- Hong Kong

- /

- Consumer Durables

- /

- SEHK:927

We Discuss Why Fujikon Industrial Holdings Limited's (HKG:927) CEO Compensation May Be Closely Reviewed

Shareholders will probably not be too impressed with the underwhelming results at Fujikon Industrial Holdings Limited (HKG:927) recently. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 13 August 2021. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. The data we present below explains why we think CEO compensation is not consistent with recent performance.

Check out our latest analysis for Fujikon Industrial Holdings

How Does Total Compensation For Johnny Yeung Compare With Other Companies In The Industry?

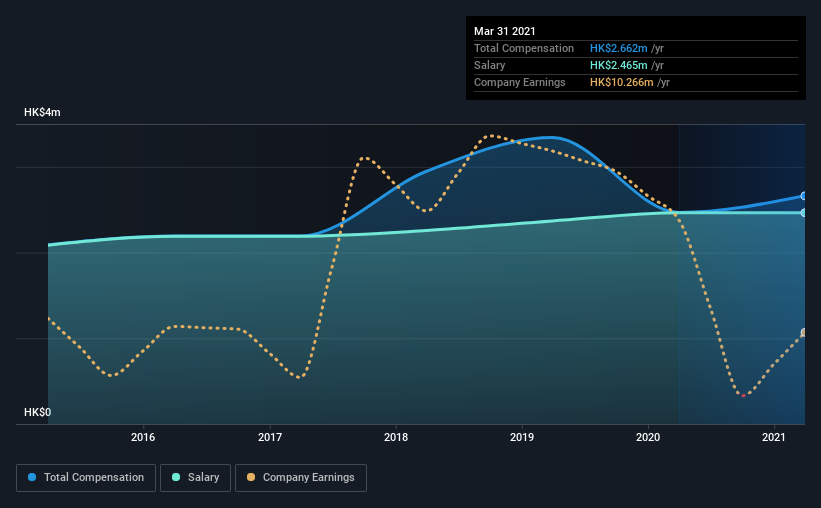

At the time of writing, our data shows that Fujikon Industrial Holdings Limited has a market capitalization of HK$426m, and reported total annual CEO compensation of HK$2.7m for the year to March 2021. That's just a smallish increase of 7.9% on last year. In particular, the salary of HK$2.47m, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$3.5m. So it looks like Fujikon Industrial Holdings compensates Johnny Yeung in line with the median for the industry. What's more, Johnny Yeung holds HK$54m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | HK$2.5m | HK$2.5m | 93% |

| Other | HK$197k | HK$3.0k | 7% |

| Total Compensation | HK$2.7m | HK$2.5m | 100% |

Speaking on an industry level, nearly 80% of total compensation represents salary, while the remainder of 20% is other remuneration. It's interesting to note that Fujikon Industrial Holdings pays out a greater portion of remuneration through salary, compared to the industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Fujikon Industrial Holdings Limited's Growth

Over the last three years, Fujikon Industrial Holdings Limited has shrunk its earnings per share by 31% per year. It saw its revenue drop 29% over the last year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Fujikon Industrial Holdings Limited Been A Good Investment?

With a three year total loss of 5.6% for the shareholders, Fujikon Industrial Holdings Limited would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 3 warning signs for Fujikon Industrial Holdings that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:927

Fujikon Industrial Holdings

An investment holding company, designs, manufactures, markets, and trades in electro-acoustic, accessories, and other electronic products in Hong Kong and Mainland China.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success