- Hong Kong

- /

- Hospitality

- /

- SEHK:1007

Longhui International Holdings Limited's (HKG:1007) 51% Share Price Surge Not Quite Adding Up

Longhui International Holdings Limited (HKG:1007) shares have continued their recent momentum with a 51% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 95% in the last year.

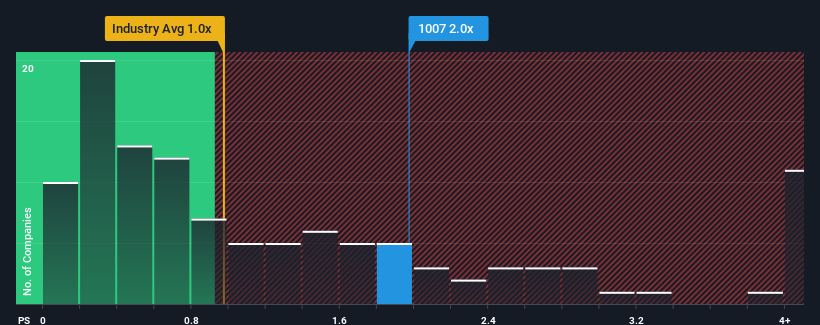

Since its price has surged higher, given close to half the companies operating in Hong Kong's Hospitality industry have price-to-sales ratios (or "P/S") below 1x, you may consider Longhui International Holdings as a stock to potentially avoid with its 2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Longhui International Holdings

What Does Longhui International Holdings' Recent Performance Look Like?

Longhui International Holdings has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Longhui International Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Longhui International Holdings' Revenue Growth Trending?

Longhui International Holdings' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. Still, lamentably revenue has fallen 55% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 19% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that Longhui International Holdings' P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From Longhui International Holdings' P/S?

Longhui International Holdings' P/S is on the rise since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Longhui International Holdings revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Longhui International Holdings (2 are a bit unpleasant!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1007

Longhui International Holdings

An investment holding company, engages in the hotpot restaurant business in the People’s Republic of China.

Moderate and slightly overvalued.

Market Insights

Community Narratives