Is Elegance Optical International Holdings (HKG:907) A Risky Investment?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Elegance Optical International Holdings Limited (HKG:907) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Elegance Optical International Holdings

What Is Elegance Optical International Holdings's Net Debt?

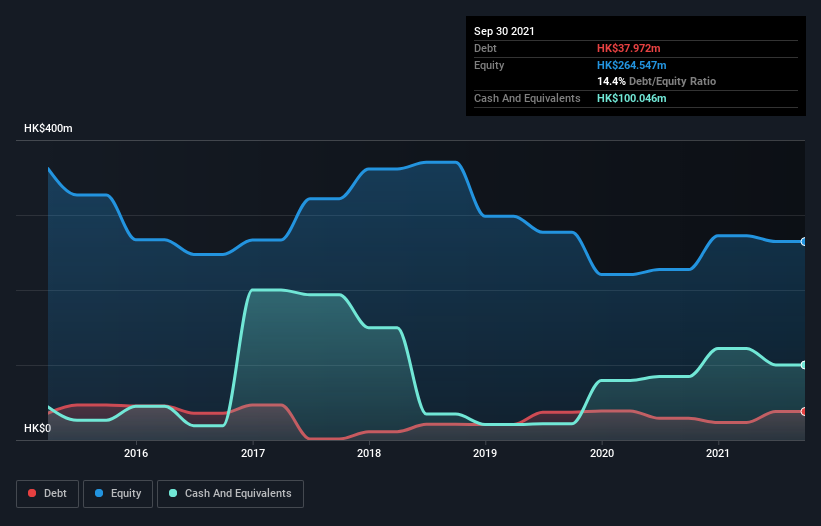

As you can see below, at the end of September 2021, Elegance Optical International Holdings had HK$38.0m of debt, up from HK$28.9m a year ago. Click the image for more detail. But on the other hand it also has HK$100.0m in cash, leading to a HK$62.1m net cash position.

How Healthy Is Elegance Optical International Holdings' Balance Sheet?

The latest balance sheet data shows that Elegance Optical International Holdings had liabilities of HK$81.3m due within a year, and liabilities of HK$35.4m falling due after that. Offsetting these obligations, it had cash of HK$100.0m as well as receivables valued at HK$16.4m due within 12 months. So these liquid assets roughly match the total liabilities.

Having regard to Elegance Optical International Holdings' size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the HK$462.6m company is short on cash, but still worth keeping an eye on the balance sheet. Despite its noteworthy liabilities, Elegance Optical International Holdings boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But it is Elegance Optical International Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Elegance Optical International Holdings had a loss before interest and tax, and actually shrunk its revenue by 29%, to HK$45m. To be frank that doesn't bode well.

So How Risky Is Elegance Optical International Holdings?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year Elegance Optical International Holdings had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of HK$87m and booked a HK$76m accounting loss. Given it only has net cash of HK$62.1m, the company may need to raise more capital if it doesn't reach break-even soon. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 5 warning signs we've spotted with Elegance Optical International Holdings (including 2 which don't sit too well with us) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Elegance Optical International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:907

Elegance Optical International Holdings

An investment holding company, manufactures and trades in optical frames and sunglasses in Europe, the United States, the People’s Republic of China, and internationally.

Moderate risk with weak fundamentals.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.