- United Arab Emirates

- /

- Insurance

- /

- DFM:DNIR

Dubai National Insurance & Reinsurance (P.S.C.) And 2 Other Promising Penny Stocks For Savvy Investors

Reviewed by Simply Wall St

As global markets respond to shifting interest rates and geopolitical uncertainties, investors are increasingly seeking opportunities beyond the traditional blue-chip stocks. Penny stocks, a term that may seem outdated but still holds significance, often represent smaller or newer companies with potential for growth at lower price points. When these stocks are supported by strong financial health and solid fundamentals, they can offer promising opportunities for those looking to diversify their portfolios.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.73 | HK$42.97B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.535 | MYR2.64B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.905 | £468.49M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.80 | £455.09M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £174.08M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR292.11M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.695 | MYR414.16M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$143.12M | ★★★★☆☆ |

| Helios Underwriting (AIM:HUW) | £2.23 | £158.38M | ★★★★★☆ |

Click here to see the full list of 5,706 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dubai National Insurance & Reinsurance (P.S.C.) operates in the insurance and reinsurance industry, offering a range of coverage services, with a market cap of AED434.28 million.

Operations: The company's revenue segments include Investments generating AED50.77 million and Underwriting with a loss of AED204.65 million.

Market Cap: AED434.28M

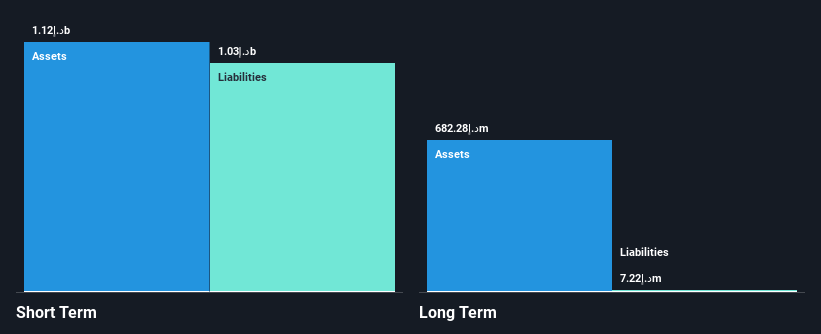

Dubai National Insurance & Reinsurance (P.S.C.) presents a mixed picture for investors interested in smaller-cap stocks. The company has maintained profitability, reporting AED6.67 million in net income for Q3 2024, but faces challenges with declining earnings over the past five years. Despite this, it remains debt-free and its short-term assets significantly exceed both short- and long-term liabilities, indicating solid financial stability. However, the board's relatively low average tenure suggests potential governance risks. With a Price-to-Earnings ratio of 11.4x below the market average, valuation appears attractive though growth prospects remain uncertain amid recent profit margin declines.

- Navigate through the intricacies of Dubai National Insurance & Reinsurance (P.S.C.) with our comprehensive balance sheet health report here.

- Assess Dubai National Insurance & Reinsurance (P.S.C.)'s previous results with our detailed historical performance reports.

Sino Hotels (Holdings) (SEHK:1221)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sino Hotels (Holdings) Limited is an investment holding company that operates and manages hotels in Hong Kong, with a market cap of HK$1.57 billion.

Operations: The company's revenue is derived from investment holding (HK$20.48 million), hotel operations at City Garden Hotel (HK$97.39 million), and club operation and hotel management services (HK$15.82 million).

Market Cap: HK$1.57B

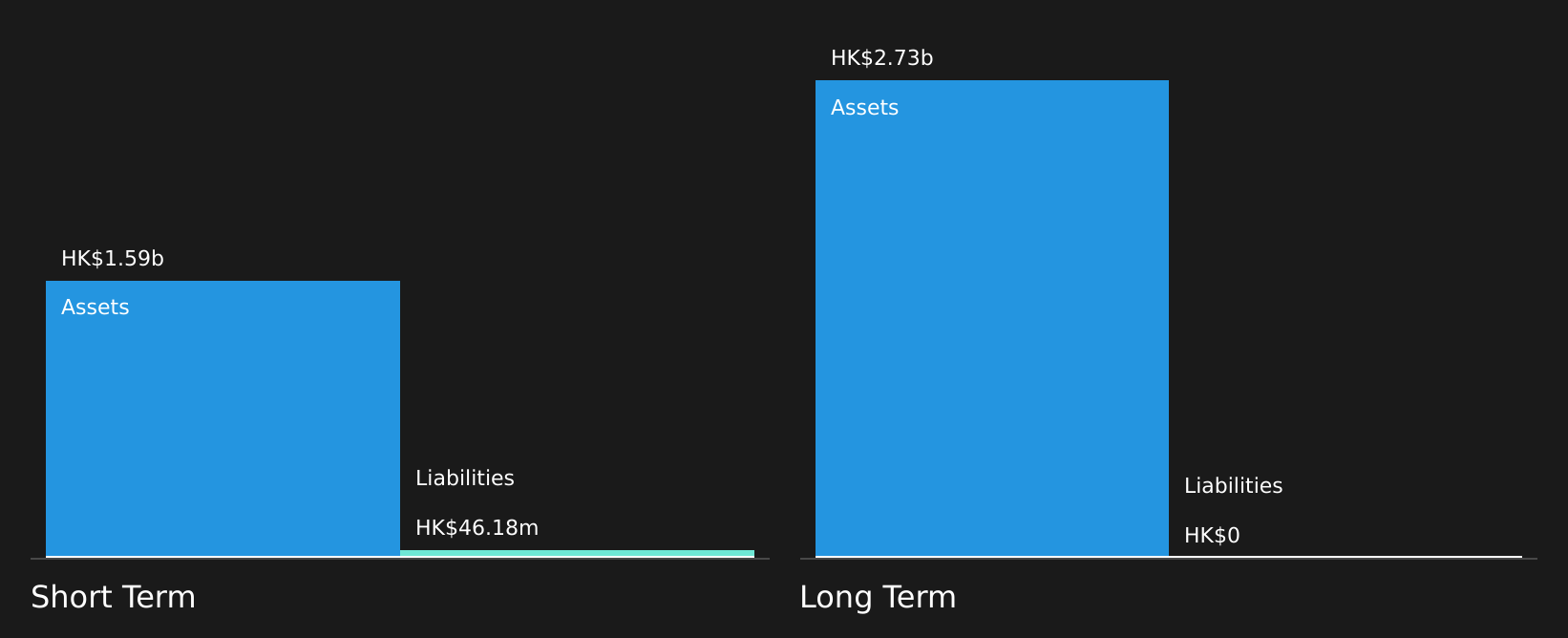

Sino Hotels (Holdings) Limited, with a market cap of HK$1.57 billion, has recently turned profitable, though its earnings have declined by 9.6% annually over the past five years. The company's financial stability is underscored by having more cash than total debt and short-term assets of HK$1.4 billion far exceeding short-term liabilities of HK$21.3 million. Despite experiencing a significant one-off loss of HK$40.9 million impacting recent results, its debt is well covered by operating cash flow at a very large rate relative to debt levels. The board's average tenure suggests experienced governance despite limited management data available for assessment.

- Get an in-depth perspective on Sino Hotels (Holdings)'s performance by reading our balance sheet health report here.

- Examine Sino Hotels (Holdings)'s past performance report to understand how it has performed in prior years.

Yuan Cheng CableLtd (SZSE:002692)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yuan Cheng Cable Co., Ltd. specializes in the design, R&D, production, and sales of wire and cable products in China with a market cap of CN¥3.25 billion.

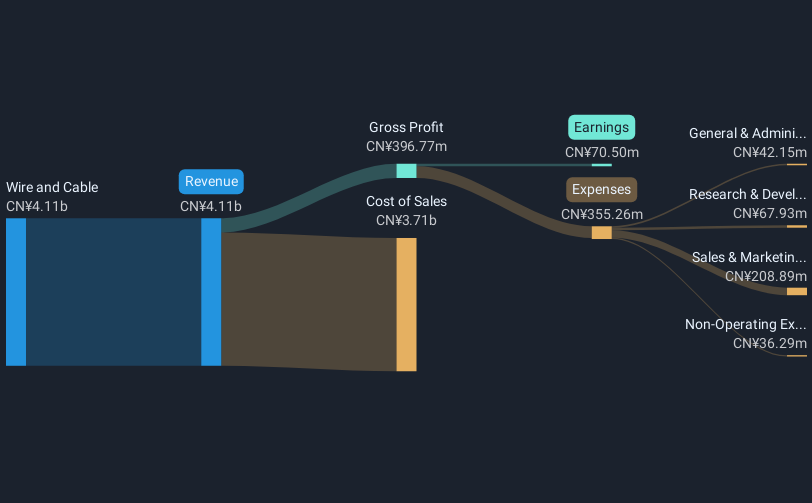

Operations: The company generates revenue of CN¥4.11 billion from its wire and cable segment.

Market Cap: CN¥3.25B

Yuan Cheng Cable Co., Ltd., with a market cap of CN¥3.25 billion, has demonstrated earnings growth of 10.1% over the past year, surpassing the electrical industry's average. However, its net profit margin has slightly decreased from 2.1% to 1.7%. The company faces challenges with high net debt to equity at 97.7%, and negative operating cash flow limits debt coverage despite interest payments being well covered by EBIT (4.4x). Although share price volatility remains high, short-term assets comfortably cover both short- and long-term liabilities, reflecting a stable financial position amidst experienced management and board oversight.

- Jump into the full analysis health report here for a deeper understanding of Yuan Cheng CableLtd.

- Learn about Yuan Cheng CableLtd's historical performance here.

Taking Advantage

- Embark on your investment journey to our 5,706 Penny Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:DNIR

Dubai National Insurance & Reinsurance (P.S.C.)

Dubai National Insurance & Reinsurance Co.

Flawless balance sheet with poor track record.

Market Insights

Community Narratives