- Hong Kong

- /

- Consumer Services

- /

- SEHK:1448

Asian Market Insights: Fu Shou Yuan International Group And 2 Promising Penny Stocks

Reviewed by Simply Wall St

As global markets navigate a complex landscape of economic indicators and cautious monetary policies, investors are increasingly exploring diverse opportunities. Penny stocks, often representing smaller or newer companies, continue to capture interest for their potential growth at lower price points. Despite the term's vintage feel, these stocks can offer surprising value when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB3.84 | THB3.79B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$2.99 | HK$2.43B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.53 | HK$946.34M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.51 | HK$2.08B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.15 | SGD466.08M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.82 | THB2.89B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.35 | SGD13.18B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.82 | THB9.74B | ✅ 3 ⚠️ 3 View Analysis > |

| Lum Chang Holdings (SGX:L19) | SGD0.44 | SGD164.83M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 955 stocks from our Asian Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Fu Shou Yuan International Group (SEHK:1448)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fu Shou Yuan International Group Limited, with a market cap of HK$6.68 billion, operates in the People's Republic of China offering burial and funeral services through its subsidiaries.

Operations: The company generates revenue primarily from burial services (CN¥1.28 billion) and funeral services (CN¥276.98 million), supplemented by other services (CN¥37 million).

Market Cap: HK$6.68B

Fu Shou Yuan International Group, with a market cap of HK$6.68 billion, faces challenges as recent earnings reveal a net loss of CN¥261.41 million for the first half of 2025, compared to a profit in the previous year. Despite being debt-free and having seasoned management and board members, the company struggles with profitability due to macroeconomic pressures and increased tax expenses. While analysts project significant earnings growth at 69% annually, its dividend yield of 18.82% is not well-covered by earnings or cash flows, raising sustainability concerns amidst declining revenues from burial services (CN¥1.28 billion) and funeral services (CN¥276.98 million).

- Click here to discover the nuances of Fu Shou Yuan International Group with our detailed analytical financial health report.

- Gain insights into Fu Shou Yuan International Group's future direction by reviewing our growth report.

Ever Sunshine Services Group (SEHK:1995)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ever Sunshine Services Group Limited is an investment holding company offering property management services in the People's Republic of China, with a market cap of HK$3.22 billion.

Operations: The company's revenue primarily comes from its property management services, which generated CN¥6.93 billion.

Market Cap: HK$3.22B

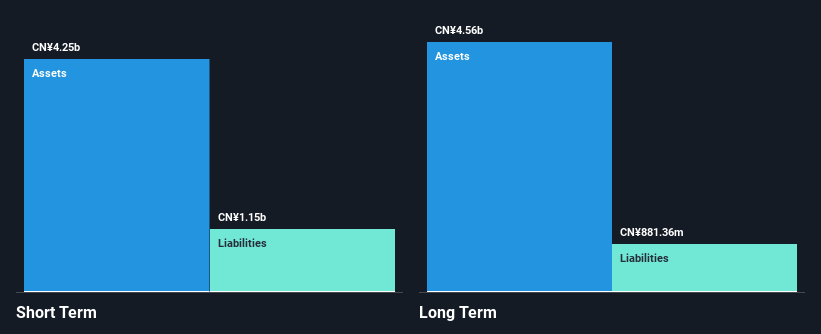

Ever Sunshine Services Group, with a market cap of HK$3.22 billion, has maintained stable weekly volatility at 5% over the past year. Despite a decline in net profit margins from 6.8% to 6.2%, the company remains financially robust with CN¥6.1 billion in short-term assets exceeding both its short-term and long-term liabilities significantly. Its debt is well-covered by operating cash flow and it trades at a favorable price-to-earnings ratio of 6.9x compared to the Hong Kong market average of 12.7x, indicating good relative value despite recent negative earnings growth (-7.1%). Recent management changes aim to bolster strategic direction amidst insider selling activity and ongoing M&A developments involving LMR Partners LLC's acquisition plans for an 8.24% stake from CIFI Holdings.

- Jump into the full analysis health report here for a deeper understanding of Ever Sunshine Services Group.

- Learn about Ever Sunshine Services Group's future growth trajectory here.

AIM Vaccine (SEHK:6660)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: AIM Vaccine Co., Ltd. is involved in the research, development, manufacture, and sale of human-use vaccines in China with a market cap of approximately HK$5.30 billion.

Operations: The company generates revenue primarily from the sale of vaccines and research and development services, amounting to CN¥1.26 billion.

Market Cap: HK$5.3B

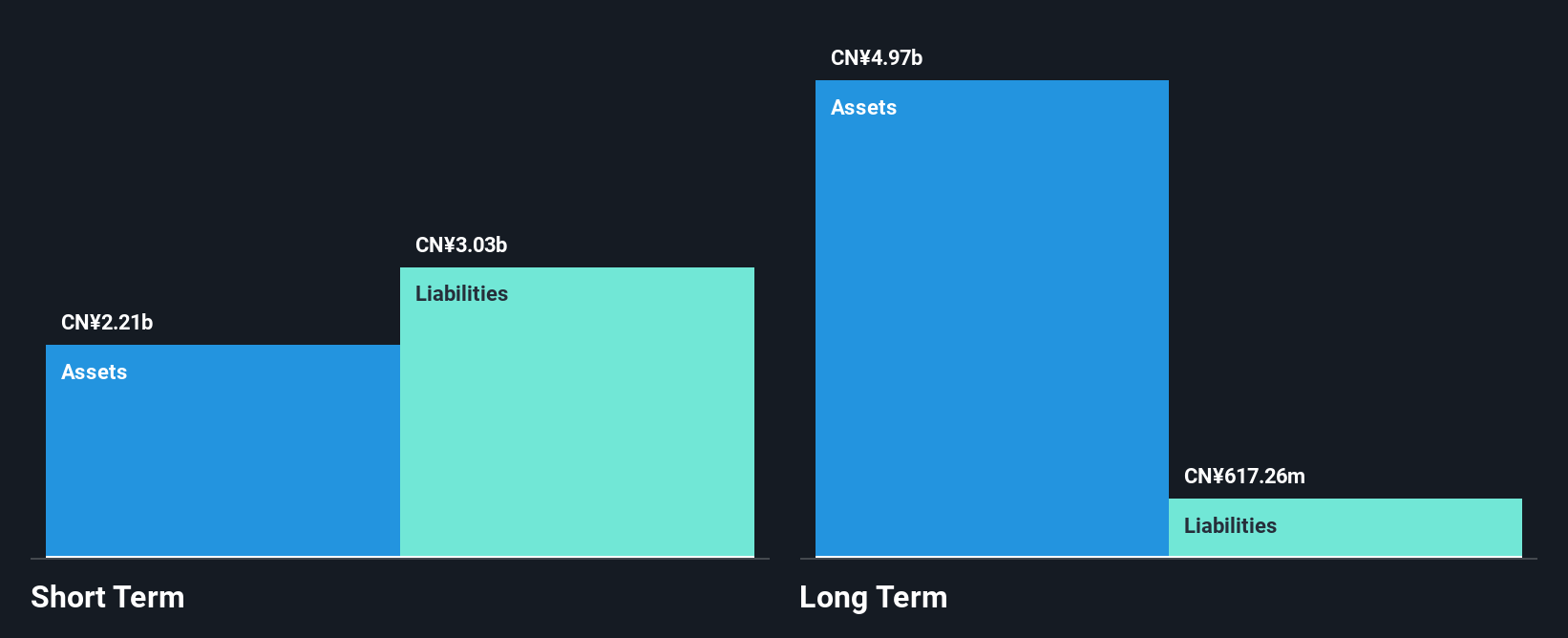

AIM Vaccine Co., Ltd., with a market cap of HK$5.30 billion, faces challenges as it remains unprofitable, with losses increasing over the past five years at 18.5% annually. Despite this, the company has a satisfactory net debt to equity ratio of 38.3% and sufficient cash runway for over three years if free cash flow remains stable. Its revenue for the first half of 2025 was CN¥514.66 million, slightly down from last year, while net loss marginally improved to CN¥131.12 million from CN¥139.25 million previously reported, reflecting ongoing financial pressures in its operations amidst forecasted revenue growth expectations.

- Get an in-depth perspective on AIM Vaccine's performance by reading our balance sheet health report here.

- Evaluate AIM Vaccine's prospects by accessing our earnings growth report.

Next Steps

- Unlock more gems! Our Asian Penny Stocks screener has unearthed 952 more companies for you to explore.Click here to unveil our expertly curated list of 955 Asian Penny Stocks.

- Contemplating Other Strategies? AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1448

Fu Shou Yuan International Group

Provides burial and funeral services in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives