- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:8491

The 12% return this week takes Cool Link (Holdings)'s (HKG:8491) shareholders one-year gains to 655%

Active investing isn't easy, but for those that do it, the aim is to find the best companies to buy, and to profit handsomely. While not every stock performs well, when investors win, they can win big. For example, the Cool Link (Holdings) Limited (HKG:8491) share price rocketed moonwards 540% in just one year. It's up an even more impressive 1,003% over the last quarter. It is also impressive that the stock is up 178% over three years, adding to the sense that it is a real winner. Anyone who held for that rewarding ride would probably be keen to talk about it.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

View our latest analysis for Cool Link (Holdings)

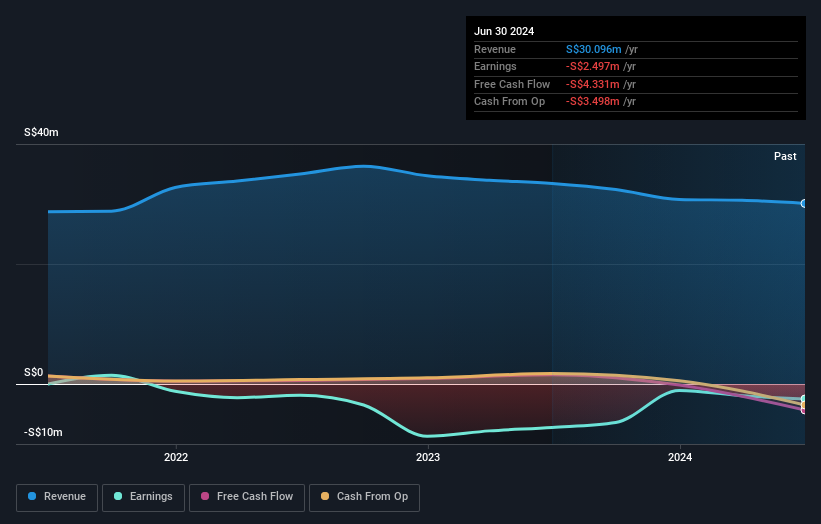

Because Cool Link (Holdings) made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Cool Link (Holdings) actually shrunk its revenue over the last year, with a reduction of 9.9%. This is in stark contrast to the splendorous stock price, which has rocketed 540% since this time a year ago. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. To us, a gain like this looks like speculation, but there might be historical trends to back it up.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. It might be well worthwhile taking a look at our free report on Cool Link (Holdings)'s earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

We've already covered Cool Link (Holdings)'s share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Cool Link (Holdings) hasn't been paying dividends, but its TSR of 655% exceeds its share price return of 540%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's good to see that Cool Link (Holdings) has rewarded shareholders with a total shareholder return of 655% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 14% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 3 warning signs we've spotted with Cool Link (Holdings) .

Cool Link (Holdings) is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8491

Cool Link (Holdings)

An investment holding company, engages in food and healthcare supplies business in Singapore, Indonesia, Malaysia, and internationally.

Excellent balance sheet slight.

Similar Companies

Market Insights

Community Narratives