- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:1797

Those who invested in East Buy Holding (HKG:1797) three years ago are up 153%

East Buy Holding Limited (HKG:1797) shareholders have seen the share price descend 14% over the month. In contrast, the return over three years has been impressive. In fact, the share price is up a full 153% compared to three years ago. To some, the recent share price pullback wouldn't be surprising after such a good run. The fundamental business performance will ultimately dictate whether the top is in, or if this is a stellar buying opportunity.

So let's assess the underlying fundamentals over the last 3 years and see if they've moved in lock-step with shareholder returns.

See our latest analysis for East Buy Holding

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last three years, East Buy Holding failed to grow earnings per share, which fell 11% (annualized). This was, in part, due to extraordinary items impacting earning in the last twelve months.

This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

It may well be that East Buy Holding revenue growth rate of 63% over three years has convinced shareholders to believe in a brighter future. In that case, the company may be sacrificing current earnings per share to drive growth, and maybe shareholder's faith in better days ahead will be rewarded.

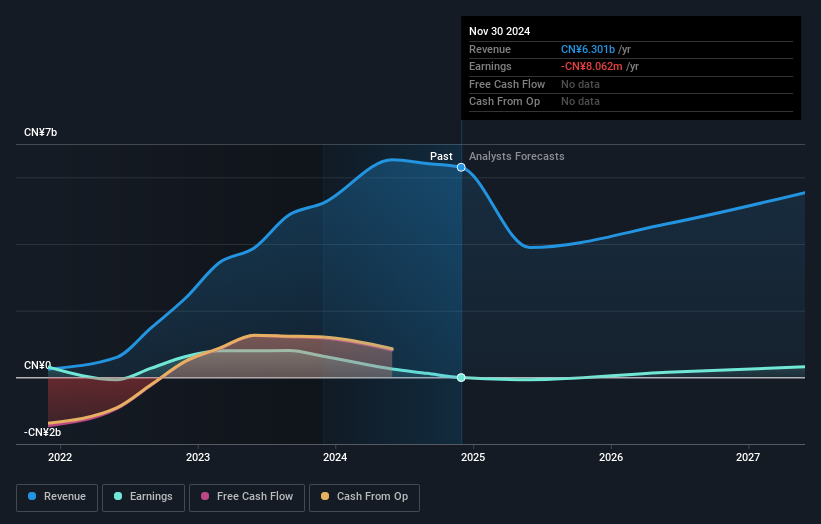

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

East Buy Holding shareholders are down 46% for the year, but the market itself is up 36%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if East Buy Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1797

East Buy Holding

An investment holding company, engages in the livestreaming e-commerce business in the People's Republic of China.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives