- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:1854

China Wantian Holdings Limited (HKG:1854) Stocks Shoot Up 28% But Its P/S Still Looks Reasonable

China Wantian Holdings Limited (HKG:1854) shares have continued their recent momentum with a 28% gain in the last month alone. The last month tops off a massive increase of 123% in the last year.

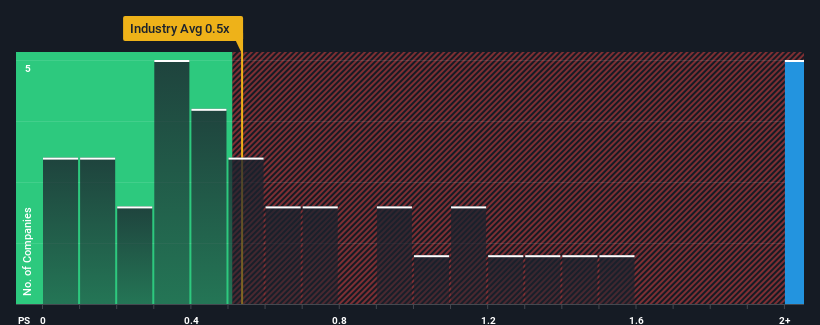

Following the firm bounce in price, you could be forgiven for thinking China Wantian Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 10.1x, considering almost half the companies in Hong Kong's Consumer Retailing industry have P/S ratios below 0.5x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for China Wantian Holdings

How China Wantian Holdings Has Been Performing

Recent times have been quite advantageous for China Wantian Holdings as its revenue has been rising very briskly. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on China Wantian Holdings' earnings, revenue and cash flow.How Is China Wantian Holdings' Revenue Growth Trending?

China Wantian Holdings' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 104%. The latest three year period has also seen an excellent 112% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 12% shows it's noticeably more attractive.

With this information, we can see why China Wantian Holdings is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From China Wantian Holdings' P/S?

China Wantian Holdings' P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of China Wantian Holdings revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for China Wantian Holdings (1 makes us a bit uncomfortable!) that you need to be mindful of.

If these risks are making you reconsider your opinion on China Wantian Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1854

China Wantian Holdings

An investment holding company, engages in the green food supply and catering chain, and environmental protection and technology businesses in Hong Kong and the People’s Republic of China.

Adequate balance sheet very low.