- Hong Kong

- /

- Hospitality

- /

- SEHK:1180

There's No Escaping Paradise Entertainment Limited's (HKG:1180) Muted Earnings Despite A 31% Share Price Rise

Paradise Entertainment Limited (HKG:1180) shareholders are no doubt pleased to see that the share price has bounced 31% in the last month, although it is still struggling to make up recently lost ground. Taking a wider view, although not as strong as the last month, the full year gain of 20% is also fairly reasonable.

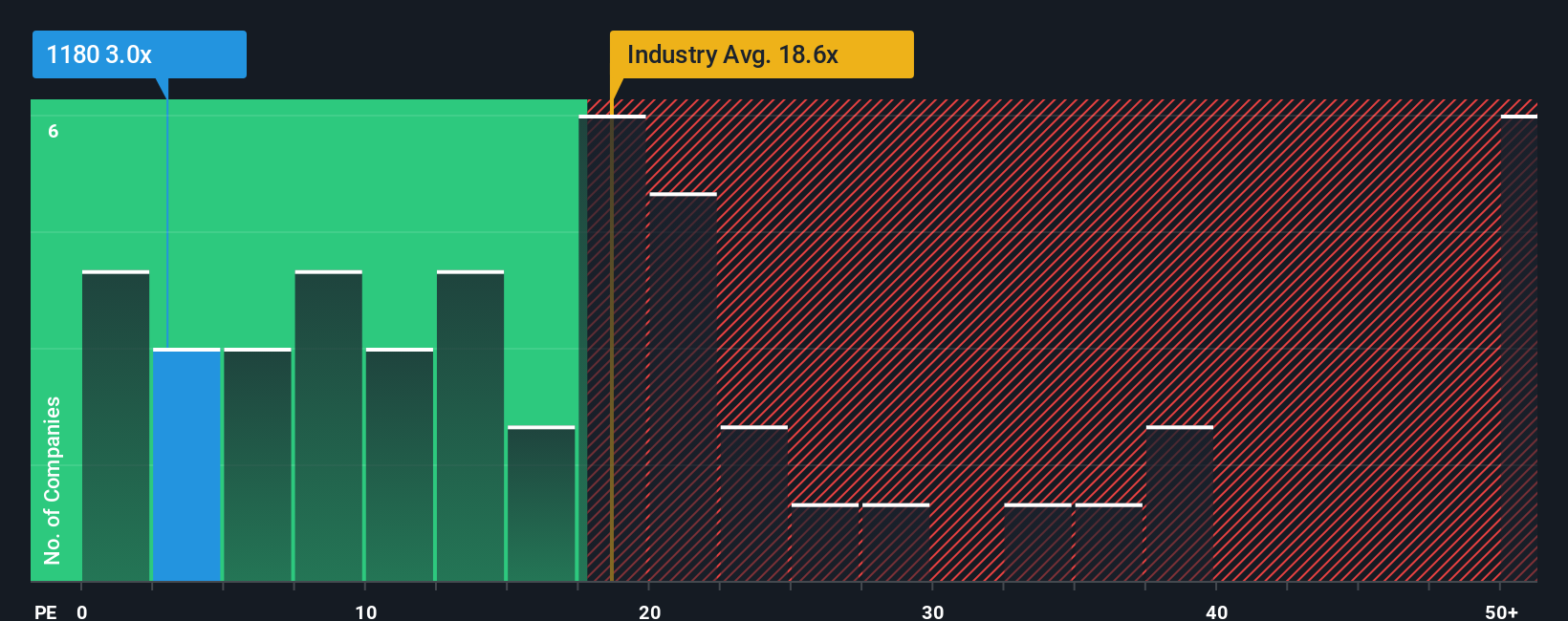

Although its price has surged higher, Paradise Entertainment's price-to-earnings (or "P/E") ratio of 3x might still make it look like a strong buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 13x and even P/E's above 27x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Paradise Entertainment certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Paradise Entertainment

How Is Paradise Entertainment's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Paradise Entertainment's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 449% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings growth is heading into negative territory, declining 28% per annum over the next three years. Meanwhile, the broader market is forecast to expand by 15% per annum, which paints a poor picture.

In light of this, it's understandable that Paradise Entertainment's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Paradise Entertainment's P/E

Shares in Paradise Entertainment are going to need a lot more upward momentum to get the company's P/E out of its slump. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Paradise Entertainment's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with Paradise Entertainment (including 2 which are concerning).

If you're unsure about the strength of Paradise Entertainment's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1180

Paradise Entertainment

An investment holding company, provides casino management services in Macau, the People’s Republic of China, the Philippines, the United States, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026