- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:241

Risks Still Elevated At These Prices As Alibaba Health Information Technology Limited (HKG:241) Shares Dive 26%

Alibaba Health Information Technology Limited (HKG:241) shares have had a horrible month, losing 26% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 52% loss during that time.

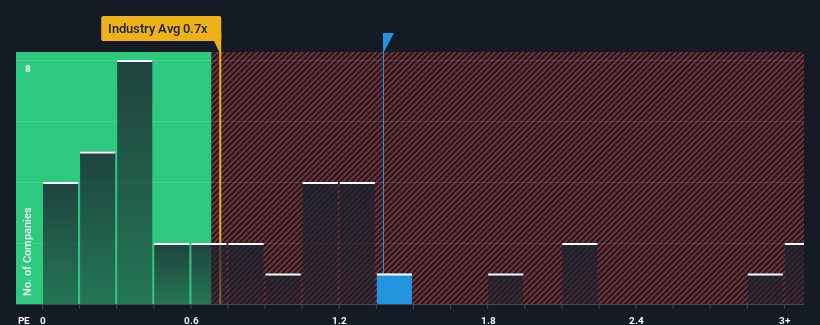

Even after such a large drop in price, you could still be forgiven for thinking Alibaba Health Information Technology is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.4x, considering almost half the companies in Hong Kong's Consumer Retailing industry have P/S ratios below 0.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Alibaba Health Information Technology

What Does Alibaba Health Information Technology's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Alibaba Health Information Technology has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Alibaba Health Information Technology will help you uncover what's on the horizon.How Is Alibaba Health Information Technology's Revenue Growth Trending?

Alibaba Health Information Technology's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. The strong recent performance means it was also able to grow revenue by 123% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 12% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 13% per year, which is not materially different.

With this information, we find it interesting that Alibaba Health Information Technology is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Final Word

There's still some elevation in Alibaba Health Information Technology's P/S, even if the same can't be said for its share price recently. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Alibaba Health Information Technology currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Alibaba Health Information Technology that you should be aware of.

If these risks are making you reconsider your opinion on Alibaba Health Information Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:241

Alibaba Health Information Technology

An investment holding company, engages in the pharmaceutical direct sales, pharmaceutical e-commerce platform, and healthcare and digital services businesses in Mainland China and Hong Kong.

Flawless balance sheet with reasonable growth potential.