Furniweb Holdings (HKG:8480) Has A Pretty Healthy Balance Sheet

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Furniweb Holdings Limited (HKG:8480) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Furniweb Holdings

How Much Debt Does Furniweb Holdings Carry?

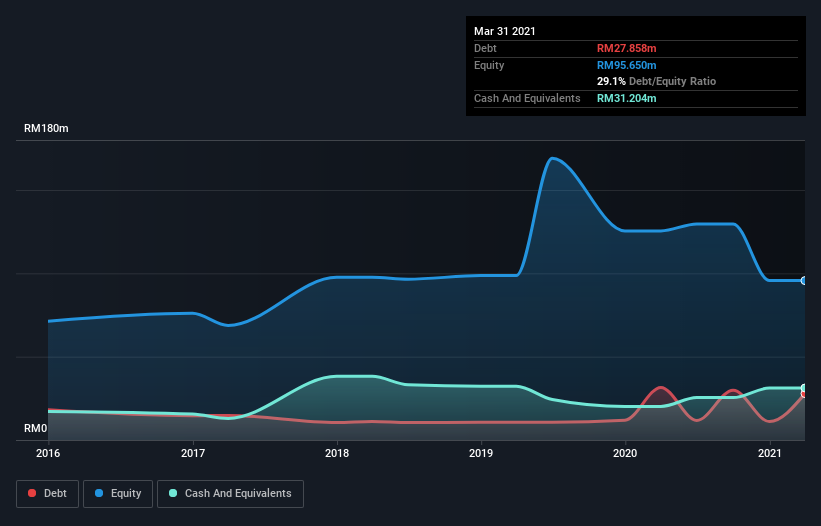

As you can see below, Furniweb Holdings had RM11.0m of debt at December 2020, down from RM31.5m a year prior. But it also has RM31.2m in cash to offset that, meaning it has RM20.2m net cash.

How Strong Is Furniweb Holdings' Balance Sheet?

The latest balance sheet data shows that Furniweb Holdings had liabilities of RM53.0m due within a year, and liabilities of RM24.4m falling due after that. Offsetting this, it had RM31.2m in cash and RM29.4m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM16.8m.

Since publicly traded Furniweb Holdings shares are worth a total of RM86.3m, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. Despite its noteworthy liabilities, Furniweb Holdings boasts net cash, so it's fair to say it does not have a heavy debt load!

Even more impressive was the fact that Furniweb Holdings grew its EBIT by 249% over twelve months. If maintained that growth will make the debt even more manageable in the years ahead. When analysing debt levels, the balance sheet is the obvious place to start. But it is Furniweb Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Furniweb Holdings has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last three years, Furniweb Holdings's free cash flow amounted to 22% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Summing up

Although Furniweb Holdings's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of RM20.2m. And it impressed us with its EBIT growth of 249% over the last year. So we don't have any problem with Furniweb Holdings's use of debt. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 3 warning signs we've spotted with Furniweb Holdings (including 1 which makes us a bit uncomfortable) .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8480

Furniweb Holdings

An investment holding company, manufactures and sells elastic textile, webbings, rubber tape, and other manufacturing products.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.