- Hong Kong

- /

- Hospitality

- /

- SEHK:132

China Investments Holdings (HKG:132) Has A Somewhat Strained Balance Sheet

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies China Investments Holdings Limited (HKG:132) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for China Investments Holdings

What Is China Investments Holdings's Net Debt?

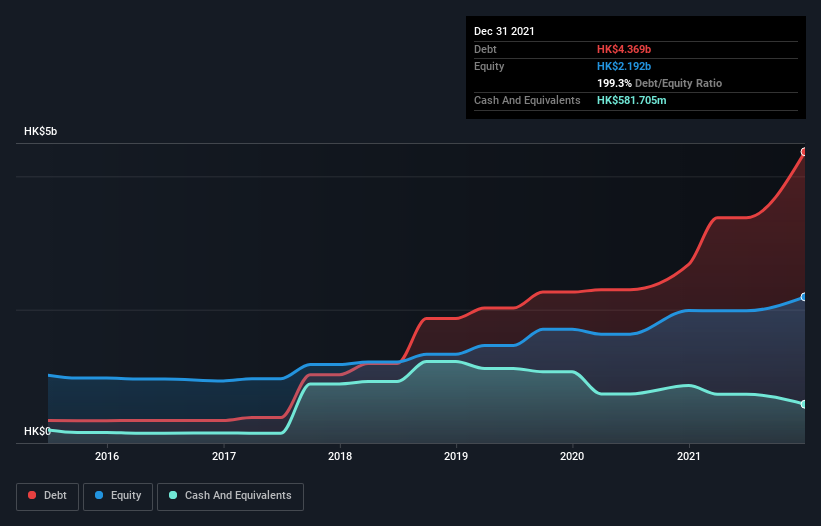

You can click the graphic below for the historical numbers, but it shows that as of December 2021 China Investments Holdings had HK$4.37b of debt, an increase on HK$2.68b, over one year. However, because it has a cash reserve of HK$581.7m, its net debt is less, at about HK$3.79b.

How Strong Is China Investments Holdings' Balance Sheet?

The latest balance sheet data shows that China Investments Holdings had liabilities of HK$1.92b due within a year, and liabilities of HK$4.19b falling due after that. On the other hand, it had cash of HK$581.7m and HK$920.8m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by HK$4.60b.

The deficiency here weighs heavily on the HK$667.8m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, China Investments Holdings would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

China Investments Holdings shareholders face the double whammy of a high net debt to EBITDA ratio (30.6), and fairly weak interest coverage, since EBIT is just 1.0 times the interest expense. The debt burden here is substantial. Looking on the bright side, China Investments Holdings boosted its EBIT by a silky 85% in the last year. Like a mother's loving embrace of a newborn that sort of growth builds resilience, putting the company in a stronger position to manage its debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since China Investments Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, China Investments Holdings saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

On the face of it, China Investments Holdings's conversion of EBIT to free cash flow left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its EBIT growth rate is a good sign, and makes us more optimistic. After considering the datapoints discussed, we think China Investments Holdings has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that China Investments Holdings is showing 3 warning signs in our investment analysis , and 2 of those shouldn't be ignored...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Hing Yip Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:132

Hing Yip Holdings

An investment holding company, engages in the big data, civil explosives, property development and investment, financial leasing, hotel operation, and wellness elderly care businesses in Hong Kong and Mainland China.

Slight and slightly overvalued.