Chong Fai Jewellery Group Holdings Company Limited's (HKG:8537) P/S Is Still On The Mark Following 154% Share Price Bounce

Chong Fai Jewellery Group Holdings Company Limited (HKG:8537) shareholders would be excited to see that the share price has had a great month, posting a 154% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 14% is also fairly reasonable.

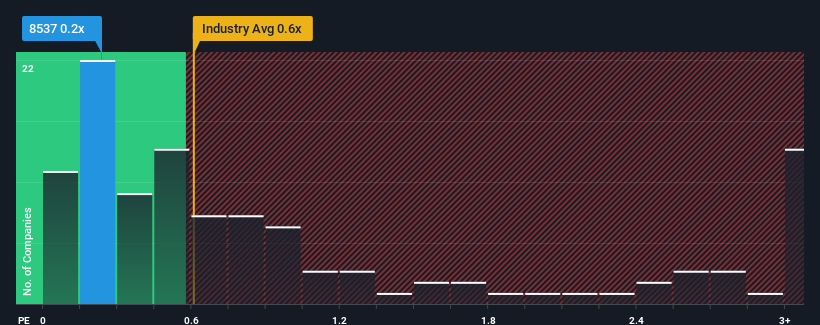

Although its price has surged higher, you could still be forgiven for feeling indifferent about Chong Fai Jewellery Group Holdings' P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Luxury industry in Hong Kong is also close to 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Chong Fai Jewellery Group Holdings

What Does Chong Fai Jewellery Group Holdings' P/S Mean For Shareholders?

The recent revenue growth at Chong Fai Jewellery Group Holdings would have to be considered satisfactory if not spectacular. One possibility is that the P/S is moderate because investors think this good revenue growth might only be parallel to the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Chong Fai Jewellery Group Holdings will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Chong Fai Jewellery Group Holdings would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 4.0%. Pleasingly, revenue has also lifted 40% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 13% shows it's about the same on an annualised basis.

With this in consideration, it's clear to see why Chong Fai Jewellery Group Holdings' P/S matches up closely to its industry peers. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Key Takeaway

Chong Fai Jewellery Group Holdings' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we've seen, Chong Fai Jewellery Group Holdings' three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Chong Fai Jewellery Group Holdings (2 are potentially serious!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8537

Chong Fai Jewellery Group Holdings

An investment holding company, engages in the design, production, retail, and wholesale of jewelry products in Hong Kong and the People’s Republic of China.

Excellent balance sheet low.

Market Insights

Community Narratives