- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:9886

We Think Dingdang Health Technology Group (HKG:9886) Can Easily Afford To Drive Business Growth

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So, the natural question for Dingdang Health Technology Group (HKG:9886) shareholders is whether they should be concerned by its rate of cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for Dingdang Health Technology Group

When Might Dingdang Health Technology Group Run Out Of Money?

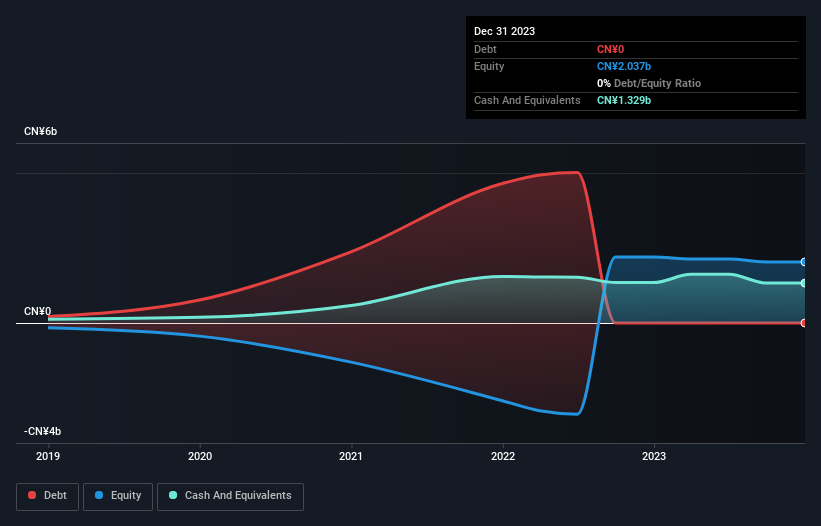

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. In December 2023, Dingdang Health Technology Group had CN¥1.3b in cash, and was debt-free. In the last year, its cash burn was CN¥26m. That means it had a cash runway of very many years as of December 2023. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. The image below shows how its cash balance has been changing over the last few years.

How Well Is Dingdang Health Technology Group Growing?

Given our focus on Dingdang Health Technology Group's cash burn, we're delighted to see that it reduced its cash burn by a nifty 90%. And while hardly exciting, it was still good to see revenue growth of 12% during that time. It seems to be growing nicely. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Can Dingdang Health Technology Group Raise More Cash Easily?

There's no doubt Dingdang Health Technology Group seems to be in a fairly good position, when it comes to managing its cash burn, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund growth. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Dingdang Health Technology Group has a market capitalisation of CN¥1.3b and burnt through CN¥26m last year, which is 1.9% of the company's market value. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

How Risky Is Dingdang Health Technology Group's Cash Burn Situation?

As you can probably tell by now, we're not too worried about Dingdang Health Technology Group's cash burn. In particular, we think its cash burn reduction stands out as evidence that the company is well on top of its spending. On this analysis its revenue growth was its weakest feature, but we are not concerned about it. Taking all the factors in this report into account, we're not at all worried about its cash burn, as the business appears well capitalized to spend as needs be. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 1 warning sign for Dingdang Health Technology Group that potential shareholders should take into account before putting money into a stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9886

Dingdang Health Technology Group

Provides digital healthcare services in the People’s Republic of China.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.