- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:156

It's Probably Less Likely That Lippo China Resources Limited's (HKG:156) CEO Will See A Huge Pay Rise This Year

Key Insights

- Lippo China Resources will host its Annual General Meeting on 6th of June

- Salary of HK$710.0k is part of CEO John Lee's total remuneration

- Total compensation is similar to the industry average

- Lippo China Resources' three-year loss to shareholders was 37% while its EPS was down 41% over the past three years

The underwhelming share price performance of Lippo China Resources Limited (HKG:156) in the past three years would have disappointed many shareholders. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. The AGM coming up on 6th of June will be an opportunity for shareholders to have their concerns addressed by the board and for them to exercise their influence on management through voting on resolutions such as executive remuneration. We think shareholders may be cautious of approving a pay rise for the CEO at the moment, based on our analysis below.

View our latest analysis for Lippo China Resources

How Does Total Compensation For John Lee Compare With Other Companies In The Industry?

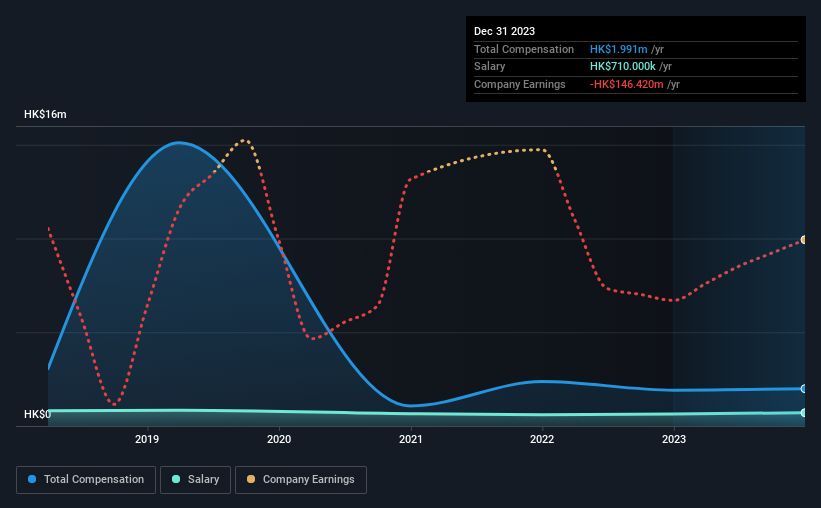

Our data indicates that Lippo China Resources Limited has a market capitalization of HK$661m, and total annual CEO compensation was reported as HK$2.0m for the year to December 2023. That's a fairly small increase of 4.2% over the previous year. We think total compensation is more important but our data shows that the CEO salary is lower, at HK$710k.

For comparison, other companies in the Hong Kong Consumer Retailing industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$2.1m. From this we gather that John Lee is paid around the median for CEOs in the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | HK$710k | HK$638k | 36% |

| Other | HK$1.3m | HK$1.3m | 64% |

| Total Compensation | HK$2.0m | HK$1.9m | 100% |

Speaking on an industry level, nearly 65% of total compensation represents salary, while the remainder of 35% is other remuneration. In Lippo China Resources' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Lippo China Resources Limited's Growth

Lippo China Resources Limited has reduced its earnings per share by 41% a year over the last three years. In the last year, its revenue is up 22%.

The reduction in EPS, over three years, is arguably concerning. But on the other hand, revenue growth is strong, suggesting a brighter future. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Lippo China Resources Limited Been A Good Investment?

With a total shareholder return of -37% over three years, Lippo China Resources Limited shareholders would by and large be disappointed. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

The returns to shareholders is disappointing along with lack of earnings growth, which goes some way in explaining the poor returns. Shareholders will get the chance at the upcoming AGM to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 2 warning signs for Lippo China Resources (of which 1 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Important note: Lippo China Resources is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:156

Lippo China Resources

An investment holding company, engages in the food, property management, and other businesses in Hong Kong, Mainland China, Singapore, Malaysia, and internationally.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives