- Hong Kong

- /

- Consumer Durables

- /

- SEHK:8005

Amidst increasing losses, Investors bid up Yuxing InfoTech Investment Holdings (HKG:8005) 17% this past week

It is doubtless a positive to see that the Yuxing InfoTech Investment Holdings Limited (HKG:8005) share price has gained some 41% in the last three months. But that is small recompense for the exasperating returns over three years. In that time, the share price dropped 63%. Some might say the recent bounce is to be expected after such a bad drop. While many would remain nervous, there could be further gains if the business can put its best foot forward.

While the last three years has been tough for Yuxing InfoTech Investment Holdings shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

See our latest analysis for Yuxing InfoTech Investment Holdings

Because Yuxing InfoTech Investment Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, Yuxing InfoTech Investment Holdings' revenue dropped 21% per year. That's definitely a weaker result than most pre-profit companies report. Arguably, the market has responded appropriately to this business performance by sending the share price down 18% (annualized) in the same time period. When revenue is dropping, and losses are still costing, and the share price sinking fast, it's fair to ask if something is remiss. It could be a while before the company repays long suffering shareholders with share price gains.

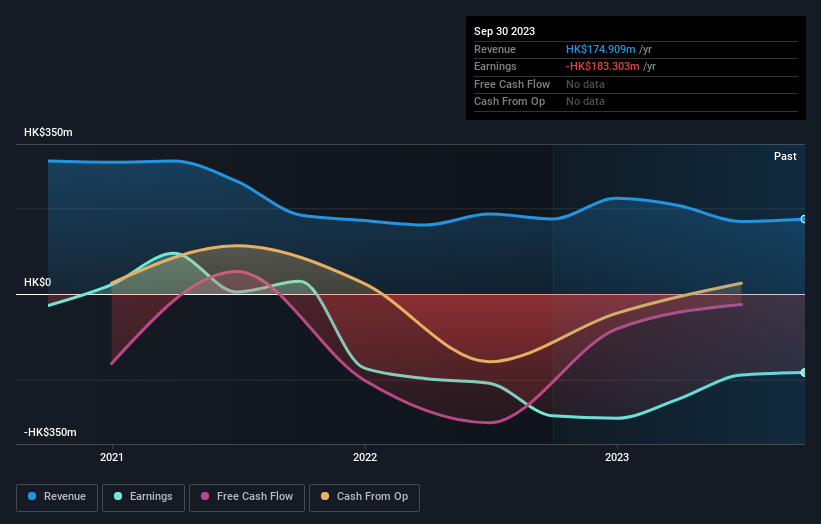

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Yuxing InfoTech Investment Holdings' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Although it hurts that Yuxing InfoTech Investment Holdings returned a loss of 6.1% in the last twelve months, the broader market was actually worse, returning a loss of 18%. What is more upsetting is the 9% per annum loss investors have suffered over the last half decade. This sort of share price action isn't particularly encouraging, but at least the losses are slowing. It's always interesting to track share price performance over the longer term. But to understand Yuxing InfoTech Investment Holdings better, we need to consider many other factors. Take risks, for example - Yuxing InfoTech Investment Holdings has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

But note: Yuxing InfoTech Investment Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8005

Yuxing InfoTech Investment Holdings

An investment holding company, primarily engages in the manufacture, distribution, and sale of information home appliances and complementary products to consumer markets in the People’s Republic of China, the United States, Hong Kong, Australia, and internationally.

Adequate balance sheet low.