- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:8413

Asia Grocery Distribution (HKG:8413) Share Prices Have Dropped 59% In The Last Three Years

Over the last month the Asia Grocery Distribution Limited (HKG:8413) has been much stronger than before, rebounding by 81%. But that doesn't change the fact that the returns over the last three years have been disappointing. Tragically, the share price declined 59% in that time. So the improvement may be a real relief to some. After all, could be that the fall was overdone.

Check out our latest analysis for Asia Grocery Distribution

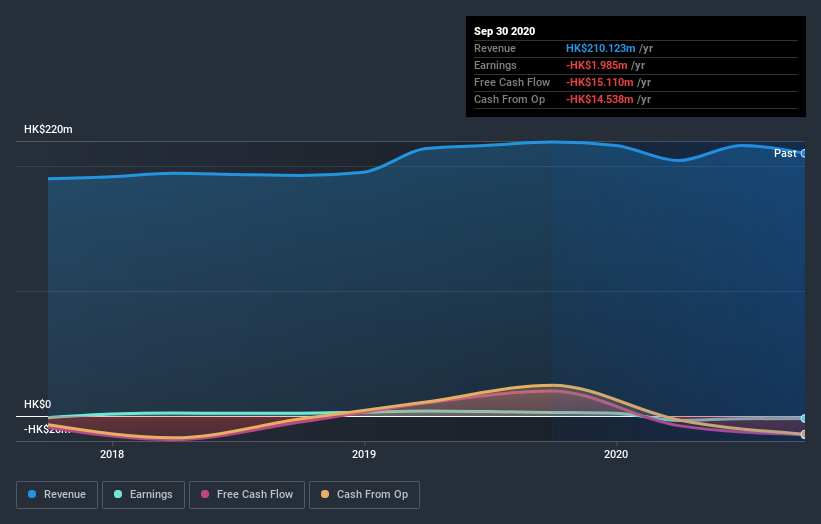

Asia Grocery Distribution wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Asia Grocery Distribution saw its revenue grow by 4.7% per year, compound. That's not a very high growth rate considering it doesn't make profits. This uninspiring revenue growth has no doubt helped send the share price lower; it dropped 17% during the period. It can be well worth keeping an eye on growth stocks that disappoint the market, because sometimes they re-accelerate. Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Asia Grocery Distribution's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

The last twelve months weren't great for Asia Grocery Distribution shares, which cost holders 16%, while the market was up about 6.2%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Unfortunately, the longer term story isn't pretty, with investment losses running at 17% per year over three years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Asia Grocery Distribution (1 doesn't sit too well with us) that you should be aware of.

We will like Asia Grocery Distribution better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading Asia Grocery Distribution or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:8413

Asia Grocery Distribution

An investment holding company, trades in and distributes food and beverage grocery products under Hung Fat Ho brand name in Hong Kong.

Flawless balance sheet slight.

Market Insights

Community Narratives