Is Lippo Limited (HKG:226) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

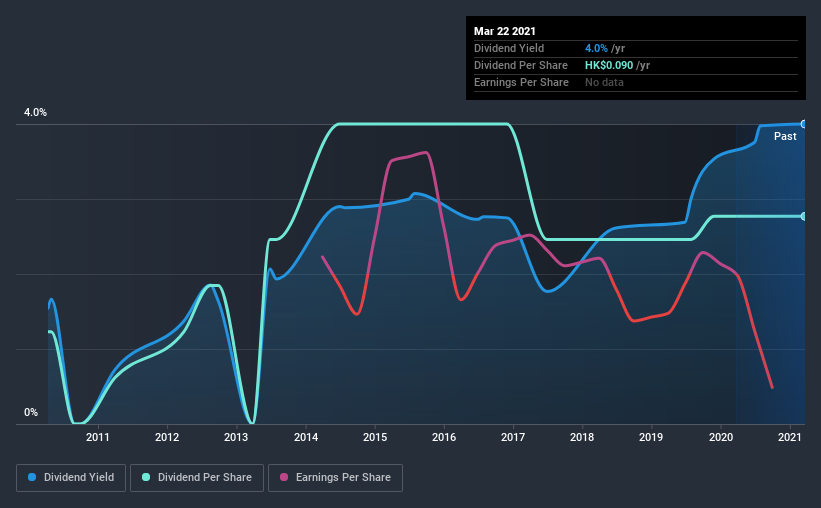

In this case, Lippo likely looks attractive to investors, given its 4.0% dividend yield and a payment history of over ten years. We'd guess that plenty of investors have purchased it for the income. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Although it reported a loss over the past 12 months, Lippo currently pays a dividend. When a company is loss-making, we next need to check to see if its cash flows can support the dividend.

Last year, Lippo paid a dividend while reporting negative free cash flow. While there may be an explanation, we think this behaviour is generally not sustainable.

We update our data on Lippo every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. For the purpose of this article, we only scrutinise the last decade of Lippo's dividend payments. This dividend has been unstable, which we define as having been cut one or more times over this time. During the past 10-year period, the first annual payment was HK$0.04 in 2011, compared to HK$0.09 last year. This works out to be a compound annual growth rate (CAGR) of approximately 8.4% a year over that time. Lippo's dividend payments have fluctuated, so it hasn't grown 8.4% every year, but the CAGR is a useful rule of thumb for approximating the historical growth.

A reasonable rate of dividend growth is good to see, but we're wary that the dividend history is not as solid as we'd like, having been cut at least once.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Lippo's EPS have fallen by approximately 60% per year during the past five years. With this kind of significant decline, we always wonder what has changed in the business. Dividends are about stability, and Lippo's earnings per share, which support the dividend, have been anything but stable.

Conclusion

To summarise, shareholders should always check that Lippo's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. We're a bit uncomfortable with Lippo paying a dividend while loss-making, especially since the dividend was also not well covered by free cash flow. Earnings per share have been falling, and the company has cut its dividend at least once in the past. From a dividend perspective, this is a cause for concern. Using these criteria, Lippo looks quite suboptimal from a dividend investment perspective.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Case in point: We've spotted 2 warning signs for Lippo (of which 1 is potentially serious!) you should know about.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

When trading Lippo or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:226

Lippo

An investment holding company, engages in the food manufacturing and retail operations through chains of cafés and bistros in Hong Kong, Mainland China, Singapore, Malaysia, Indonesia, and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives