- Hong Kong

- /

- Hospitality

- /

- SEHK:132

Investors bid Hing Yip Holdings (HKG:132) up HK$51m despite increasing losses YoY, taking one-year return to 168%

While Hing Yip Holdings Limited (HKG:132) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 17% in the last quarter. But that doesn't change the fact that the returns over the last year have been very strong. We're very pleased to report the share price shot up 161% in that time. So it is important to view the recent reduction in price through that lense. Only time will tell if there is still too much optimism currently reflected in the share price.

Since it's been a strong week for Hing Yip Holdings shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for Hing Yip Holdings

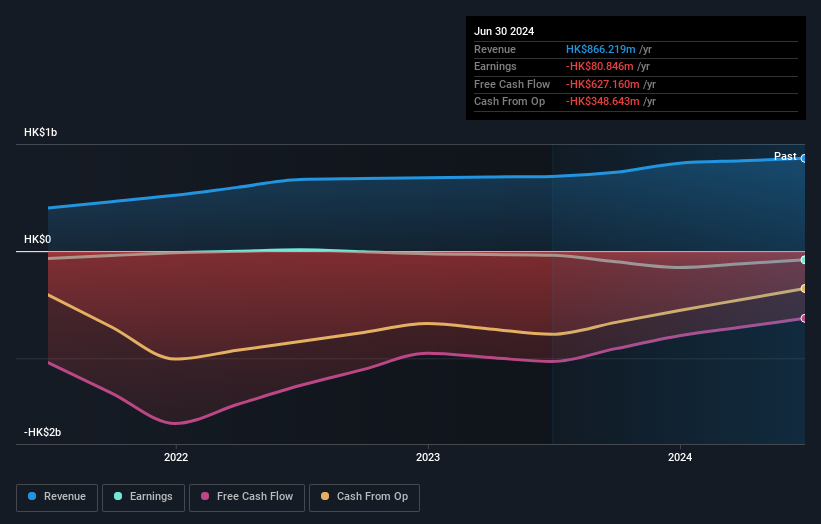

Given that Hing Yip Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last year Hing Yip Holdings saw its revenue grow by 24%. That's a fairly respectable growth rate. The revenue growth is decent but the share price had an even better year, gaining 161%. If the profitability is on the horizon then now could be a very exciting time to be a shareholder. Of course, we are always cautious about succumbing to 'fear of missing out' when a stock has shot up strongly.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Hing Yip Holdings stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Hing Yip Holdings, it has a TSR of 168% for the last 1 year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Hing Yip Holdings shareholders have received a total shareholder return of 168% over one year. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 6% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 4 warning signs we've spotted with Hing Yip Holdings (including 2 which are a bit unpleasant) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hing Yip Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:132

Hing Yip Holdings

An investment holding company, engages in the big data, civil explosives, property development and investment, financial leasing, hotel operation, and wellness elderly care businesses in Hong Kong and Mainland China.

Slight and slightly overvalued.

Market Insights

Community Narratives