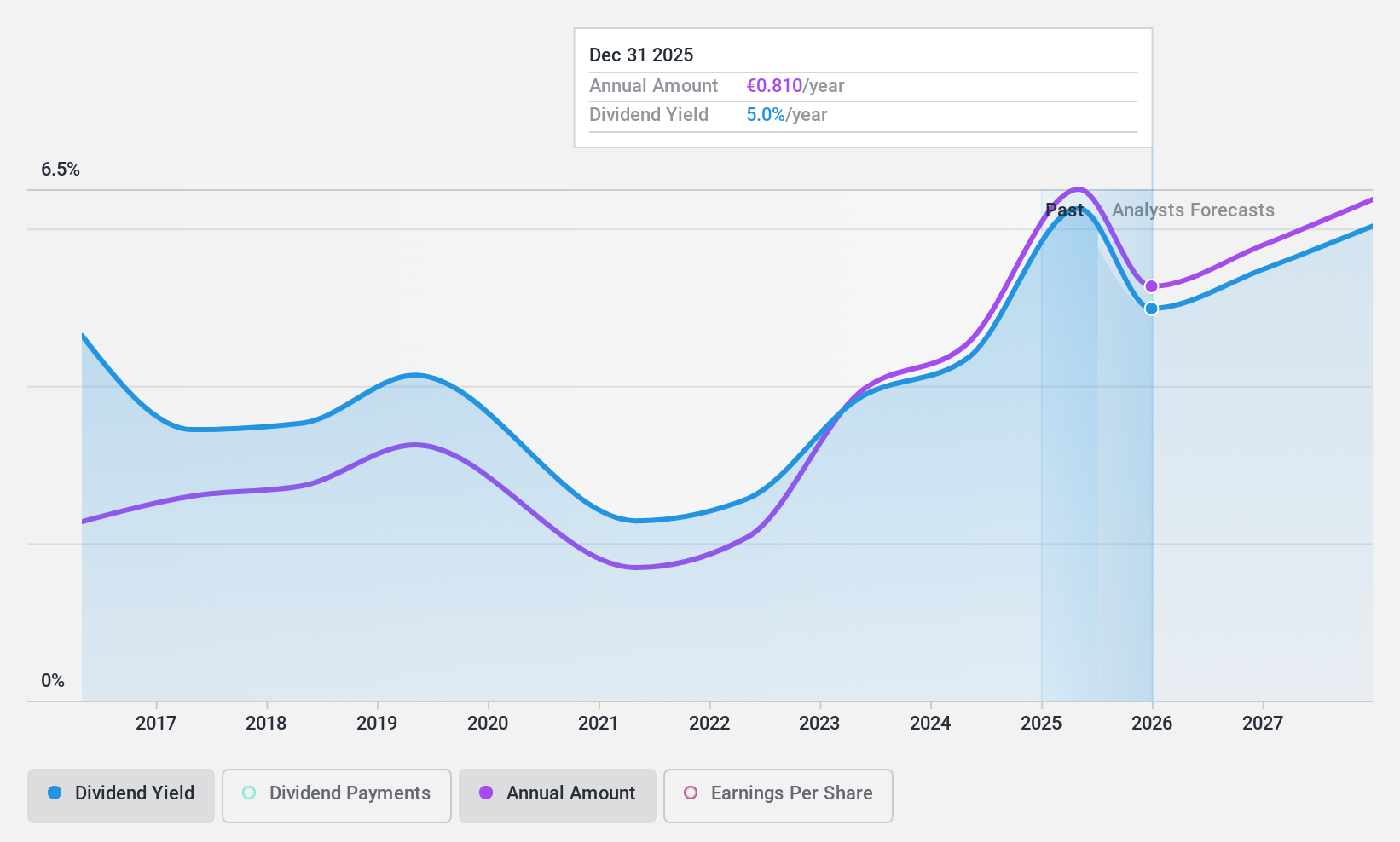

B&C Speakers (BIT:BEC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: B&C Speakers S.p.A. is involved in the production and marketing of professional loudspeakers under the B&C brand both in Italy and internationally, with a market cap of €170.23 million.

Operations: B&C Speakers S.p.A. generates its revenue primarily from the Acoustic Transducers segment, amounting to €99.40 million.

Dividend Yield: 4.2%

B&C Speakers' dividends are well-covered by earnings and cash flows, with a payout ratio of 44.1% and a cash payout ratio of 50.8%. Despite past volatility in dividend payments, the company has shown growth over the last decade. Recent earnings reports indicate strong financial performance, with net income rising to €15.78 million for nine months ending September 2024 from €11.67 million a year earlier, supporting dividend sustainability despite its lower yield compared to market leaders.

- Navigate through the intricacies of B&C Speakers with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of B&C Speakers shares in the market.

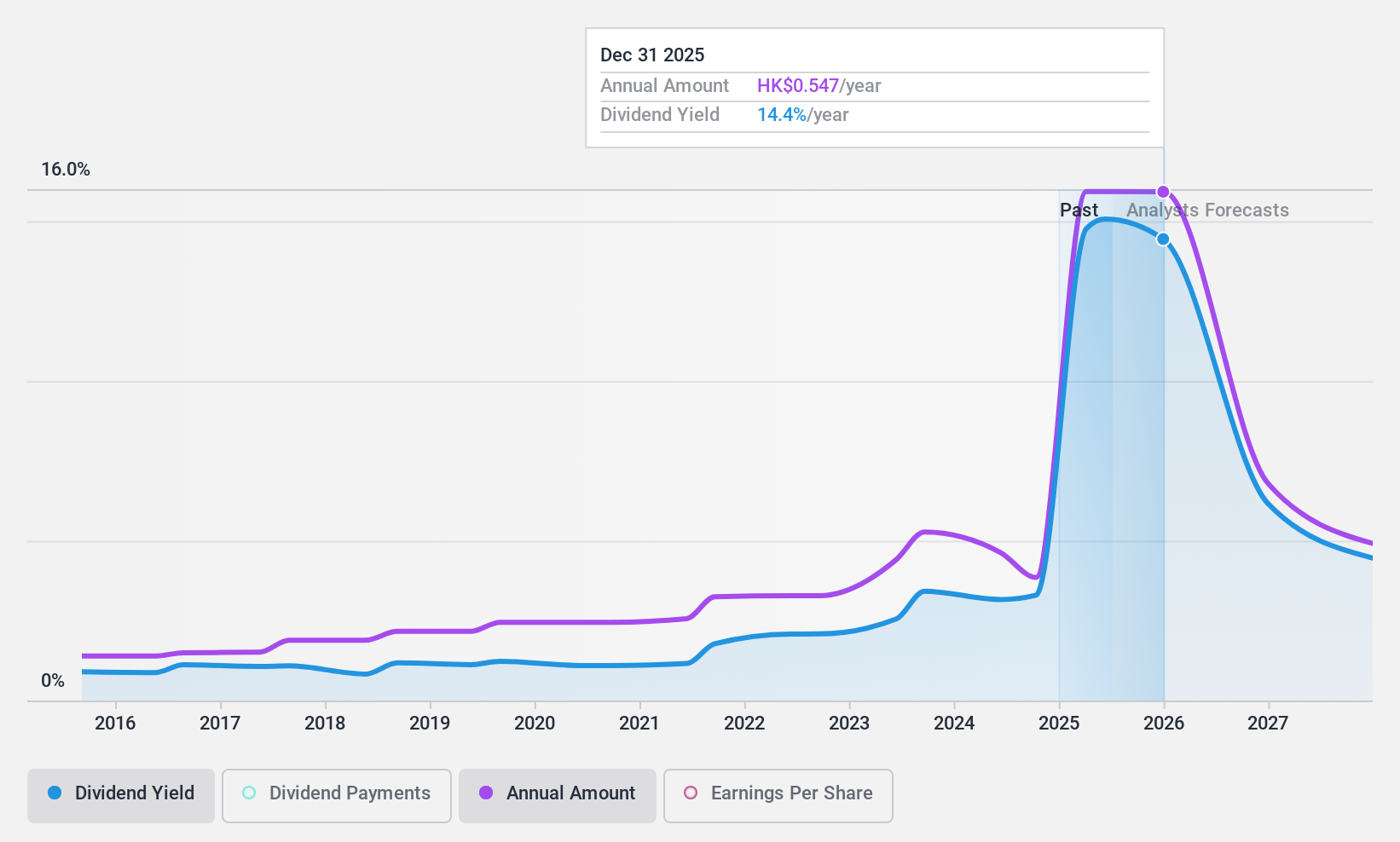

Fu Shou Yuan International Group (SEHK:1448)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fu Shou Yuan International Group Limited, with a market cap of HK$8.79 billion, operates in the People's Republic of China offering burial and funeral services through its subsidiaries.

Operations: Fu Shou Yuan International Group Limited generates revenue from burial services (CN¥1.78 billion) and funeral services (CN¥357.97 million) in the People’s Republic of China.

Dividend Yield: 4%

Fu Shou Yuan International Group's dividend yield is lower than the top 25% of Hong Kong dividend payers. However, its dividends are well-covered by earnings and cash flows, with payout ratios of 43.6% and 44.2%, respectively. Despite a volatile dividend history over the past decade, there has been growth in payments during this period. Earnings are projected to grow annually by 13.43%, potentially supporting future dividend sustainability despite past instability.

- Dive into the specifics of Fu Shou Yuan International Group here with our thorough dividend report.

- Upon reviewing our latest valuation report, Fu Shou Yuan International Group's share price might be too optimistic.

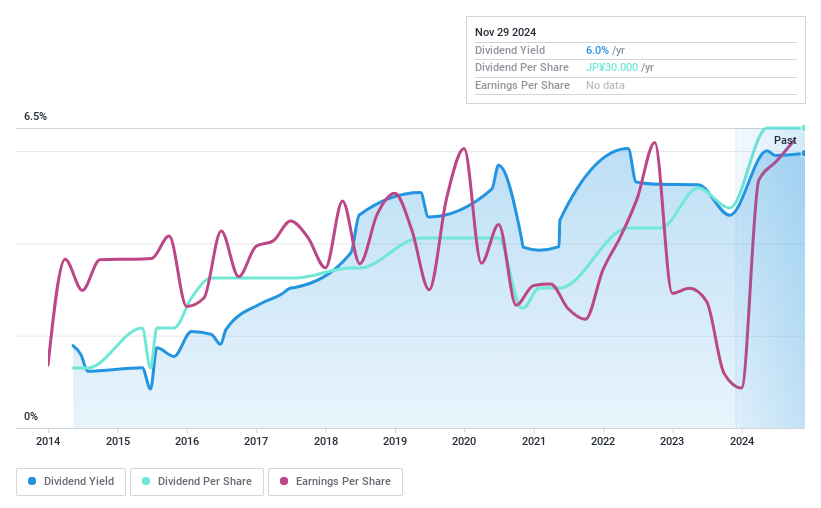

MIRARTH HOLDINGSInc (TSE:8897)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MIRARTH HOLDINGS, Inc. operates in the real estate sector in Japan and has a market capitalization of ¥68.36 billion.

Operations: MIRARTH HOLDINGS, Inc. generates revenue through its Real Estate Business with ¥189.09 billion, Energy Business contributing ¥13.73 billion, and Asset Management Business providing ¥1.05 billion.

Dividend Yield: 6%

MIRARTH HOLDINGS Inc. recently increased its dividend to JPY 7.00 per share, reflecting growth from JPY 6.00 last year, yet its dividends have been historically volatile over the past decade. With a payout ratio of 29% and a cash payout ratio of 20.6%, dividends are well-covered by earnings and cash flows despite high debt levels. Trading significantly below estimated fair value, the stock's yield remains attractive within Japan's top quartile for dividend payers at 5.95%.

- Delve into the full analysis dividend report here for a deeper understanding of MIRARTH HOLDINGSInc.

- Our expertly prepared valuation report MIRARTH HOLDINGSInc implies its share price may be lower than expected.

Where To Now?

- Discover the full array of 1964 Top Dividend Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1448

Fu Shou Yuan International Group

Provides burial and funeral services in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives