- Thailand

- /

- Personal Products

- /

- SET:S&J

January 2025's Best Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate the early days of President Trump's administration, U.S. stocks have surged toward record highs fueled by optimism around potential trade policy shifts and advancements in artificial intelligence. Amid this backdrop of economic activity and investor sentiment, dividend stocks stand out as a compelling option for those seeking steady income streams, especially when market volatility looms large.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.00% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

Click here to see the full list of 1959 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

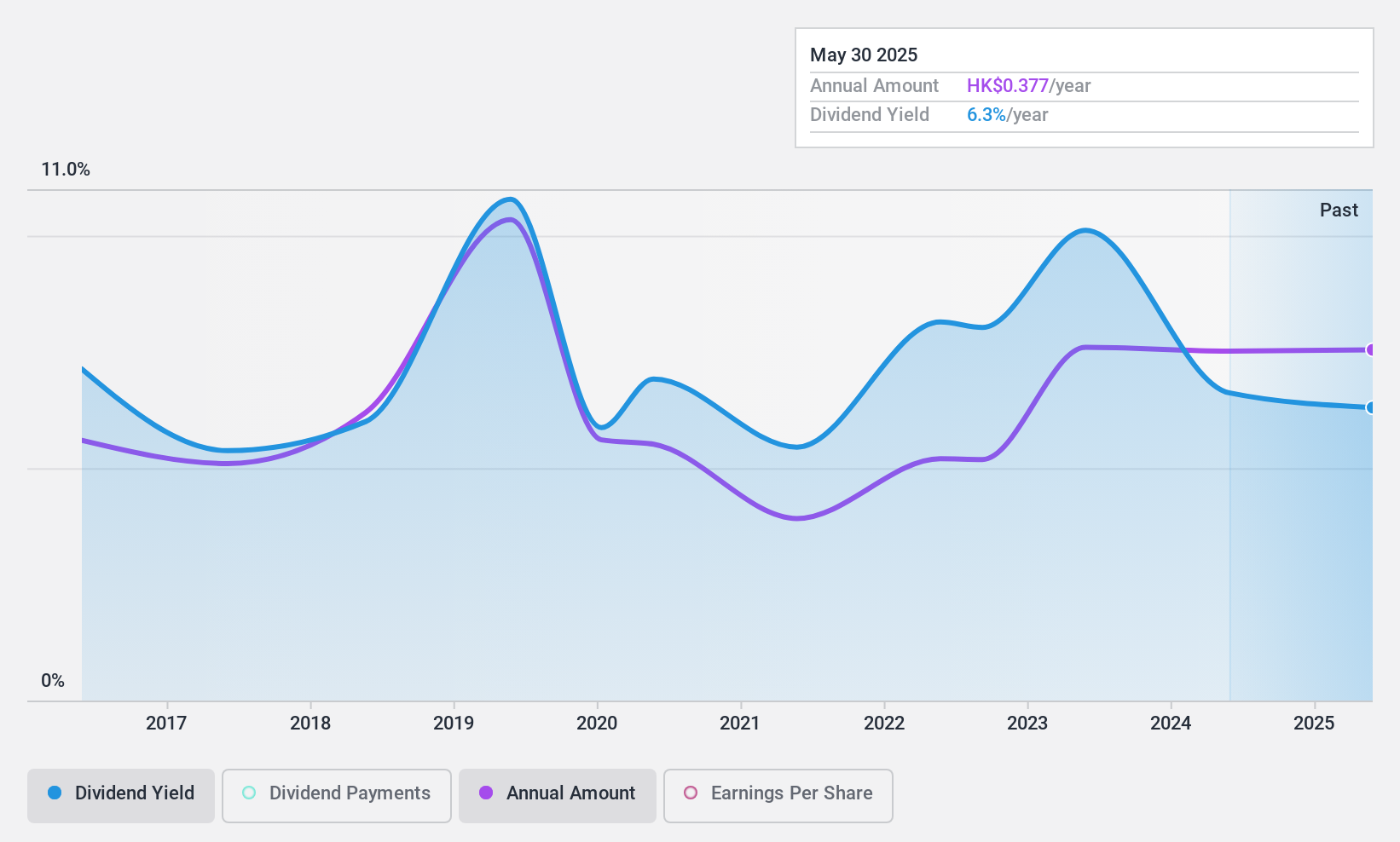

Pico Far East Holdings (SEHK:752)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pico Far East Holdings Limited is an investment holding company involved in exhibition, event, and brand activation, visual branding activation, museum and themed environment services, and meeting architecture activation with a market cap of HK$2.62 billion.

Operations: Pico Far East Holdings Limited generates revenue from various segments, including Exhibition, Event and Brand Activation (HK$5.71 billion), Visual Branding Activation (HK$344.19 million), Meeting Architecture Activation (HK$176.64 million), and Museum and Themed Entertainment (HK$461.61 million).

Dividend Yield: 6.2%

Pico Far East Holdings offers a mixed dividend profile. While its dividends are well-covered by earnings and cash flows, with payout ratios of 45.1% and 37.7% respectively, the dividend history has been volatile over the past decade. Recent announcements include a special dividend of HK$0.035 per share and an increased final dividend of HK$0.075 per share for fiscal year 2024, reflecting growing earnings and sales figures from HK$5.33 billion to HK$6.33 billion year-on-year.

- Click here to discover the nuances of Pico Far East Holdings with our detailed analytical dividend report.

- Our expertly prepared valuation report Pico Far East Holdings implies its share price may be lower than expected.

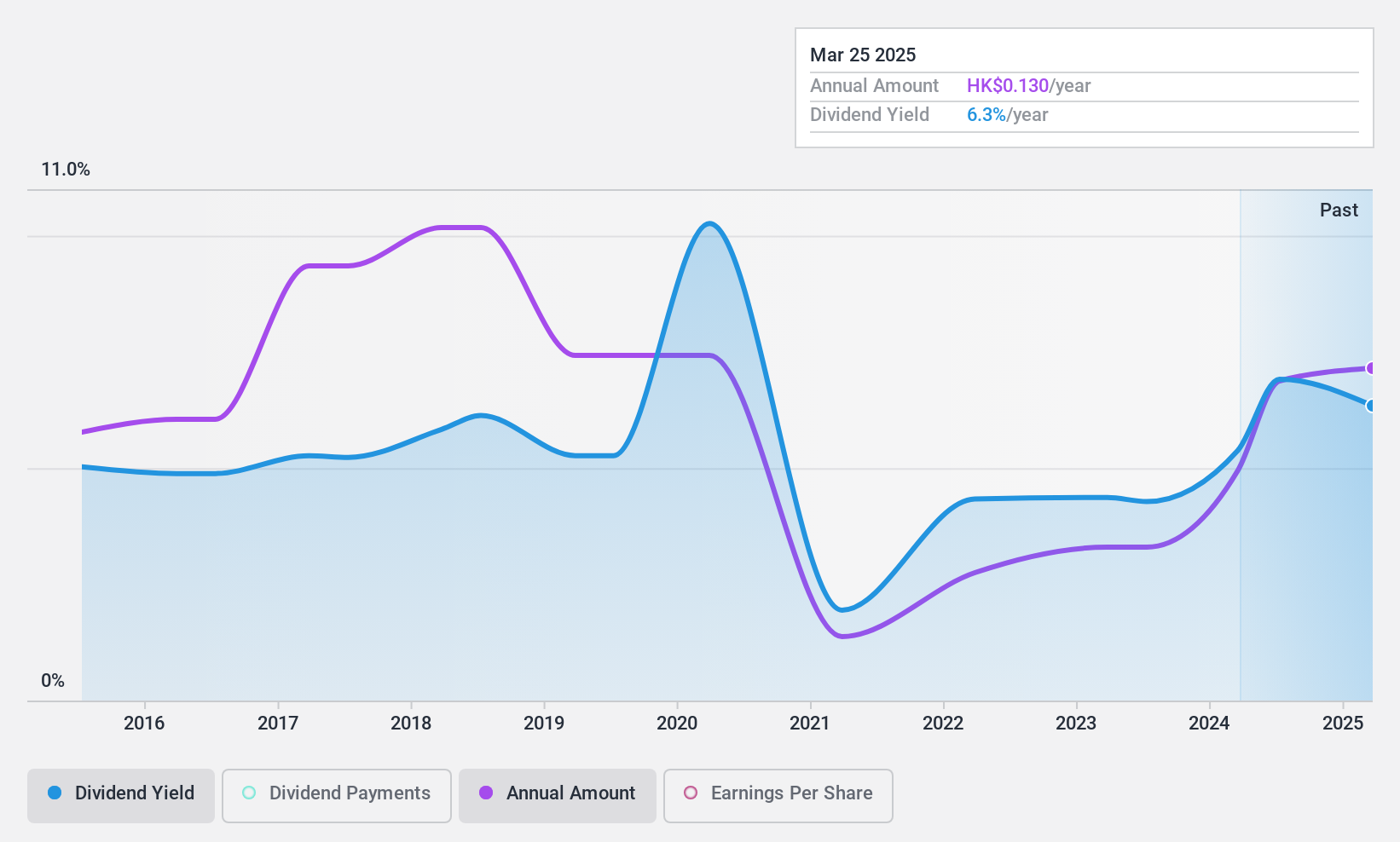

Carpenter Tan Holdings (SEHK:837)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Carpenter Tan Holdings Limited is an investment holding company that designs, manufactures, and distributes wooden handicrafts and accessories under the Carpenter Tan brand, with a market cap of HK$1.56 billion.

Operations: Carpenter Tan Holdings Limited generates revenue primarily from the manufacture and sales of wooden handicrafts and accessories, amounting to CN¥506 million.

Dividend Yield: 6%

Carpenter Tan Holdings' dividend payments have been volatile over the past decade, though they are covered by earnings with a payout ratio of 49.4% and cash flows at 89.5%. Despite this volatility, dividends have grown in the last ten years. The company's price-to-earnings ratio of 8.3x suggests it is undervalued compared to the Hong Kong market average of 10x. Recent board changes include appointing Mr. Tan Lizi and Ms. Liu Kejia as executive directors effective February 2025.

- Navigate through the intricacies of Carpenter Tan Holdings with our comprehensive dividend report here.

- The analysis detailed in our Carpenter Tan Holdings valuation report hints at an inflated share price compared to its estimated value.

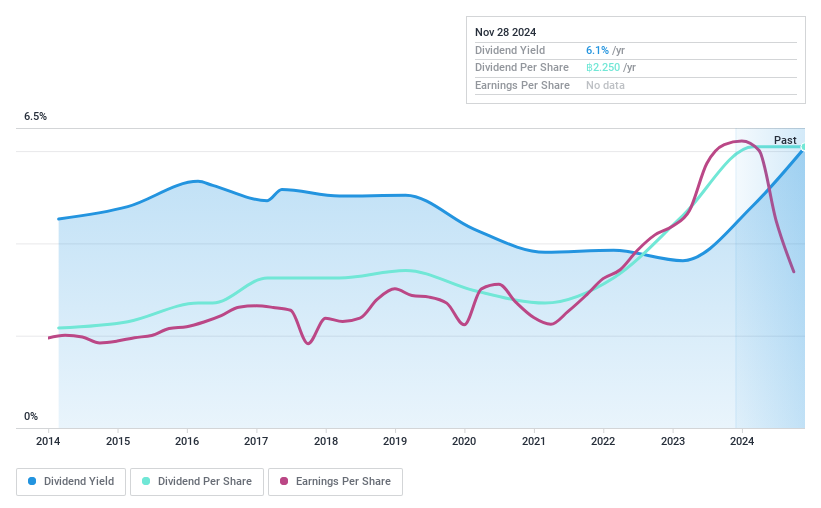

S & J International Enterprises (SET:S&J)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: S & J International Enterprises Public Company Limited, along with its subsidiaries, is engaged in the manufacturing and distribution of cosmetic products both within Thailand and internationally, with a market capitalization of THB4.84 billion.

Operations: S & J International Enterprises generates revenue primarily from its Cosmetics segment at THB5.12 billion and Packaging segment at THB1.35 billion.

Dividend Yield: 7.0%

S&J International Enterprises' dividend payments have been stable and reliable over the past decade, though they are not well covered by free cash flows, with a high cash payout ratio of 172.4%. The current payout ratio of 86.4% indicates dividends are covered by earnings but remain unsustainable long-term without improved cash flow coverage. Despite a declining net profit margin and lower earnings, S&J maintains a competitive price-to-earnings ratio of 12.4x against the TH market average.

- Click here and access our complete dividend analysis report to understand the dynamics of S & J International Enterprises.

- The valuation report we've compiled suggests that S & J International Enterprises' current price could be inflated.

Seize The Opportunity

- Click here to access our complete index of 1959 Top Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:S&J

S & J International Enterprises

Manufactures and distributes cosmetic products in Thailand and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives