Here's Why Chong Fai Jewellery Group Holdings (HKG:8537) Can Afford Some Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Chong Fai Jewellery Group Holdings Company Limited (HKG:8537) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Chong Fai Jewellery Group Holdings

What Is Chong Fai Jewellery Group Holdings's Net Debt?

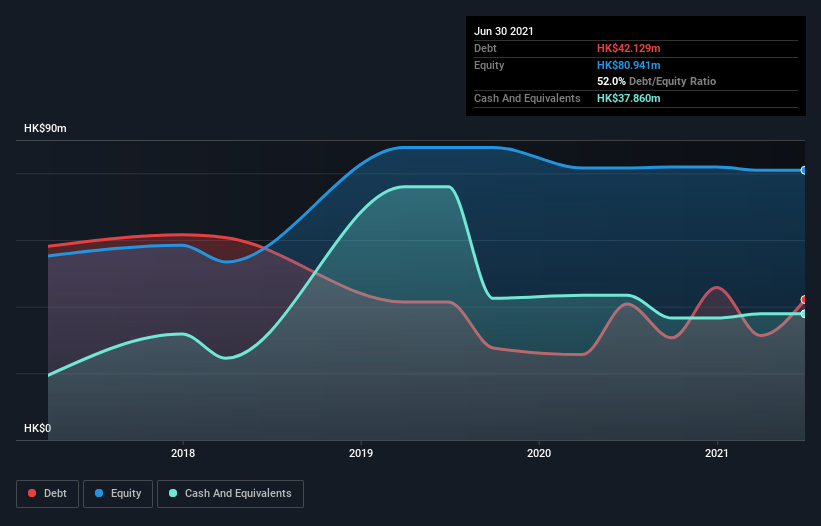

The chart below, which you can click on for greater detail, shows that Chong Fai Jewellery Group Holdings had HK$42.1m in debt in March 2021; about the same as the year before. However, it also had HK$37.9m in cash, and so its net debt is HK$4.27m.

How Healthy Is Chong Fai Jewellery Group Holdings' Balance Sheet?

The latest balance sheet data shows that Chong Fai Jewellery Group Holdings had liabilities of HK$54.2m due within a year, and liabilities of HK$1.10m falling due after that. On the other hand, it had cash of HK$37.9m and HK$2.35m worth of receivables due within a year. So it has liabilities totalling HK$15.1m more than its cash and near-term receivables, combined.

This deficit isn't so bad because Chong Fai Jewellery Group Holdings is worth HK$52.5m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. When analysing debt levels, the balance sheet is the obvious place to start. But it is Chong Fai Jewellery Group Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Chong Fai Jewellery Group Holdings's revenue was pretty flat, and it made a negative EBIT. While that hardly impresses, its not too bad either.

Caveat Emptor

Importantly, Chong Fai Jewellery Group Holdings had an earnings before interest and tax (EBIT) loss over the last year. Its EBIT loss was a whopping HK$8.2m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. For example, we would not want to see a repeat of last year's loss of HK$474k. So in short it's a really risky stock. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Chong Fai Jewellery Group Holdings that you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8537

Chong Fai Jewellery Group Holdings

An investment holding company, engages in the design, production, retail, and wholesale of jewelry products in Hong Kong and the People’s Republic of China.

Excellent balance sheet low.

Market Insights

Community Narratives