As global markets navigate through a period of uncertainty, with mixed signals from major economies and fluctuating commodity prices, Asia's stock markets have been showing resilience, particularly in sectors poised for growth. In this environment, companies with high insider ownership can be appealing as they often indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.6% | 57.5% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Samyang Foods (KOSE:A003230) | 11.7% | 28.6% |

| PharmaResearch (KOSDAQ:A214450) | 35% | 30.9% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 34% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.7% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Let's dive into some prime choices out of the screener.

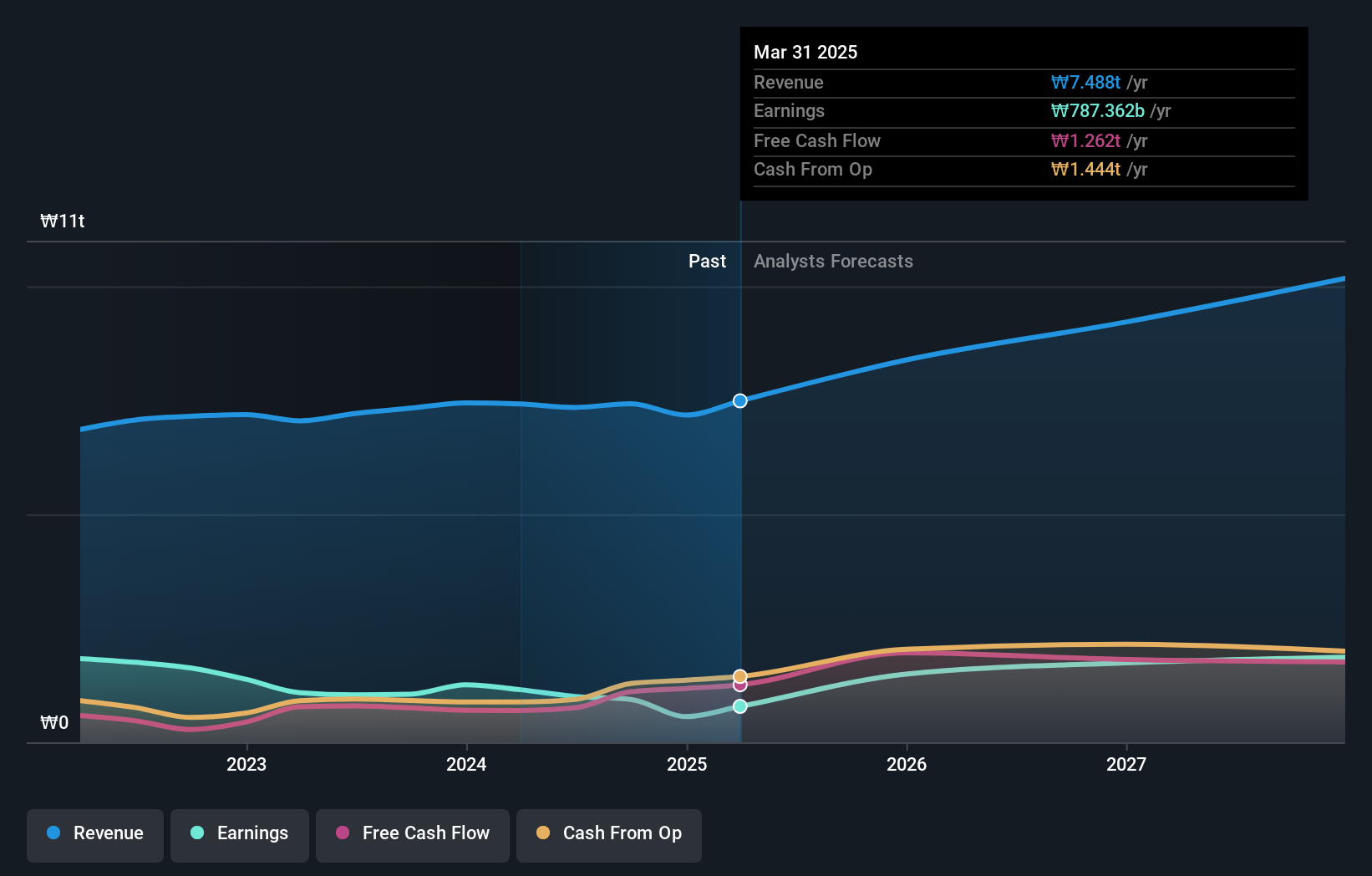

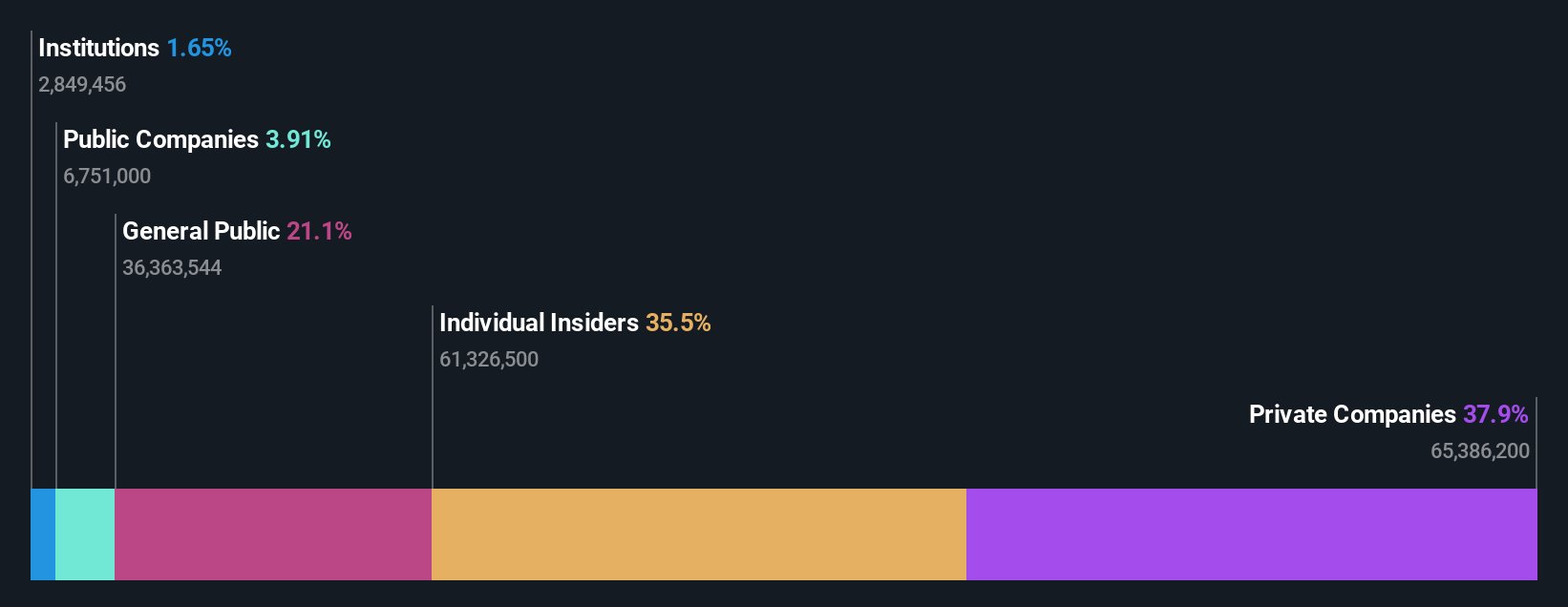

LG (KOSE:A003550)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LG Corp., with a market cap of ₩11.07 billion, operates through its subsidiaries in the electronics, chemicals, and telecommunication and services sectors.

Operations: LG's revenue primarily stems from its subsidiaries, with LG CNS Co., LTD contributing ₩6.93 billion and LG Corp. itself generating ₩849.78 million in revenue, alongside additional earnings from D&O amounting to ₩302.72 million.

Insider Ownership: 38.5%

LG Corp. demonstrates strong growth potential with earnings expected to grow significantly at 29.1% annually, outpacing the Korean market's 24%. Despite a low forecasted return on equity of 6.2%, its revenue is projected to increase by 10.8% per year, surpassing the market's 7.6%. The company trades at a substantial discount, about 60.3% below estimated fair value, and analysts anticipate a stock price rise of approximately 28.3%, with no recent insider trading activity noted.

- Unlock comprehensive insights into our analysis of LG stock in this growth report.

- Our valuation report unveils the possibility LG's shares may be trading at a discount.

Laopu Gold (SEHK:6181)

Simply Wall St Growth Rating: ★★★★★★

Overview: Laopu Gold Co., Ltd. designs, manufactures, and sells jewelry products in Mainland China, Hong Kong, and Macau with a market cap of HK$123.81 billion.

Operations: The company generates revenue primarily from its Jewelry & Watches segment, which amounts to CN¥17.34 billion.

Insider Ownership: 35.5%

Laopu Gold is experiencing robust growth, with revenue expected to increase by 23.9% annually, outpacing the Hong Kong market's 8.8%. Earnings are projected to grow significantly at 34% per year, exceeding market expectations of 12.9%. Despite no recent insider trading activity, its high insider ownership aligns with strong earnings quality and a forecasted return on equity of 54.9% in three years. Recent inclusion in the FTSE All-World Index underscores its expanding market presence.

- Dive into the specifics of Laopu Gold here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Laopu Gold's share price might be too optimistic.

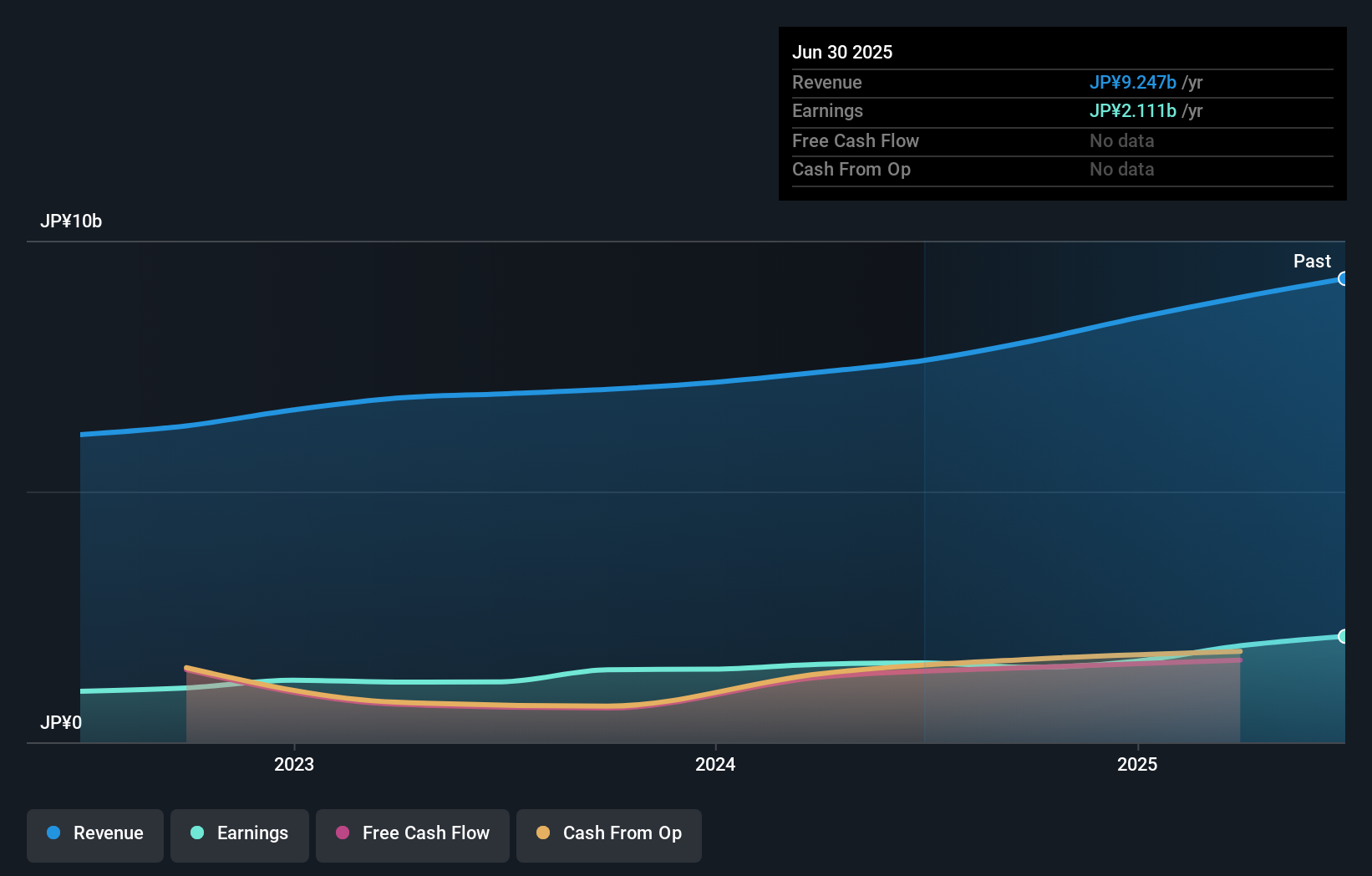

Fixstars (TSE:3687)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fixstars Corporation is a software company operating in Japan and internationally, with a market capitalization of ¥68.96 billion.

Operations: The company generates revenue through its SaaS business, which accounts for ¥665.51 million, and its Solution Business, contributing ¥8.86 billion.

Insider Ownership: 20.6%

Fixstars Corporation, with substantial insider ownership, is set to experience significant earnings growth of 24.62% annually over the next three years, outpacing the Japanese market's average. Despite a highly volatile share price recently and no notable insider trading activity in the last three months, Fixstars' recent release of AIBooster software enhances AI workload performance and cost management capabilities. This positions it well amidst rising GPU infrastructure costs.

- Click here to discover the nuances of Fixstars with our detailed analytical future growth report.

- Our expertly prepared valuation report Fixstars implies its share price may be too high.

Key Takeaways

- Dive into all 617 of the Fast Growing Asian Companies With High Insider Ownership we have identified here.

- Ready For A Different Approach? The end of cancer? These 28 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6181

Laopu Gold

Designs, manufactures, and sells jewelry products in Mainland China, Hong Kong, and Macau.

Exceptional growth potential with solid track record.

Market Insights

Community Narratives