- Hong Kong

- /

- Real Estate

- /

- SEHK:485

We Think The Compensation For China Sinostar Group Company Limited's (HKG:485) CEO Looks About Right

Key Insights

- China Sinostar Group to hold its Annual General Meeting on 20th of September

- Total pay for CEO Xing Qiao Wang includes HK$444.0k salary

- The total compensation is 80% less than the average for the industry

- Over the past three years, China Sinostar Group's EPS fell by 20% and over the past three years, the total loss to shareholders 44%

Performance at China Sinostar Group Company Limited (HKG:485) has been rather uninspiring recently and shareholders may be wondering how CEO Xing Qiao Wang plans to fix this. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 20th of September. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

See our latest analysis for China Sinostar Group

How Does Total Compensation For Xing Qiao Wang Compare With Other Companies In The Industry?

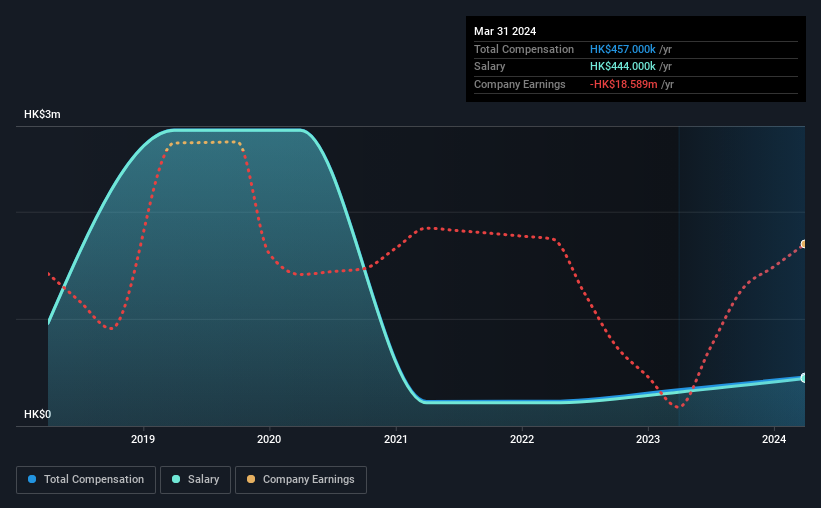

According to our data, China Sinostar Group Company Limited has a market capitalization of HK$28m, and paid its CEO total annual compensation worth HK$457k over the year to March 2024. We note that's an increase of 35% above last year. We note that the salary portion, which stands at HK$444.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the Hong Kong Consumer Durables industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$2.3m. This suggests that Xing Qiao Wang is paid below the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$444k | HK$316k | 97% |

| Other | HK$13k | HK$23k | 3% |

| Total Compensation | HK$457k | HK$339k | 100% |

Speaking on an industry level, nearly 85% of total compensation represents salary, while the remainder of 15% is other remuneration. China Sinostar Group has gone down a largely traditional route, paying Xing Qiao Wang a high salary, giving it preference over non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at China Sinostar Group Company Limited's Growth Numbers

Over the last three years, China Sinostar Group Company Limited has shrunk its earnings per share by 20% per year. Its revenue is up 34% over the last year.

The decrease in EPS could be a concern for some investors. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. It's hard to reach a conclusion about business performance right now. This may be one to watch. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has China Sinostar Group Company Limited Been A Good Investment?

The return of -44% over three years would not have pleased China Sinostar Group Company Limited shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Xing Qiao receives almost all of their compensation through a salary. The loss to shareholders over the past three years is certainly concerning. The fact that earnings growth has gone backwards could be a factor for the downward trend in the share price. In the upcoming AGM, shareholders will get the opportunity to discuss these concerns with the board and assess if the board's plan is likely to improve company performance.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 4 warning signs for China Sinostar Group (3 don't sit too well with us!) that you should be aware of before investing here.

Switching gears from China Sinostar Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:485

China Sinostar Group

An investment holding company, engages in the development and sale of properties in the People’s Republic of China.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026