- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:2517

Undiscovered Gems in Hong Kong to Explore This October 2024

Reviewed by Simply Wall St

As the Hong Kong market navigates a landscape shaped by global geopolitical tensions and fluctuating oil prices, investors are keenly observing how these factors impact various sectors. Amidst this backdrop, small-cap stocks present intriguing opportunities for those looking to explore potential growth avenues in October 2024. Identifying a good stock often involves assessing its resilience to external pressures and its ability to capitalize on emerging market trends, making the current environment ripe for discovering hidden gems in Hong Kong's financial landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Carote | 2.36% | 85.09% | 92.12% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited is an investment holding company involved in the extraction and sale of coal products in the People's Republic of China, with a market capitalization of approximately HK$13.24 billion.

Operations: The company generates revenue primarily from the extraction and sale of coal products in China. It has a market capitalization of approximately HK$13.24 billion.

Kinetic Development Group, a small-cap player in Hong Kong's market, is trading at 57.5% below our fair value estimate and boasts a robust earnings growth of 39.2% over the past year, outpacing the Oil and Gas industry's 4.6%. The company has a satisfactory net debt to equity ratio of 4.7%, reflecting prudent financial management as it reduced from 28.4% to 12.5% in five years. Recent results show sales reaching CNY 2.53 billion with net income at CNY 1.10 billion for the first half of 2024, alongside dividend declarations enhancing shareholder value.

Time Interconnect Technology (SEHK:1729)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Time Interconnect Technology Limited is an investment holding company that manufactures and sells cable assembly and networking cable products across several international markets, with a market cap of HK$9.93 billion.

Operations: Time Interconnect generates revenue primarily through its server and cable assembly segments, contributing HK$2.57 billion and HK$2.57 billion respectively, while the digital cable segment adds HK$1.36 billion.

Time Interconnect Technology, a smaller player in Hong Kong's market, has shown impressive earnings growth of 71.6% over the past year, outpacing the Electrical industry average of 15.1%. Despite its high net debt to equity ratio at 83.3%, interest payments are well covered by EBIT with a coverage of 10.4 times. Recent results for the half-year ended June 2024 reported sales of HK$2.67 billion and net income rising to HK$202.6 million from HK$151 million last year, reflecting robust performance in medical equipment and digital cable sectors with improved profit margins.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. is a Chinese company specializing in home meal products, with a market capitalization of HK$10.19 billion.

Operations: Guoquan Food derives its revenue primarily from retail sales through grocery stores, amounting to CN¥5.998 billion.

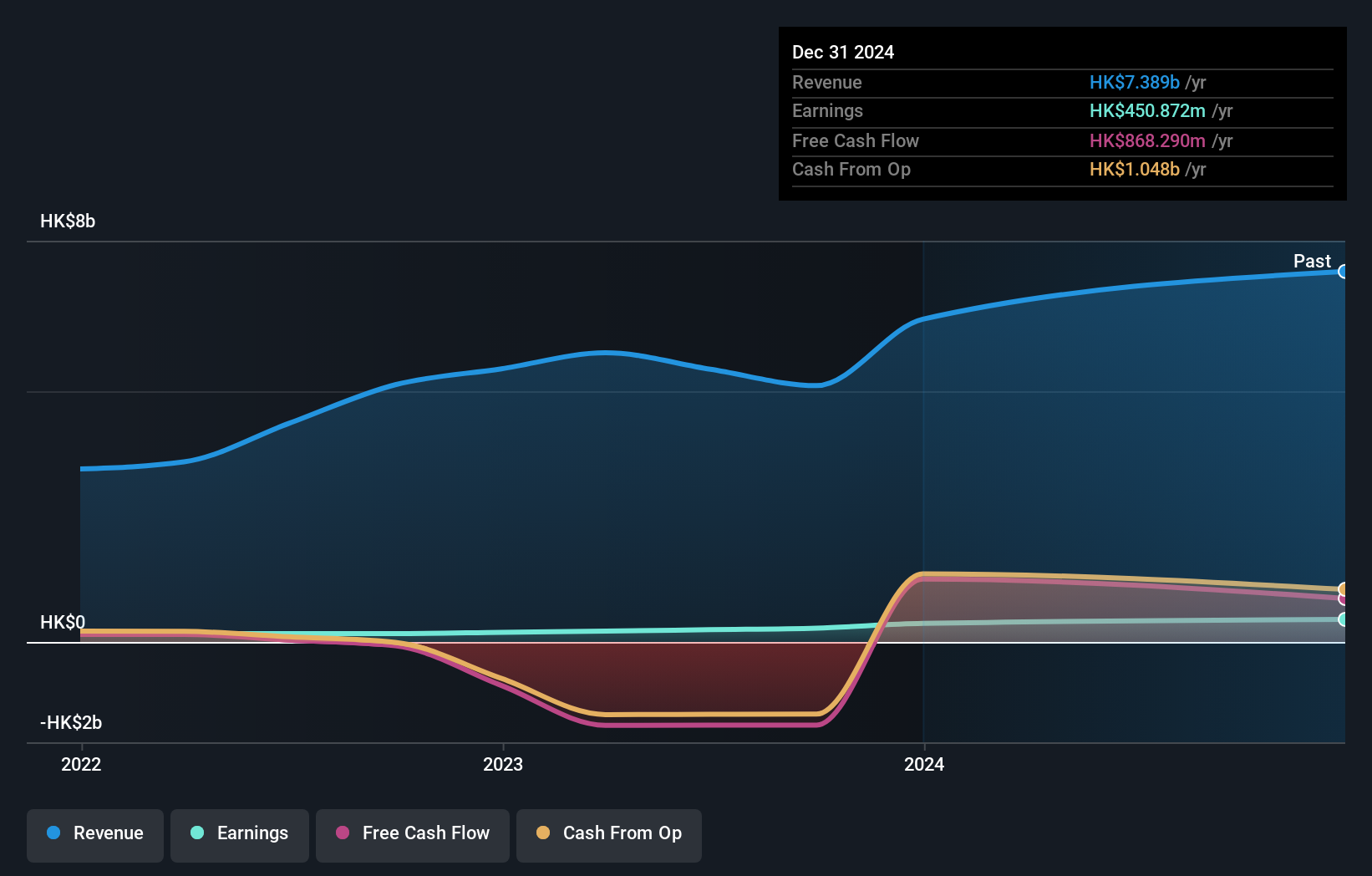

Guoquan Food, a smaller player in the market, reported half-year sales of CNY 2.67 billion, down from CNY 2.76 billion last year, while net income fell to CNY 85.98 million from CNY 107.7 million. Despite these figures, the company remains free cash flow positive and is trading at an estimated 51.7% below its fair value. Earnings per share also saw a dip to CNY 0.0313 from last year's CNY 0.0403, reflecting recent challenges in performance amidst industry volatility.

- Click here and access our complete health analysis report to understand the dynamics of Guoquan Food (Shanghai).

Learn about Guoquan Food (Shanghai)'s historical performance.

Seize The Opportunity

- Reveal the 168 hidden gems among our SEHK Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2517

Guoquan Food (Shanghai)

Operates as a home meal products company in Mainland China.

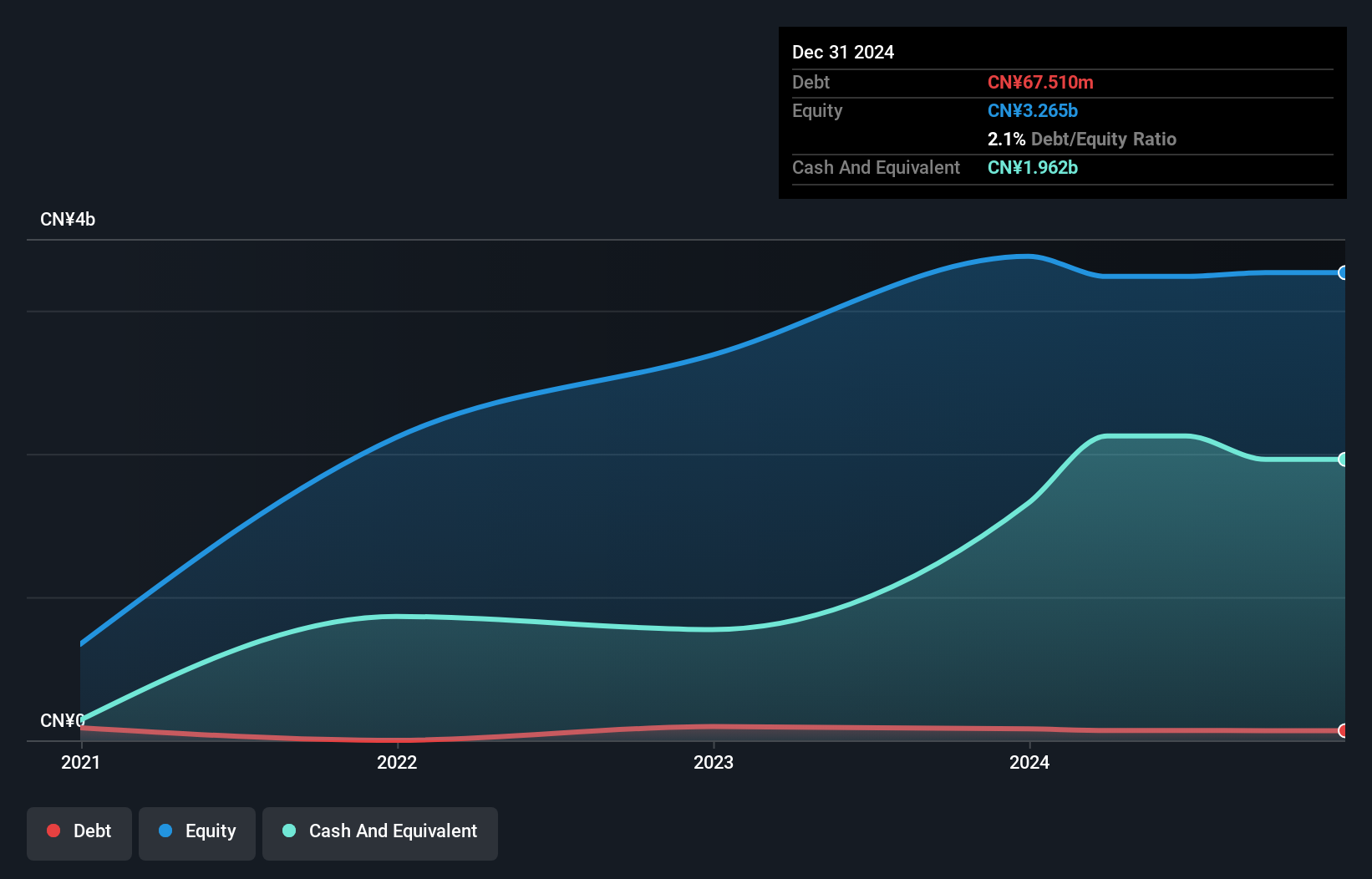

Solid track record with excellent balance sheet.

Market Insights

Community Narratives