- Hong Kong

- /

- Consumer Services

- /

- SEHK:1317

China Maple Leaf Educational Systems Limited (HKG:1317) Just Reported Full-Year Earnings: Have Analysts Changed Their Mind On The Stock?

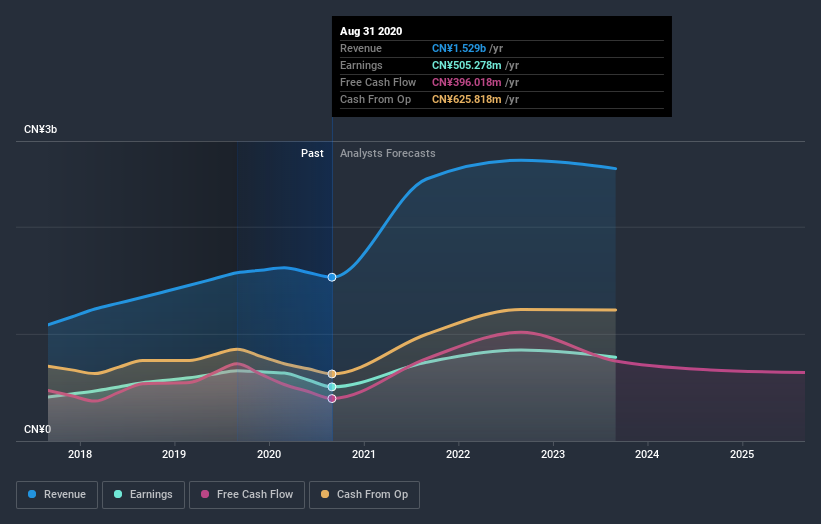

Shareholders might have noticed that China Maple Leaf Educational Systems Limited (HKG:1317) filed its annual result this time last week. The early response was not positive, with shares down 8.8% to HK$2.18 in the past week. The result was fairly weak overall, with revenues of CN¥1.5b being 6.6% less than what the analysts had been modelling. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on China Maple Leaf Educational Systems after the latest results.

See our latest analysis for China Maple Leaf Educational Systems

Taking into account the latest results, the current consensus from China Maple Leaf Educational Systems' seven analysts is for revenues of CN¥2.45b in 2021, which would reflect a huge 60% increase on its sales over the past 12 months. Statutory earnings per share are predicted to jump 43% to CN¥0.24. In the lead-up to this report, the analysts had been modelling revenues of CN¥2.48b and earnings per share (EPS) of CN¥0.26 in 2021. The analysts seem to have become a little more negative on the business after the latest results, given the minor downgrade to their earnings per share numbers for next year.

It might be a surprise to learn that the consensus price target was broadly unchanged at CN¥2.57, with the analysts clearly implying that the forecast decline in earnings is not expected to have much of an impact on valuation. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values China Maple Leaf Educational Systems at CN¥4.09 per share, while the most bearish prices it at CN¥1.92. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The analysts are definitely expecting China Maple Leaf Educational Systems' growth to accelerate, with the forecast 60% growth ranking favourably alongside historical growth of 18% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 21% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that China Maple Leaf Educational Systems is expected to grow much faster than its industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for China Maple Leaf Educational Systems. Fortunately, they also reconfirmed their revenue numbers, suggesting sales are tracking in line with expectations - and our data suggests that revenues are expected to grow faster than the wider industry. The consensus price target held steady at CN¥2.57, with the latest estimates not enough to have an impact on their price targets.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for China Maple Leaf Educational Systems going out to 2023, and you can see them free on our platform here..

Even so, be aware that China Maple Leaf Educational Systems is showing 2 warning signs in our investment analysis , and 1 of those is significant...

If you’re looking to trade China Maple Leaf Educational Systems, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1317

China Maple Leaf Educational Systems

Operates private and preschools in the People’s Republic of China, Malaysia, Singapore, and internationally.

Good value with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026