- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:1137

It Looks Like Hong Kong Technology Venture Company Limited's (HKG:1137) CEO May Expect Their Salary To Be Put Under The Microscope

Key Insights

- Hong Kong Technology Venture will host its Annual General Meeting on 18th of June

- Total pay for CEO Ricky Wong includes HK$11.9m salary

- The overall pay is 593% above the industry average

- Hong Kong Technology Venture's three-year loss to shareholders was 83% while its EPS was down 37% over the past three years

The results at Hong Kong Technology Venture Company Limited (HKG:1137) have been quite disappointing recently and CEO Ricky Wong bears some responsibility for this. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 18th of June. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. From our analysis, we think CEO compensation may need a review in light of the recent performance.

Check out our latest analysis for Hong Kong Technology Venture

Comparing Hong Kong Technology Venture Company Limited's CEO Compensation With The Industry

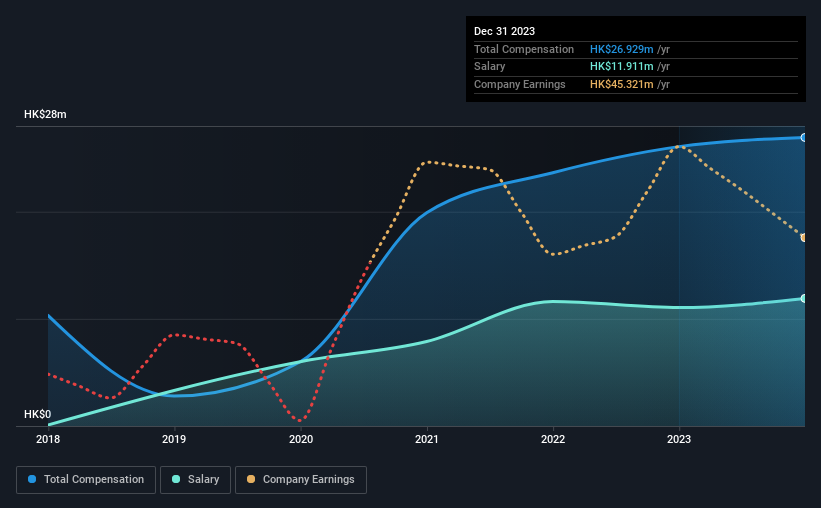

Our data indicates that Hong Kong Technology Venture Company Limited has a market capitalization of HK$1.5b, and total annual CEO compensation was reported as HK$27m for the year to December 2023. That's just a smallish increase of 3.3% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at HK$12m.

For comparison, other companies in the Hong Kong Consumer Retailing industry with market capitalizations ranging between HK$781m and HK$3.1b had a median total CEO compensation of HK$3.9m. This suggests that Ricky Wong is paid more than the median for the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | HK$12m | HK$11m | 44% |

| Other | HK$15m | HK$15m | 56% |

| Total Compensation | HK$27m | HK$26m | 100% |

Speaking on an industry level, nearly 63% of total compensation represents salary, while the remainder of 37% is other remuneration. In Hong Kong Technology Venture's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Hong Kong Technology Venture Company Limited's Growth Numbers

Over the last three years, Hong Kong Technology Venture Company Limited has shrunk its earnings per share by 37% per year. Revenue was pretty flat on last year.

Few shareholders would be pleased to read that EPS have declined. And the flat revenue is seriously uninspiring. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Hong Kong Technology Venture Company Limited Been A Good Investment?

Few Hong Kong Technology Venture Company Limited shareholders would feel satisfied with the return of -83% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 1 warning sign for Hong Kong Technology Venture that investors should be aware of in a dynamic business environment.

Switching gears from Hong Kong Technology Venture, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if Hong Kong Technology Venture might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1137

Hong Kong Technology Venture

Engages in the e-commerce and technology businesses in Hong Kong.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026