- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:2360

Here's Why Best Mart 360 Holdings (HKG:2360) Can Manage Its Debt Responsibly

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Best Mart 360 Holdings Limited (HKG:2360) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Best Mart 360 Holdings

What Is Best Mart 360 Holdings's Debt?

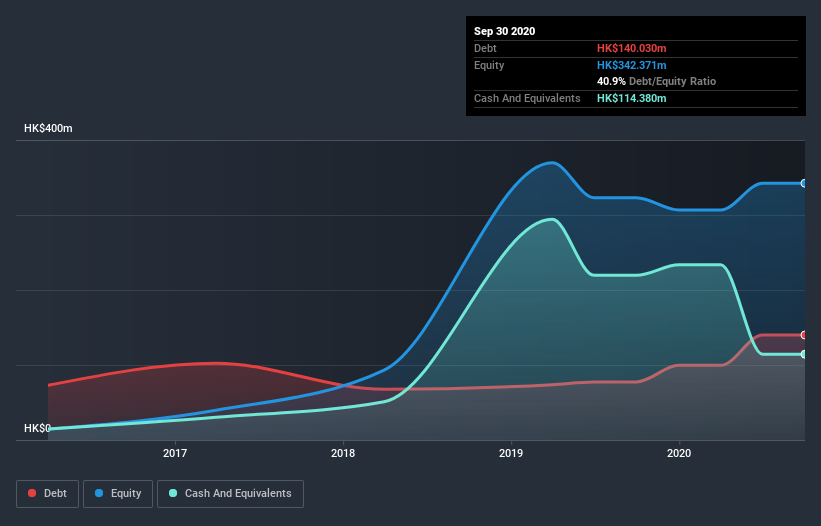

The image below, which you can click on for greater detail, shows that at September 2020 Best Mart 360 Holdings had debt of HK$140.0m, up from HK$77.5m in one year. However, it also had HK$114.4m in cash, and so its net debt is HK$25.7m.

How Strong Is Best Mart 360 Holdings' Balance Sheet?

According to the last reported balance sheet, Best Mart 360 Holdings had liabilities of HK$355.8m due within 12 months, and liabilities of HK$102.2m due beyond 12 months. On the other hand, it had cash of HK$114.4m and HK$21.9m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by HK$321.8m.

Since publicly traded Best Mart 360 Holdings shares are worth a total of HK$1.94b, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. Carrying virtually no net debt, Best Mart 360 Holdings has a very light debt load indeed.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Best Mart 360 Holdings's low debt to EBITDA ratio of 0.49 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 3.0 times last year does give us pause. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Importantly, Best Mart 360 Holdings's EBIT fell a jaw-dropping 78% in the last twelve months. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. When analysing debt levels, the balance sheet is the obvious place to start. But it is Best Mart 360 Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Happily for any shareholders, Best Mart 360 Holdings actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

Based on what we've seen Best Mart 360 Holdings is not finding it easy, given its EBIT growth rate, but the other factors we considered give us cause to be optimistic. In particular, we are dazzled with its conversion of EBIT to free cash flow. Looking at all this data makes us feel a little cautious about Best Mart 360 Holdings's debt levels. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Best Mart 360 Holdings is showing 4 warning signs in our investment analysis , you should know about...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade Best Mart 360 Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Best Mart 360 Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2360

Best Mart 360 Holdings

An investment holding company, engages in leisure food retailing by operating chain retail stores under Best Mart 360 and FoodVille brands in Hong Kong, Macau, and the People’s Republic of China.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026