We're Not Very Worried About Reach New Holdings' (HKG:8471) Cash Burn Rate

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So should Reach New Holdings (HKG:8471) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Reach New Holdings

Does Reach New Holdings Have A Long Cash Runway?

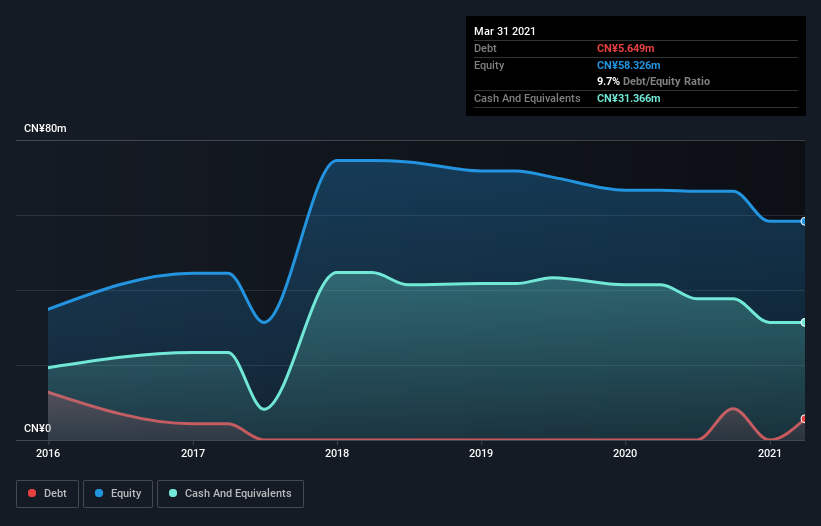

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at December 2020, Reach New Holdings had cash of CN¥31m and no debt. In the last year, its cash burn was CN¥11m. Therefore, from December 2020 it had 3.0 years of cash runway. That's decent, giving the company a couple years to develop its business. You can see how its cash balance has changed over time in the image below.

How Well Is Reach New Holdings Growing?

Reach New Holdings boosted investment sharply in the last year, with cash burn ramping by 64%. On top of that, the fact that operating revenue was basically flat over the same period compounds the concern. Taken together, we think these growth metrics are a little worrying. In reality, this article only makes a short study of the company's growth data. This graph of historic earnings and revenue shows how Reach New Holdings is building its business over time.

How Hard Would It Be For Reach New Holdings To Raise More Cash For Growth?

Even though it seems like Reach New Holdings is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Reach New Holdings' cash burn of CN¥11m is about 2.6% of its CN¥404m market capitalisation. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

So, Should We Worry About Reach New Holdings' Cash Burn?

As you can probably tell by now, we're not too worried about Reach New Holdings' cash burn. For example, we think its cash runway suggests that the company is on a good path. While its increasing cash burn wasn't great, the other factors mentioned in this article more than make up for weakness on that measure. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. On another note, Reach New Holdings has 3 warning signs (and 1 which is potentially serious) we think you should know about.

Of course Reach New Holdings may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8471

Reach New Holdings

Engages in manufacture and supply of garment accessories and labeling solutions in the People’s Republic of China.

Mediocre balance sheet low.

Market Insights

Community Narratives