- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:2360

3 Promising Penny Stocks With Market Caps Under US$300M

Reviewed by Simply Wall St

In a week where major global stock indexes showed mixed results, with growth stocks outperforming value shares significantly, the market landscape remains diverse and full of opportunity. Penny stocks, often associated with smaller or newer companies, continue to capture investor interest due to their potential for growth at accessible price points. Despite being an older term, these stocks can offer intriguing possibilities when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$143.12M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.43 | MYR1.2B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.155 | £811.93M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.14 | HK$43.17B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$65.06M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £1.04 | £164.05M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

Click here to see the full list of 5,700 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

China ITS (Holdings) (SEHK:1900)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China ITS (Holdings) Co., Ltd. is an investment holding company that offers products, specialised solutions, and services in infrastructure technology within China and internationally, with a market cap of HK$340.60 million.

Operations: The company's revenue is divided into two main segments: the Energy business, generating CN¥572.68 million, and the Railway Business, contributing CN¥223.68 million.

Market Cap: HK$340.6M

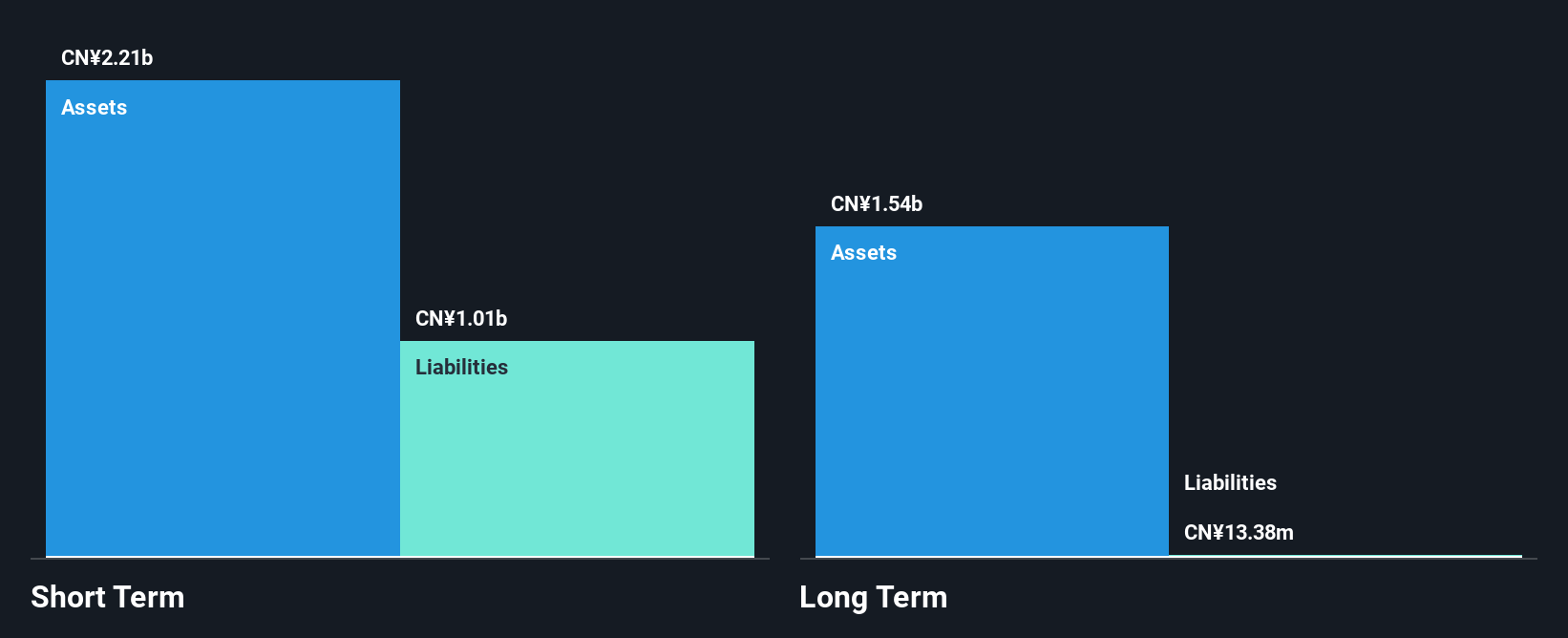

China ITS (Holdings) has demonstrated profitability growth over the past five years, with earnings increasing by 53% annually, though recent earnings have declined. The company maintains a strong financial position, having more cash than debt and no long-term liabilities. Its short-term assets significantly exceed its liabilities, ensuring liquidity. Despite a high dividend yield of 11.03%, the stock's share price remains highly volatile. While its Price-to-Earnings ratio is favorable compared to the Hong Kong market average, recent profit margins have decreased due to large one-off items impacting results and negative earnings growth last year.

- Get an in-depth perspective on China ITS (Holdings)'s performance by reading our balance sheet health report here.

- Assess China ITS (Holdings)'s previous results with our detailed historical performance reports.

Best Mart 360 Holdings (SEHK:2360)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Best Mart 360 Holdings Limited is an investment holding company that operates as a leisure food retailer with chain retail stores under the Best Mart 360 and FoodVille brands in Hong Kong, Macau, and the People’s Republic of China, with a market cap of HK$1.64 billion.

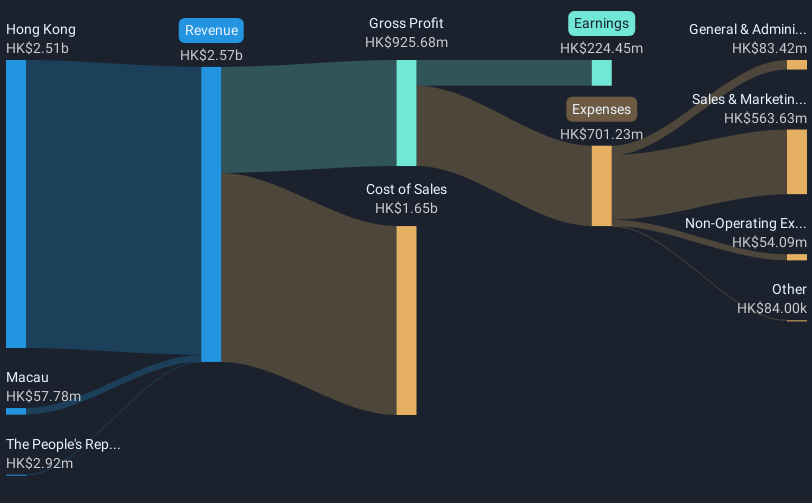

Operations: The company generates revenue of HK$2.57 billion from its retailing sales of food and beverage, household, and personal care products.

Market Cap: HK$1.64B

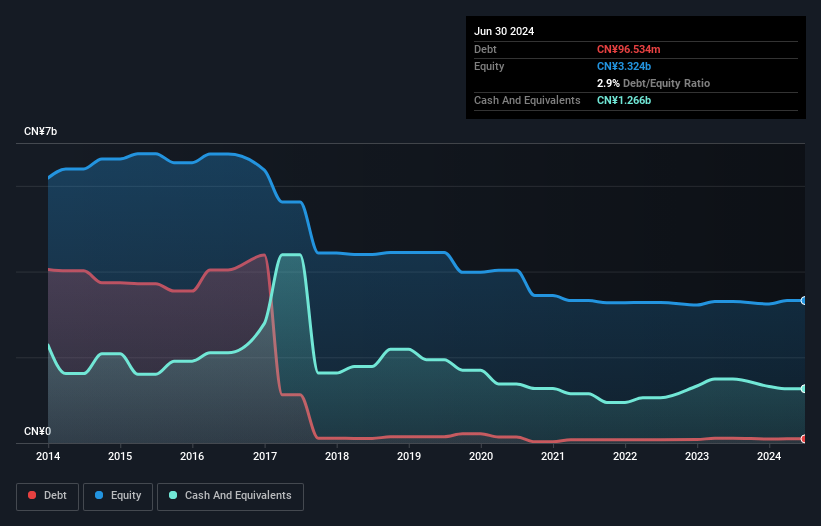

Best Mart 360 Holdings has shown robust financial health, with a debt to equity ratio reduced to 16.8% over five years and more cash than debt. Its revenue of HK$2.57 billion supports strong earnings growth, outperforming the industry average last year. The company’s Return on Equity is outstanding at 49.2%, and it trades significantly below its estimated fair value, suggesting potential undervaluation. While the management team and board are relatively new with an average tenure of 1.3 years, corporate governance improvements are underway with a newly established governance committee aimed at enhancing accountability and transparency.

- Click here to discover the nuances of Best Mart 360 Holdings with our detailed analytical financial health report.

- Learn about Best Mart 360 Holdings' historical performance here.

Hengdeli Holdings (SEHK:3389)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hengdeli Holdings Limited, along with its subsidiaries, manufactures and sells watch accessories in Mainland China and Hong Kong, with a market cap of HK$532.89 million.

Operations: The company's revenue is primarily derived from High-End Consuming Accessories, generating CN¥970.75 million, and Commodity Trading, contributing CN¥580.14 million.

Market Cap: HK$532.89M

Hengdeli Holdings has recently transitioned to profitability, with its revenue primarily from high-end consuming accessories (CN¥970.75 million) and commodity trading (CN¥580.14 million). Despite a low Return on Equity of 1.3%, the company maintains financial stability with short-term assets exceeding both long-term and short-term liabilities, and more cash than total debt. The board is seasoned, averaging 14.5 years in tenure, though recent leadership changes saw Mr. Cheung Wing Lun Tony succeed his father as chairman following Mr. Zhang's resignation for personal commitments, potentially influencing strategic direction amidst stable weekly volatility at 5%.

- Click to explore a detailed breakdown of our findings in Hengdeli Holdings' financial health report.

- Gain insights into Hengdeli Holdings' historical outcomes by reviewing our past performance report.

Key Takeaways

- Dive into all 5,700 of the Penny Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Best Mart 360 Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2360

Best Mart 360 Holdings

An investment holding company, operates as a leisure food retailer that operates chain retail stores under Best Mart 360 and FoodVille brands in Hong Kong, Macau, and the People’s Republic of China.

Flawless balance sheet and good value.